- Bitcoin price breaks above the descending trendline on Sunday, signaling a potential bullish momentum in the near future.

- Ethereum's price surges above the $3,240 level, marking a shift in market structure from bearish to bullish.

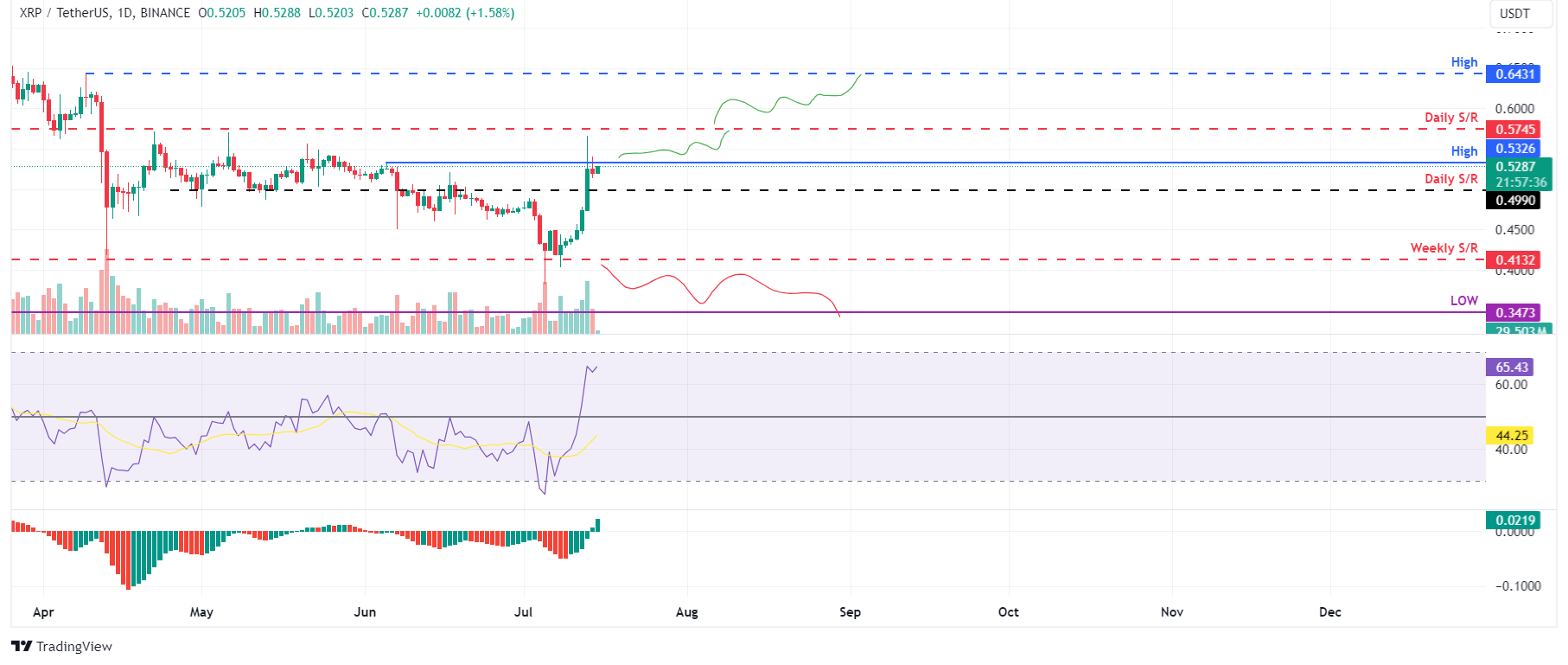

- Ripple's price breaches the daily resistance level at 0.499 on Saturday, signaling a potential bullish trend on the horizon.

Bitcoin (BTC) broke above its descending trendline on Sunday, signaling potential bullish momentum in the near term. Concurrently, Ethereum (ETH) and Ripple (XRP) also surged, surpassing significant resistance levels and setting the stage for a bullish trajectory across the cryptocurrency market.

Bitcoin price sets for a rally

Bitcoin price broke above the descending trendline on Sunday, trading 1% up at $61,365 on Monday. The trendline is formed by connecting multiple swing high levels from early June to mid-July.

If the trendline holds as pullback support around the $58,357 level, which coincides with the weekly support level, BTC could rally 9% from that level, targeting its daily resistance level of $63,956.

The Relative Strength Index (RSI) on the daily chart is trading above the neutral level of 50, and the Awesome Oscillator (AO) is on its way to doing the same. If bulls are indeed making a comeback, then both momentum indicators must maintain their positions above their respective mean levels. Such a development would add a tailwind to the recovery rally.

BTC/USDT daily chart

Conversely, if BTC closes below $56,405 and forms a lower low in the daily timeframe, it may signal persistent bearish sentiment. This scenario could trigger a 7.5% decline in Bitcoin’s price, targeting a revisit of its daily support at $52,266.

Ethereum price shows potential for further rally

Ethereum price broke above the $3,240 level on Sunday and, at the time of writing trades 0.87% up at $3,275 on Monday.

If the $3,240 level holds as support, ETH could increase 8.8%, targeting a retest of its daily high from July 1 at $3,524.

The Relative Strength Index (RSI) on the daily chart is trading above the neutral level of 50, and the Awesome Oscillator (AO) is on its way to doing the same. If bulls are indeed making a comeback, then both momentum indicators must maintain their positions above their respective mean levels. Such a development would add a tailwind to the recovery rally.

If the bulls are aggressive and the overall crypto market outlook is positive, and ETH closes above $3,524, it could extend an additional rise of 5.5% to retest its daily high of $3,717 from June 9.

ETH/USDT daily chart

On the other hand, if Ethereum's daily candlestick closes below $2,817, forming a lower low in the daily timeframe, it may signal persistent bearish sentiment. This scenario could trigger a 7% decline in Ethereum's price, targeting a revisit of its daily support at $2,621.

Ripple price shows potenti for the bulls

Ripple price broke above the daily resistance level of $0.499 on Saturday. Currently, it faces resistance around the $0.532 daily high level from June 5. At the time of writing, it trades 1.7% up at the $0.528 level.

If XRP closes above $0.532, it could rally 7.76% to retest its daily resistance level of $0.574.

On the daily chart, the Relative Strength Index (RSI) and the Awesome Oscillator (AO) are currently positioned above their critical thresholds of 50 and zero, respectively. These momentum indicators strongly indicate bullish dominance.

Furthermore, surpassing the $0.574 level could pave the way for an additional 12% rally to retest the next daily high, recorded on April 9, at $0.643.

XRP/USDT daily chart

However, if Ripple daily candlestick closes below $0.413, it indicates sustained bearish sentiment, forming a lower low in the daily timeframe. Such a scenario could lead to a 16% decline in Ripple's price, targeting a revisit of its low from March 12 at $0.347.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink holds near three-year high fueled by EU tokenized securities partnership

Chainlink (LINK) price trades slightly down around $25.50 on Tuesday following a 33% rally that was spurred by its partnership with Frankfurt-based fintech 21X for Europe’s first tokenized securities trading and settlement system.

Trending altcoins: Hedera, VeChain and Algorand extend rally by posting double-digit gains

Three trending altcoins – Hedera (HBAR), VeChain (VET), and Algorand (ALGO) – post double-digit gains on Tuesday after surging last week, benefiting from the recent consolidation of Bitcoin prices.

Ondo Finance Price Forecast: ONDO reaches a new all-time high of $1.79

Ondo Finance surges more than 11% on Tuesday and reaches a new all-time high of $1.79. ONDO’s daily trading volume reached a new yearly high of $994 million, suggesting a surge in traders’ interest and liquidity.

XRP en route to new all-time high; key metrics to watch out for

Ripple whales have accumulated over $1.8 billion worth of XRP tokens amid a 200% rise in weekly active addresses. WisdomTree filed an S-1 registration with the SEC for an XRP ETF. XRP investors across several cohorts realized over $2.7 billion in profits in past three days following heavy Ripple token unlock.

Bitcoin: A healthy correction

Bitcoin (BTC) experienced a 7% correction earlier in the week, dropping to $90,791 on Tuesday before recovering to $97,000 by Friday. On-chain data suggests a modest rebound in institutional demand, with holders buying the dip. A recent report indicates BTC remains undervalued, projecting a potential rally toward $146K.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.