Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC flatlines while altcoin bulls rethink their strategy

- Bitcoin price is still in the transition period, trying to exit the bear market and re-enter the bullish part of the cycle above $31,800.

- Ethereum price could tag $2,128 upon a decisive daily candlestick close above $1,941.

- Ripple price is at risk of 15% losses to $0.40 unless XRP bulls fasten their grip.

Bitcoin (BTC) price continues to resist falling under bears control as it hovers around the $30,000 psychological level. While the initial run-up in BTC benefitted altcoins like Ethereum (ETH) and Ripple (XRP), the current state of struggle for BTC has caused many altcoins to remain flat. Some altcoins even look primed for a correction as many sell signals erupt on the four-hour and daily time frames.

Also Read: Week Ahead: Buy the dip or sit on your hands?

Bitcoin contracts amid an overbought market

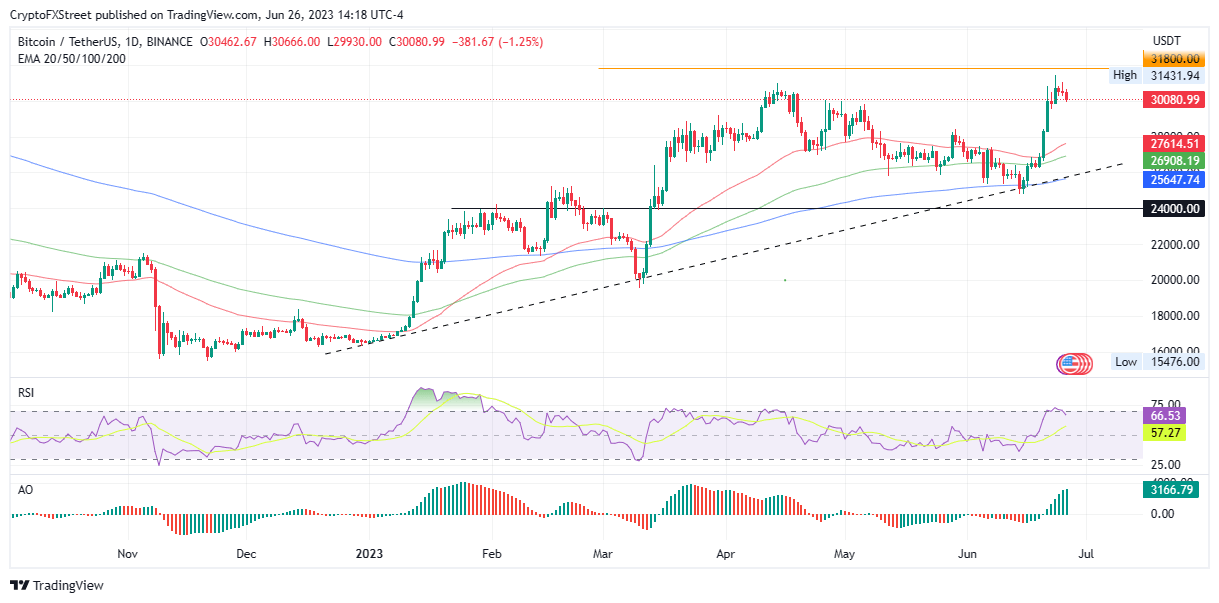

Bitcoin (BTC) price contraction could be a good thing or spell doom for investors depending on how investors play their hand. The king of crypto soared 25% since June 15 to record an intra-day high of $31,431 on June 23 before pulling back 5% to the current price of $30,097.

Based on the Relative Strength Index (RSI) trajectory after breaking below the 70 level, Bitcoin price is suffering in the wake of an overbought market, confirming a sell signal according to Well Wilder’s thesis.

Nevertheless, as bulls look for an entry point, an increase in buyer momentum could see Bitcoin price break into the crucial zone between $31,800 and $35,300. Escaping this zone could clear the path for the flagship cryptocurrency to target higher levels.

The up-facing Exponential Moving Averages (EMA) and the Awesome Oscillators (AO) above the midline suggest that the bulls are still in the lead.

BTC/USDT 1-Day Chart

Conversely, BTC bulls failing to re-enter the market could see bears gain control, with the ensuing pressure sending the king of crypto to the 50- and 100-day EMA at $27,614 and $26,908 levels, respectively. In the dire case, BTC could break below the support confluence between the 200-day EMA and the uptrend line at $25,647, exposing it to the $24,000 lows seen in mid-March.

Also Read: Bitcoin price breaches $31,000 as the IMF attests to the flagship crypto being unstoppable

Ethereum price tests the 50-day EMA support

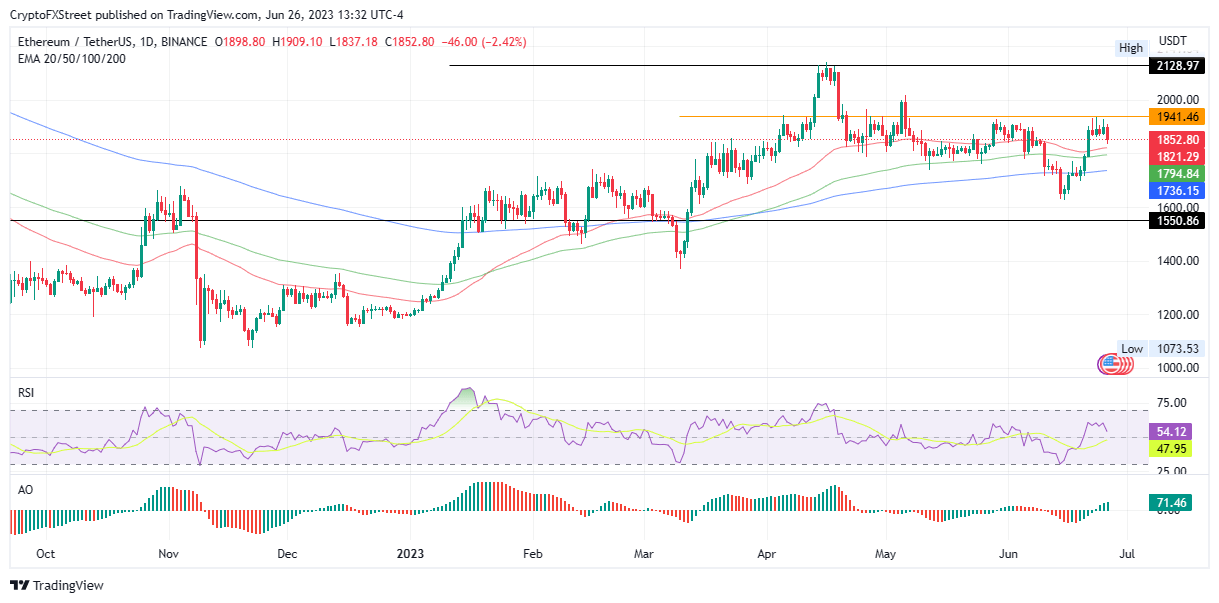

Ethereum (ETH) price is $1,852 at the time of writing, on course to test the 50-day EMA at $1,821. Unless the prominent altcoin breaks its current correlation to BTC and heads north, its fate is certain. A decisive daily candlestick close above $1,941 could clear the path for a rally to $2,128.

This is plausible considering the AO indicator is still in the positive zone, and the largest altcoin by market capitalization is also enjoying robust support offered by the 100- and 200-day EMA at $1,794 and $1,736 in addition to the 50-day EMA.

ETH/USDT 1-Day Chart

On the flip side, the down-facing RSI suggests fading momentum among ETH bulls, which could give room for bears to take over. Such an outcome could see the PoS token lose all the ground covered over the past two weeks.

XRP bulls must act now

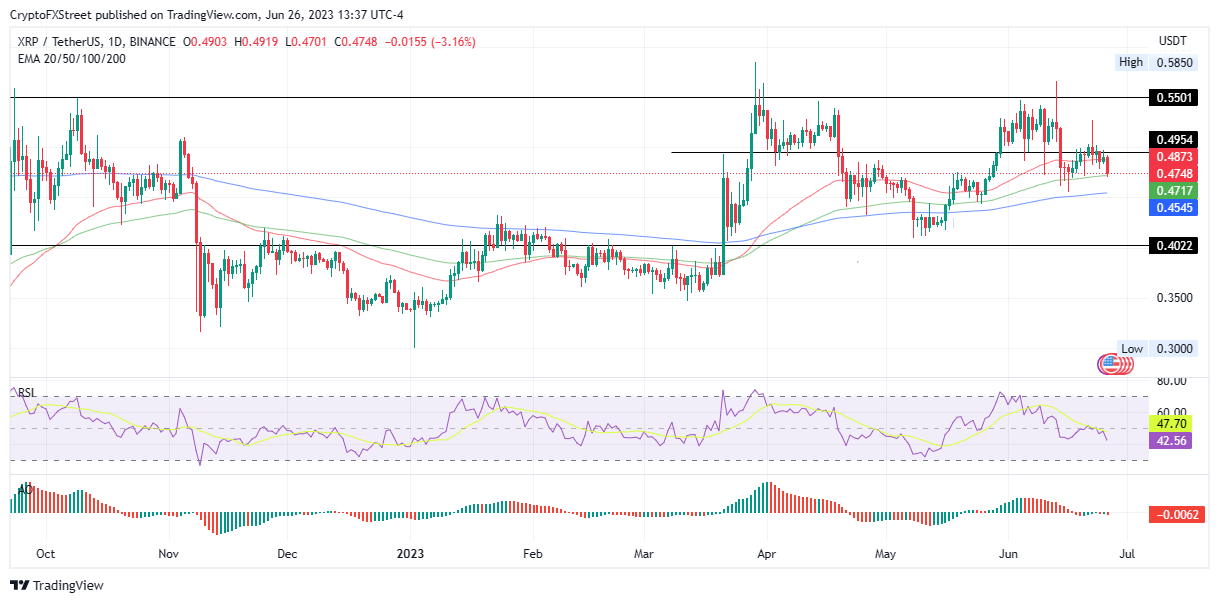

Ripple (XRP) price is trading with a bearish bias, having lost all the ground covered since June 17. The latest downtrend has seen the remittance token flip the 50-EMA support at $0.487 resistance, setting the tone for a continued downtrend.

Amid falling buyer momentum indicated by the dropping RSI and growing overhead pressure as XRP keeps flipping support levels into resistances, Ripple price could break below the 100- and 200-day EMA at $0.471 and $0.454 to retest the $0.402 swing low. Such a move would denote a 15% slump.

This outlook is bolstered by the AO, steadily edging farther away from the midline.

XRP/USDT 1-Day Chart

On the flipside, Ripple price could correct if XRP bulls capitalize on the 100-day EMA support as an entry point, with the subsequent buying pressure restoring the payments token above the $0.495 hurdle. Nevertheless, the bearish thesis would only be invalidated upon a decisive candlestick close above the $0.550 resistance level.

Also Read: XRP sees inflow of $240,000 in a week as crypto funds record largest influx of capital in 2023

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.