- The crpyto bears taking a breather amid quiet Easter trading.

- Ripple outperforms the top 3 widely traded coins.

The world’s no. 1 digital coin, Bitcoin, continues to trade range bounce around 0.6850 heading into the weekly closing. Ethereum and Ripple also keep their recent trading range amid quiet Easter trading. Ripple, however, outperforms the top 3 most dominantly traded digital assets. The total market capitalization of the top 20 cryptocurrencies now stands at $198.85 billion, as cited by CoinMarketCap.

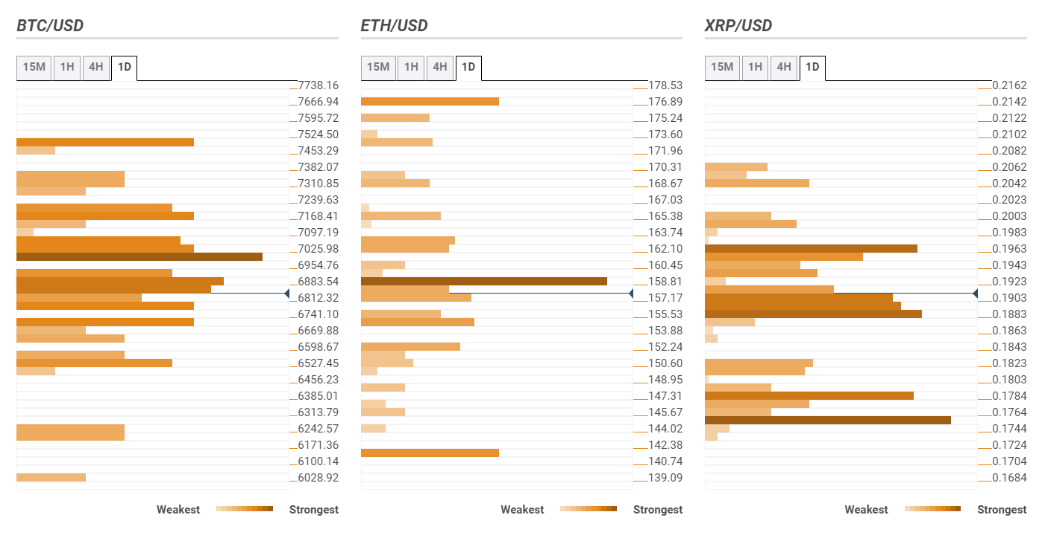

The top three coins could likely resume Friday’s corrective slide, with the FXStreet’s Confluence Detector tool suggesting key technical levels to watch out for in the week ahead.

BTC/USD: Remains vulnerable amid lack of healthy support levels

Amid a tug-of-war between the bulls and the bears so far this Easter, Bitcoin is likely to face the immediate resistance at 6883, the confluence of the upper Bollinger Band on 15-minutes chart, SMA 10 4H and previous high 1H. Further up, a minor next hurdle awaits around 6950, where the Fib 38.2% 1D and Bollinger Band 1H Upper coincide.

The buying interest will intensify above the latter, with the strong resistance at 7026 back in play. The barrier is the confluence of the Pivot Point 1D R1 and Fib 61.8% 1W.

Having said that, the downside appears more compelling amid a lack of substantial levels. The immediate support is aligned at 6741, the previous week low and Pivot point 1D S2.

A failure to resist above the 6740 area will expose the next support at 6527, Pivot Point 1 Week S1.

ETH/USD: Bearish bias still intact while below 158.58

At the current level of 157.80, any further upside attempts in Ethereum are likely to face a stiff resistance at 158.58, a cluster of Fib 38.2% 1D, SMA50 4H and SMA50 1H.

Only a sustained move above that level would revive the recovery momentum from Friday’s sell-off.

To the downside, the next support is the Fib 61.8% 1W at 153.88 below which a test of the Fib 38.2% 1M at 152.24 is likely on the cards.

XRP/USD: 0.1963 is the level to beat for the bulls

Ripple is on track to conquer the symmetrical triangle pattern target near 0.1960, which also marks the key hurdle for the bulls. That level represents the Fib 61.8% 1M.

On its way to that target, a minor resistance at 0.1943 needs to be taken-out, the intersection of Fib 38.2% 1W and SMA50 1D.

Any pullbacks will likely remain shallow, as a number of support levels are stack up, with the immediate one seen at 0.1900, the Fib 38.2% 1D and SMA50 4H intersection. A break below the last would call for a test of 0.1883, where the Fib 61.8% 1W and 1D meet.

If the sellers regain complete control below the latter, a test of the strong support of the previous year low at 0.1754 will be inevitable.

See all the cryptocurrency technical levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.