Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins falter after BTC fails to rally [Video]

- Bitcoin price faces a blockade in its journey to retest the $50,000 psychological barrier.

- Ethereum price reveals an ongoing uptrend as it inches closer to the $4,000 hurdle.

- Ripple price eyes the retest of the $0.90 resistance barrier.

![Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins falter after BTC fails to rally [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Bitcoin/Bitcoin_2_XtraLarge.jpg)

Bitcoin price has set up a bottom reversal pattern similar to the one seen in mid-December 2021. The resulting technical formation is likely to result in a bullish outlook that will ripple out into other altcoins including Ethereum and XRP.

Bitcoin price vies to restart an uptrend

Bitcoin price has set up a triple bottom, indicating the downtrend is ending and a new uptrend is beginning. Although BTC rallied yesterday by 4%, it failed to sustain gains, resulting in a retest of the $45,678 support floor.

As buyers place their bid orders again, BTC seems to be restarting the uptrend and is likely to surge another 3% before it encounters the 200-day Simple Moving Average (SMA) at $48,075. A decisive close above this barrier will confirm the bulls’ intentions and propel BTC to retest the 50-day SMA at $51,344.

BTC/USD 4-hour chart

While things are looking up for Bitcoin price, a breakdown of the $45,678 support level will invalidate the triple bottom setup and indicate weak buying pressure that could trigger an 8% correction to $41,762.

Ethereum price continues its bullish outlook

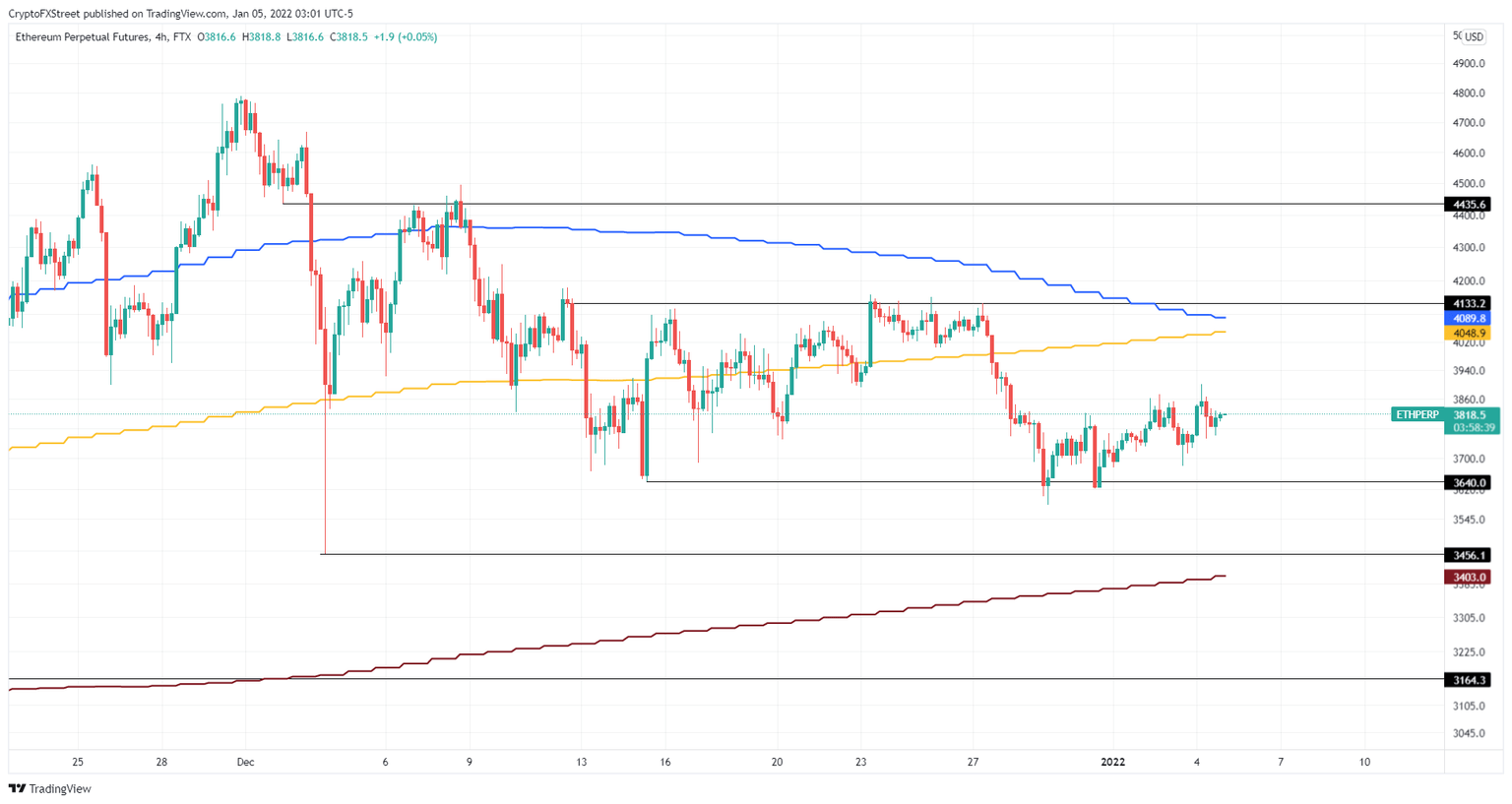

Ethereum price has continued its uptrend as it sets up higher highs and higher lows since December 31, 2021. If the bullish outlook continues, ETH could soon retest the confluence of 50-day and 100-day SMAs, present between $4,000 and $4,100.

This run-up will likely face immense selling pressure from holders around $4,100. Clearing this barrier will allow ETH to make another quick climb to $4,435. In a highly bullish case, ETH could set a new high at $5,000.

ETH/USD 4-hour chart

Regardless of the bullish outlook for Ethereum price, a breakdown of the $3,640 support level will confirm the weakness among buyers and invalidate the bullish thesis. This development will crash ETH down to $3,456, which is present just above the 200-day SMA at $3,403.

Here, buyers can band together and give the bullish outlook another go.

Ripple price falters but stands up

Ripple price has been consolidating above the 3-day demand zone, extending from $0.704 to $0.778. Ripple managed to muster the bullish momentum required to rally higher without tapping into the said demand zone.

This run-up failed to sustain, resulting in a slow consolidative downtrend to where it currently trades - $0.829. If the uptrend resumes, the XRP price will retest the $0.89.

In a highly bullish case, Ripple could extend beyond $0.829 and retest $0.939, constituting a 13% ascent from the current position. In some cases, Ripple price could first dip into the 3-day demand zone before it restarts its uptrend.

XRP/USD 4-hour chart

While the bullish outlook makes sense, a potential spike in selling pressure that pushes Ripple price to produce a four-hour candlestick close below $0.704 will create a lower low, invalidating the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.