Top 3 Price Prediction Bitcoin, Ethereum, Ripple: A short squeeze to remember

- Bitcoin price shows the largest liquidations in over a month.

- Ethereum's price shows signs of a healthy countertrend rally that has not reached its climax.

- Ripple price could test lower levels of support near $0.40.

Volatility has entered the crypto market, making the short-term moves ever more challenging but rewarding as well. Key levels have been defined to try and gauge the next big move.

Bitcoin price liquidates shorts

Bitcoin price trades mid-$19,000 range as the peer-to-peer digital currency was rejected at the $20,000 level following an impressive 10% short squeeze bull run. The short squeeze was catalyzed on Thursday, October 13, after BTC fell 10% in less than 4 hours upon releasing the US September CPI data that came in higher than expected. The news prompted sidelined bears to enter the market and ultimately buy into the smart money trap.

According to analyst On-Chain College, the 10% rally liquidated 31 million dollars worth of shorts in just an hour, the highest hourly short liquidation level in over a month.

Bitcoin price currently auctions at $19,346. The Relative Strength Index on larger time frames is in the supportive territory of an upcoming bull run, but it is worth noting that lower times have breached extremely oversold conditions. The indicator is an anomalous gesture of more volatile and unpredictable future market days.

Invalidation of the bearish thesis is a breach above the recently rejected crossing 8-day exponential moving average at $19,400. If the bulls can reconquer this barrier, a spike back toward $20,400 could occur, resulting in a 6% increase from the current Bitcoin price. If the bulls do not hurdle the $19,400 barrier, a reattempt at liquidity levels near $18,700 will be a probable outcome.

BTC/USDT 1-Day Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price should climb a bit higher

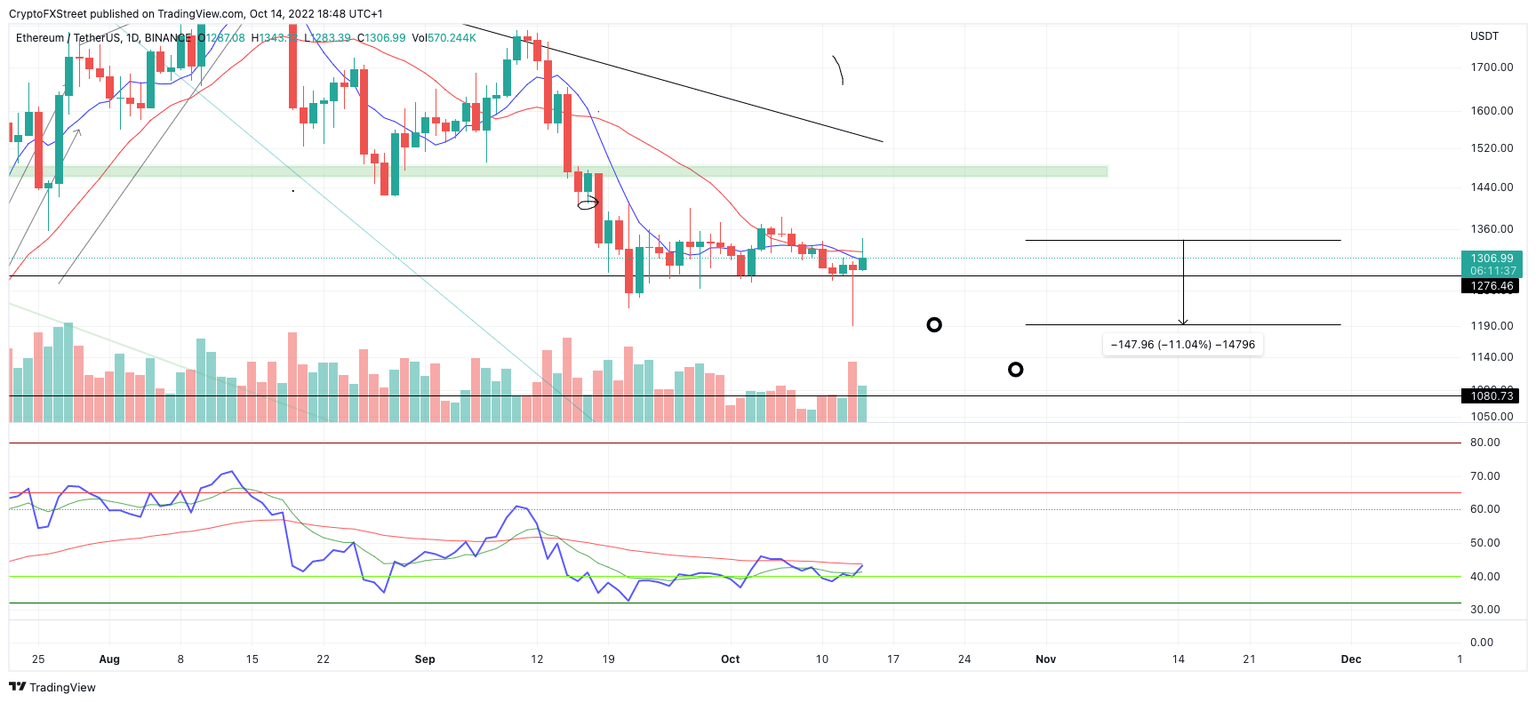

Ethereum price is floating on treacherous waters as the sell-off that occurred on Thursday broke through the September lows. Upon the release of US CPI data, the decentralized smart contract token declined 10% before propelling back into the $1,300 zone.

Ethereum price auctions at $1,305. Like Bitcoin, the 8-day exponential and 21-day simple moving averages are acting as resistance for the ETH price to ascend higher. Still, the Relative Strength Index has room to climb after the impressive short squeeze. Additionally, no recent divergences suggest a healthy higher is in play. Bears holding on to shorts may be challenged further in the days to come.

Based on the technicals, a hike towards $1,370 stands a fair chance of occurring. Invalidation of a continuation of the countertrend thesis remains intact so long as the $1,255 liquidity level remains unbroken. If the bears breach this level again, the newfound lows at $1,190 will be in jeopardy. ETH may find support near $1,100 or even $1,050, resulting in a 17% decline from the current market value.

ETH/USDT 1-Day Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Ripple price could fall lower

Ripple price is up 3% on the day after witnessing a 7% increase followed by a profit-taking frenzy. Despite Thursday's erratic short squeeze, the Relative Strength Index (RSI) has been stair-stepping south within the last few days. The 8-day EMA is also providing resistance near $0.50.

XRP price currently auctions at $0.49. After breaching overbought territories earlier in September, the RSI has yet to test the lower support boundaries, which would entice sidelined bulls to enter the market confidently. Additionally, the volume remains sparse compared to the previous bull run.

Combining these factors, the digital remittance token still has a chance to test the $0.40 level as support. Invalidation of the bearish thesis is a breach above the high at $0.56. If the bulls conquer this level, a rise towards $0.61 will likely be underway, resulting in a 24% increase from the current Ripple price.

XRP/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.