- Bitcoin's price retests the key resistance zone at $62,066, and rejection may continue to drive its downtrend.

- Ethereum's price experiences a brief rise before a potential downtrend continues.

- Ripple's price retests its daily resistance level at $0.643; failure to close above this level could result in a price decline.

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) each saw modest recoveries with brief upward movements on Thursday. Still, these gains seem temporary, as technical analysis and market conditions indicate that the overall downward trends for these cryptocurrencies are expected to resume in the coming days.

Bitcoin price poised for a decline after rejection at key resistance level

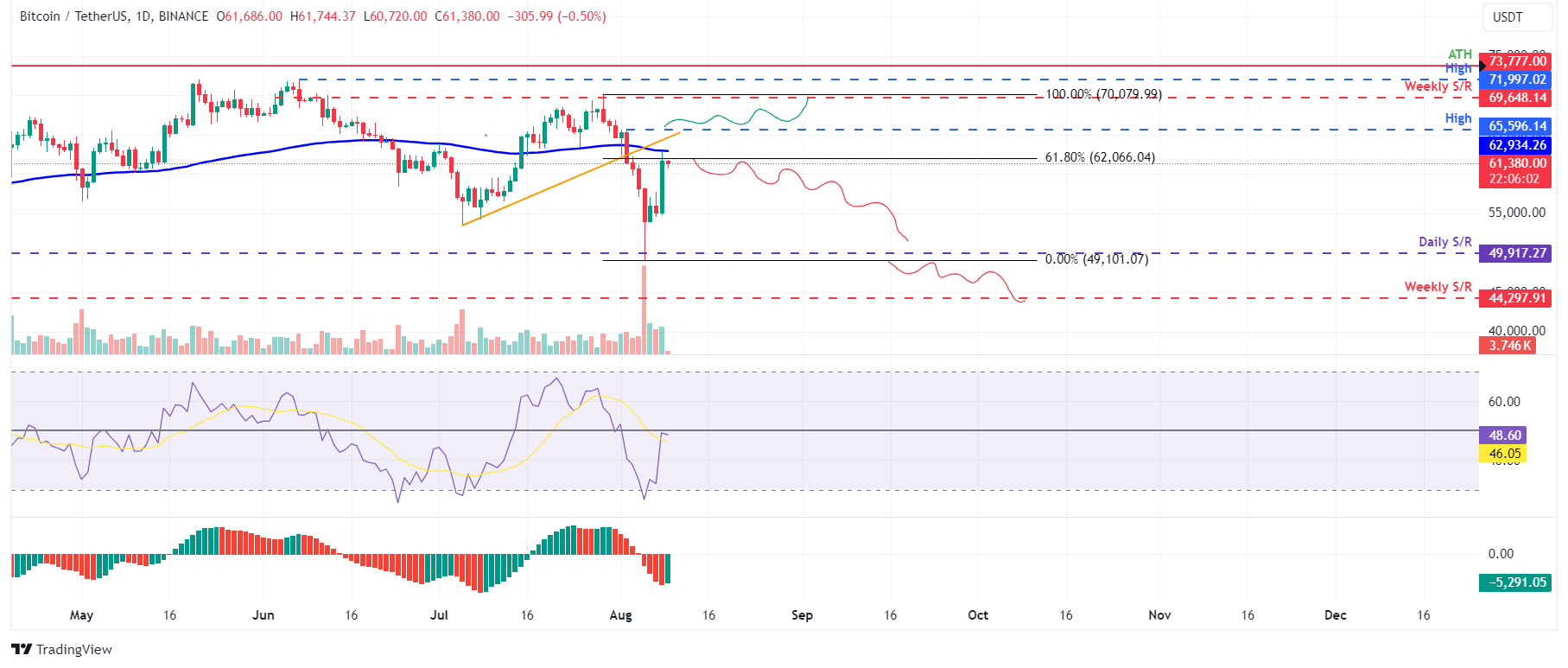

Bitcoin price retested its 61.8% Fibonacci retracement level at $62,066 (drawn from the swing high of $70,079 on July 29 to Monday's low of $49,101) on Thursday. As of Friday, it trades slightly lower by 0.6% at $61,380.

If BTC faces rejection at the $62,066 level, which also coincides with the broken trendline and the 100-day Exponential Moving Average (EMA) at around $63,021, it will be a critical zone to watch.

Failure to break above $62,066 might trigger a 19% crash, back to retest the $49,917 daily support level.

The Relative Strength Index (RSI) indicator in the daily chart faces resistance around the neutral level of 50, and the Awesome Oscillator (AO) is still below its neutral level of zero. However, they are comfortably below their respective neutral levels of 50 and zero. These momentum indicators strongly indicate bearish dominance.

BTC/USDT daily chart

On the other hand, If BTC closes above the August 2 high of $65,596, it would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 6% rise in Bitcoin's price to retest its weekly resistance at $69,648

Ethereum price vulnerable to decline after hitting key resistance barrier

Ethereum price closed below the daily support level of $2,927 on August 3, dropping 16.5% over the next two days. However, after testing the weekly support at $2,118, it rebounded with a 10.68% increase from Tuesday to Thursday. As of Friday, it is trading slightly lower at $2,668, down 0.3%.

If ETH continues to recover, it may encounter resistance around the 50% retracement level at $2,843 (drawn from the swing high of $3,562 on July 22 and Monday's low of $2,124). This level closely aligns with the daily resistance at $2,927, making it a crucial area to monitor for potential reversal.

If Ethereum's price fails to surpass the $2,843 level, it could decline 25% to retest its weekly support at $2,118.

The daily chart's RSI and the AO have fallen below their neutral levels of 50 and zero, respectively, indicating an overarching bearish trend based on these momentum indicators.

ETH/USDT daily chart

However, if Ethereum price closes above the $3,396 daily high from July 29, it would create a higher high on the daily timeframe, potentially leading to a 5% increase as it retests the July 22 high of $3,562.

Ripple price poised for a fall as key resistance level holds firm

Ripple price retested its daily resistance level at $0.643 on Wednesday and faced multiple rejections at this level. As of Friday, it trades slightly lower by 0.2% at $0.616.

If the $0.643 level holds as resistance, XRP could crash 15% to revisit its next daily support at $0.544.

The daily chart's RSI and AO have recently crossed their neutral levels of 50 and zero, respectively. However, for bears to gain control, both momentum indicators need to fall below their neutral levels, which would strengthen the bearish trend.

XRP/USDT daily chart

Conversely, if Ripple's price closes above the $0.643 daily resistance level, it would change the market structure by forming a higher high on the daily chart, potentially driving a 12% increase toward the next daily resistance level at $0.724.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.