Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bears might take another stab due to FOMC

- Bitcoin price could crash below the June 18 swing low at $17,593.

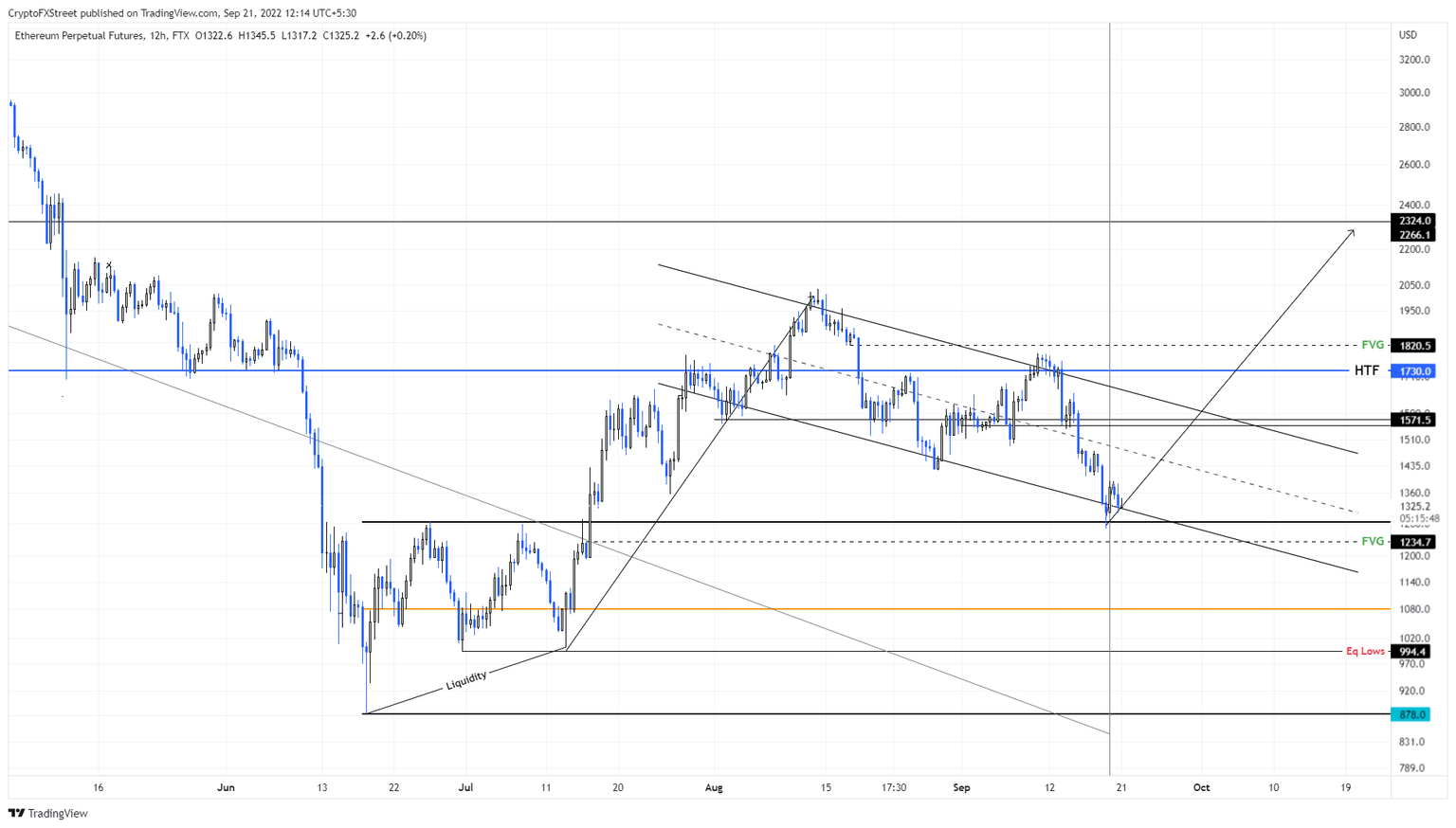

- Ethereum price could briefly extend a wick down to $1,234 before attempting a run-up to $1,730.

- Ripple price could retrace to the $0.381 support level before retesting $0.439 or $0.477.

Bitcoin price is in a consolidative phase with no directional bias in sight. This lackluster performance has caused Ethereum, Ripple and other alts to lose their volatility. However, the US Federal Reserve (Fed) is scheduled to announce its monetary policy decision on September 21 at 18:00 GMT, and this is likely to cause volatility.

The current base interest rate set by the Fed is hovering at 2.5%, but after today’s policy meeting, the US central bank is widely expected to raise it by 75 basis points to 3.25% in order to combat rising inflation. The popular speculation is that this narrative could induce short-term liquidity run on both ends but eventually trigger an uptrend.

If, instead of a 75 bps hike, the Fed decides to hike by 100 bps, pushing up the base interest rate to 3.5% – as is possible – it could cause markets to crash. Therefore, investors should pay close attention to the announcement and wait for the post-meet speech from Jerome Powell, the acting chairman of the Federal Reserve, for possible hints of future policy.

Regardless, patience is truly a virtue before events like this, so investors should exercise it.

Bitcoin price bore market participants

Bitcoin price has already collected the sell-stop liquidity resting below the previous weekly lows at $18,500, and seems ready for a recovery. However, as mentioned above, the FOMC meeting could play a pivotal role in determining where the markets move next.

Due to the massive sell-off over the past few weeks it may be the case that markets have already priced in – and probably overshot – the base case scenario of a 75 bps hike, so once the news actually hits the wires there may be a rebalancing reaction. Such an outcome could trigger a run-up in stock and crypto markets.

In this case, investors should provide BTC room to move down temporarily to the June 18 swing low at $17,593.A sweep of this level could catalyze a reversal, however, pushing BTC to the immediate hurdle at $19,539 and $20,737. Beyond these levels, BTC could even attempt to revisit $22,575 and set a double top.

BTC/USD 12-hour chart

On the other hand, if the Fed delivers a more hawkish message or raises rates by 100 bps it could lead the BTC price to fall. If Bitcoin price breaches below and then flips the $18,293 support level into a resistance barrier, it will invalidate the bullish outlook and trigger a crash to $15,550.

Ethereum price ready to recover losses

Ethereum price seems to be hovering in a descending parallel channel after creating three lower lows and two lower highs since August 4. While ETH currently hovers above a stable support floor at $1,280, there is a chance of further decline.

A sell-off in Bitcoin price could knock Ethereum price to fill the imbalance, aka Fair Value Gap (FVG), at $1,234. However, a resurgence of buyers followed by a reversal in the big crypto post the Federal Open Market Committee (FOMC) meeting could trigger a run-up.

Such a development could see ETH reach the immediate resistance level at $1,550. A successful flip of this level will put the recently shifted Proof-of-Stake token against the high time-frame resistance level at $1,730.

ETH/USD 12-hour chart

Although things are looking temporarily indecisive due to the still-unknown interest rate hike, Bitcoin price and its reaction to the FOMC meeting could play a crucial role in determining the directional bias. If Ethereum price produces a daily candlestick close below $1,280, it will invalidate the bullish outlook and potentially crash to $1,080.

Ripple price back to the pavilion

Ripple price has successfully blown past the $0.381 resistance level after a 24% leg-up. However, due to the FOMC meeting, there might be a sudden but brief pullback to $0.381.

Apart from this potential scenario, the XRP price looks bullish and is likely to continue its ascent to $0.439. A flip of this level into a support floor could extend this move to $0.477.

XRP/USD 12-hour chart

On the other hand, if the FOMC causes the Bitcoin price to tank, Ripple price will follow suit. In such a case, if XRP price breaks below the $0.331 support floor and flips it into a resistance level, it will invalidate the bullish thesis. This development could see XRP price revisit the $0.309 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.