Top 3 Price Prediction Bitcoin, Ethereum, Ripple: A drop below $26,200 could be fatal for BTC

- Bitcoin price must defend the $26,200 support level at all costs or risk a drop down to $21,000.

- Ethereum price eyes more losses with $1,700 in sight, but BTC can alter this fate.

- Ripple price may fall 10% before June 13 when the court extension lapses, so hurry up, Judge Torres.

Bitcoin (BTC) price has investors in limbo as it continues to move horizontally within a fixed range. Unfortunately, Ethereum (ETH) and Ripple (XRP) must pay the price of their association with the big crypto and could drop lower or rise higher depending on how BTC bulls play their hand.

Also Read: Bitcoin and Ethereum have further correction potential

Bitcoin price to drop further unless this level holds

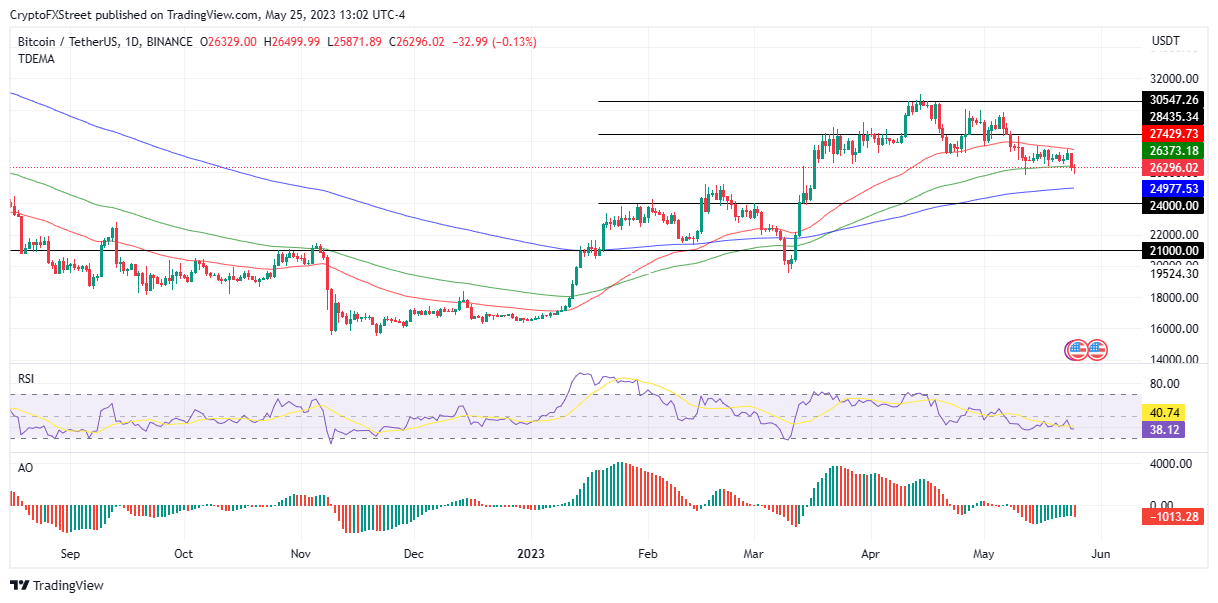

Bitcoin (BTC) price remains bearish despite the horizontal consolidation. As overhead selling pressure from the 50- and 100-day Exponential Moving Average (EMA) at $27,429 and $26,373 continue accumulating, the flagship cryptocurrency could fall lower.

An increase in seller momentum could see Bitcoin price drop into the $26,200 zone, triggering massive sell-offs that could see BTC tag the 200-day EMA at $24,978. Notably, industry sleuths say the $26,200 level is crucial for BTC as it coincides with the moving average, and losing it could open the drains for a drawdown to $21,000.

If #BTC loses the ~$26200 support (blue) then price would drop into the lower $20000s (green)

— Rekt Capital (@rektcapital) May 25, 2023

The ~$26200 happens to be a confluent support with the 200-week MA (orange)$BTC #Crypto #Bitcoin pic.twitter.com/jM6qmrmLvw

The Relative Strength Index (RSI) supports the downside narrative moving below the midline and heading south. Similarly, the Awesome Oscillators share the same belief, losing the green feel as red slowly flashes in. This bolsters the case for the bears.

BTC/USDT 1-Day Chart

Conversely, if buying pressure from the 100- and 200-day EMAs increases, Bitcoin price could increase, potentially rising above the 50-day EMA and flipping it to support. Further north, BTC could tag the $28,435 resistance level or, in the dire case, tag the $30,547 hurdle, denoting a 15% ascent from the current levels.

Also Read: Here’s why US PCE could make or break Bitcoin price rally to $30,000

Ethereum price may be crippled without Bitcoin

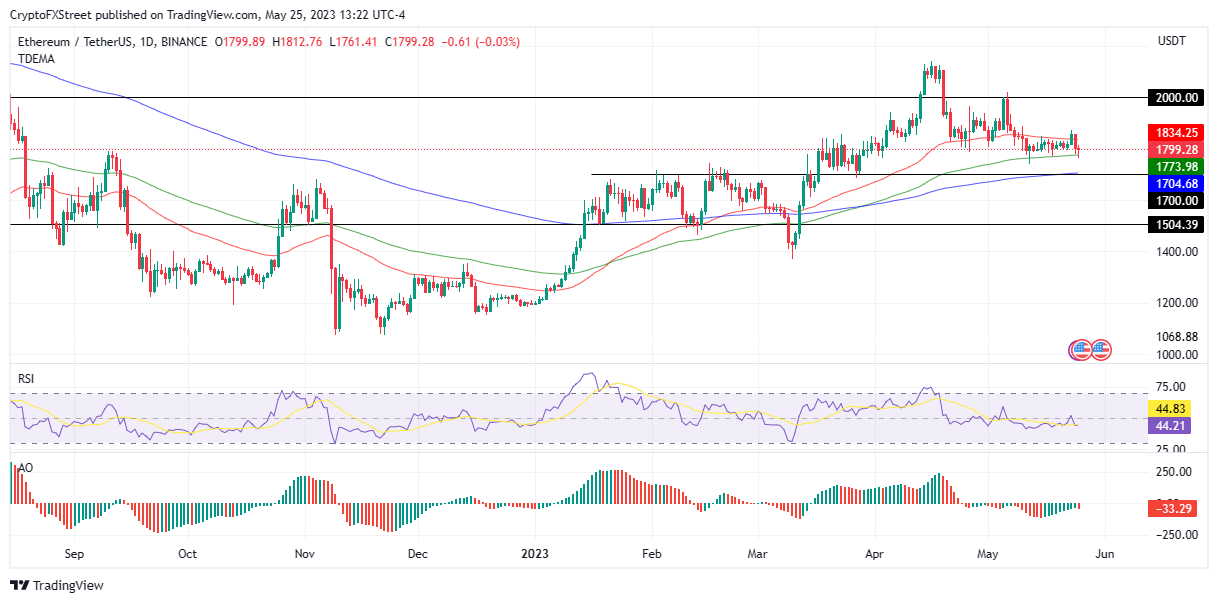

Ethereum (ETH) price, like BTC, is trapped within a fixed supplier congestion zone, with all signs indicating a continued downtrend once its breaches below the supplier congestion zone. This could lead the PoS token to the March 20 lows around $1,700, where the horizontal line and the 200-day EMA collide.

Failure by bulls to leverage the 200-day EMA at $1,704 could solidify the bear trend for ETH, extending it to a prolonged-downtrend target around the $1,500 level.

ETH/USDT 1-Day Chart

On the other hand, Ethereum price leveraging buying pressure from the $50-day EMA could clear the skies for a run-up to the $2,000 level and collect buy-side liquidity above it.

Also Read: Ethereum price takes a turn for the worse, flirts with 10% correction

Ripple price needs a win in the SEC lawsuit

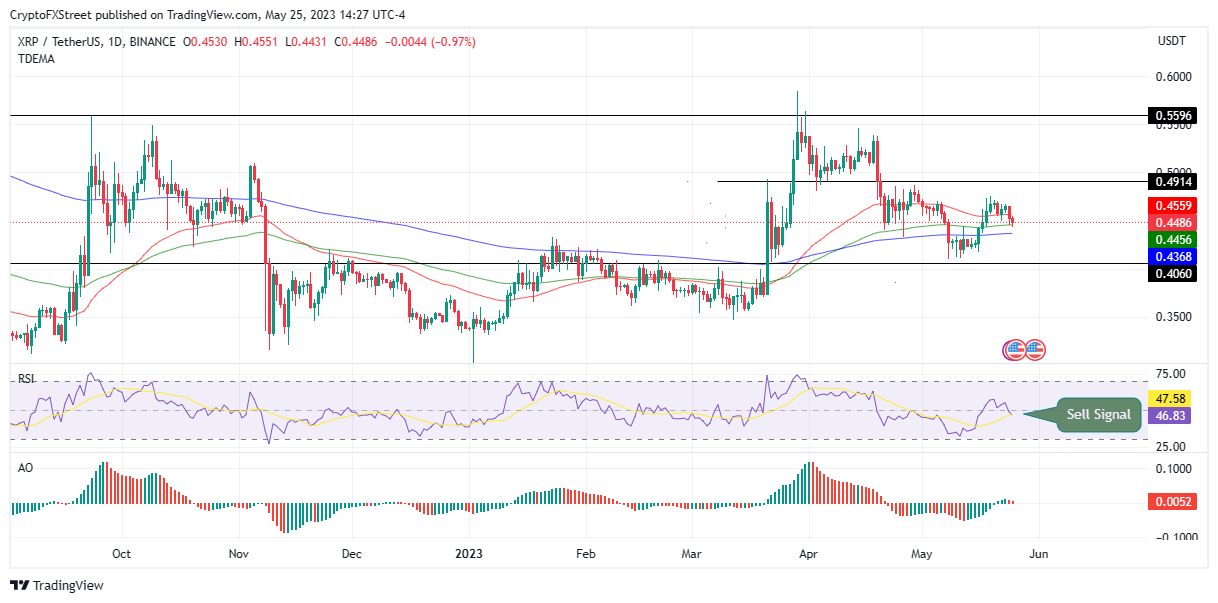

Ripple (XRP) price had broken its correlation with Bitcoin, responding only to network news. However, it appears that when there are no developments on the network, BTC leadership comes into play.

If selling pressure increases, Ripple price could escalate toward the $0.406 level before a possible trend reversal. Notice the sell signal on the Relative Strength Index, just above execution once the purple band breaks below the yellow band.

XRP/USDT 1-Day Chart

On the other hand, buying pressure from the 100- and 200-day EMA could catalyze a push toward the $0.491 resistance level or, in a highly bullish case, tag $0.559 before June 13.

Notably, the significance of this day is that Ripple CEO Brad Garlinghouse has predicted it to be when Judge Analisa Torres finally issues her summary judgment in the SEC lawsuit.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.