Top 3 Price Prediction Bitcoin, Ethereum, Ripple: 2023 is a trade-by-trade market, and this one looks bullish

- Bitcoin price has risen by 3% since the start of the new year.

- Ethereum price could rally back to $1,400, the midpoint of October’s trading range.

- XRP price is lagging behind ETH and BTC but could explode for substantial gains.

The crypto market is producing a turn that could result in more uptrend gains. Still, a countertrend trade in the current environment is highly risky, and one should handle their own risk accordingly.

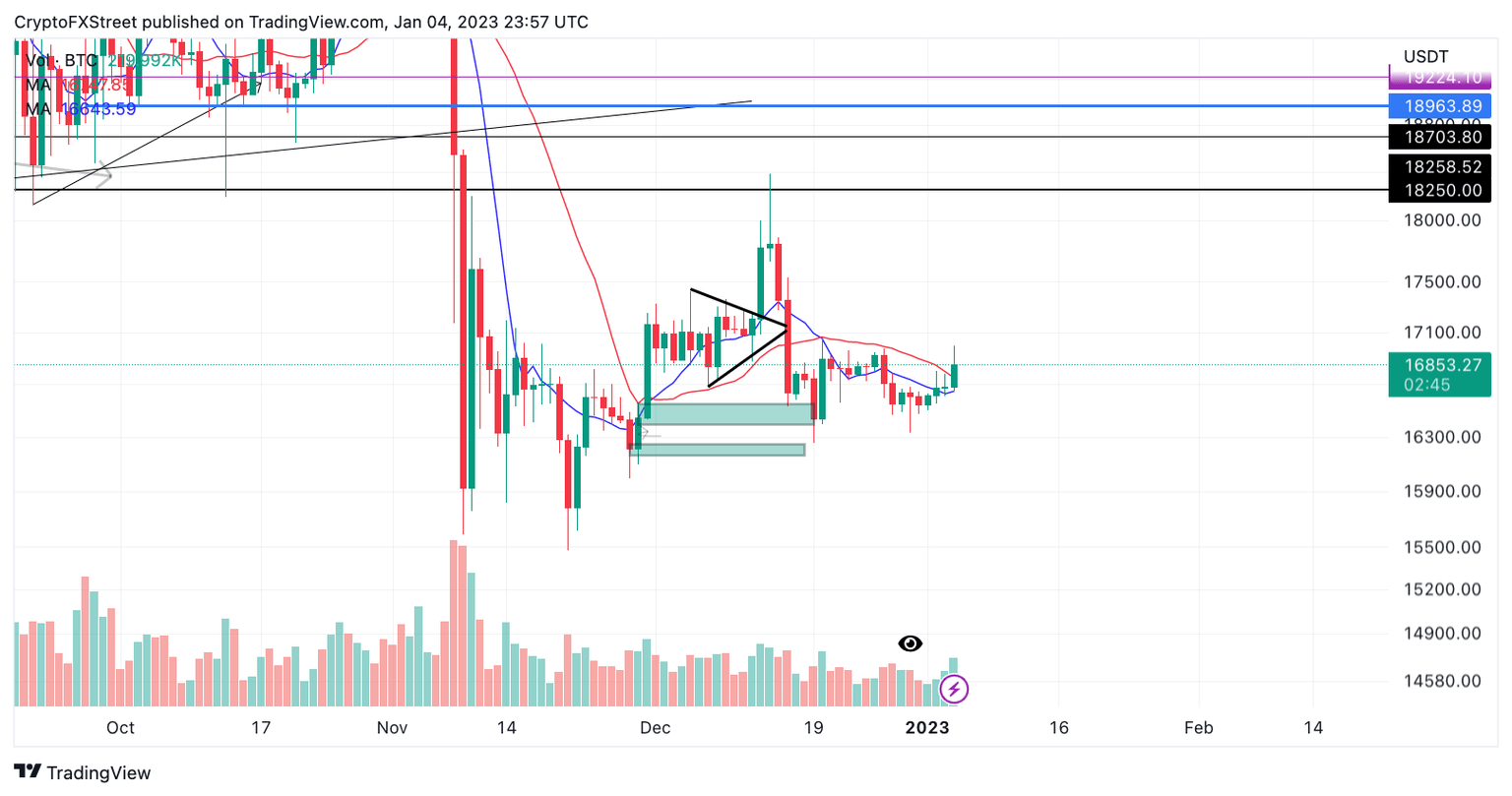

Bitcoin price is likely to move higher

Bitcoin price is putting forth optimistic signals as the peer-to-peer digital currency has risen by 3% since 2023's opening bell. The move north took place after the bulls established a higher pivot point at $16,333 on December 30, compared to the previous bearish attempt that was halted at $16,256 on December 19.

Bitcoin price currently auctions at $16,854, up 1% on the day after falling just $9 short of tagging the psychological $17,000 resistance. As January 4th's market nears the final hour, the BTC price seems poised to settle above the recently breached 21-day simple moving average (SMA) at $16,750.

In doing so, sidelined bulls could begin re-entering the market to challenge key levels within December's trading range. Ultimately, the December swing high at $18,387 could succumb to a challenge, resulting in a 9% Increase from BTC's current market value.

BTC/USDT 1-Day Chart

A daily close below the recently breached 8-day exponential moving average (EMA) at $16,500 would void the newly established uptrend's possibility to rally further. As a consequence, the 2022 low at $15,476 could be subject to a liquidation, resulting in a 9% decline from the current Bitcoin price.

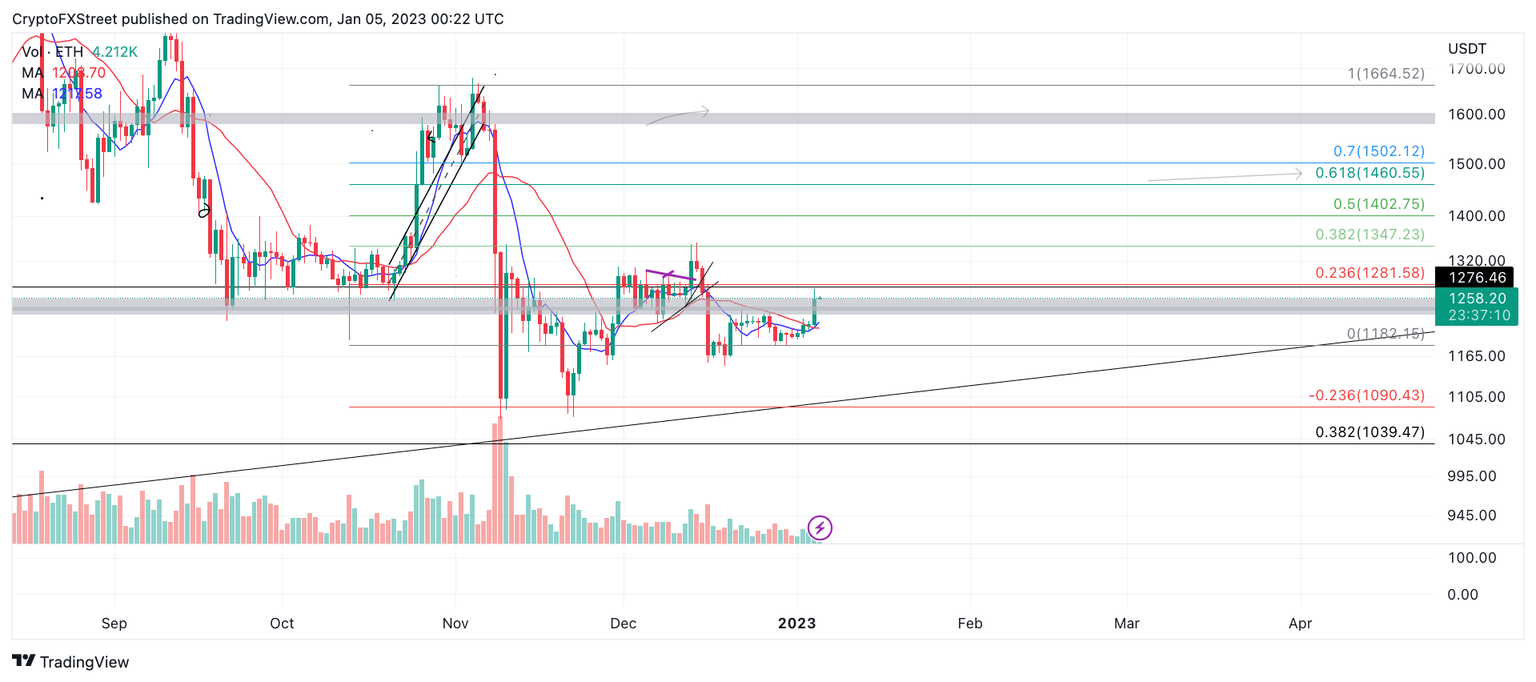

Ethereum price enters October's range

Ethereum price has risen by 6% since the start of the new year. The bulls have produced a bullish engulfing candle back into October's support zone, aiding two previous countertrend rallies. Like Bitcoin's technicals, the decentralized smart-contract token hurdled both the 8-day exponential and 21-day simple moving averages during January 4th’s upward move.

Ethereum price currently trades at $1,216. A Fibonacci retracement tool surrounding October's swing low and swing high shows the current rise as just a 23.6% retracement. If the market is genuinely bullish, the bulls should be able to rally into the midpoint of October's trading range at $1,400, resulting in an additional 12% gain.

ETH/USDT 1-Day Chart

Invalidation of the bullish thesis would be a closing candlestick beneath the recently colliding moving indicators at $1,210. If the breach occurs, the bears could re-route south and challenge December's low at $1,150, resulting in a 7% decline.

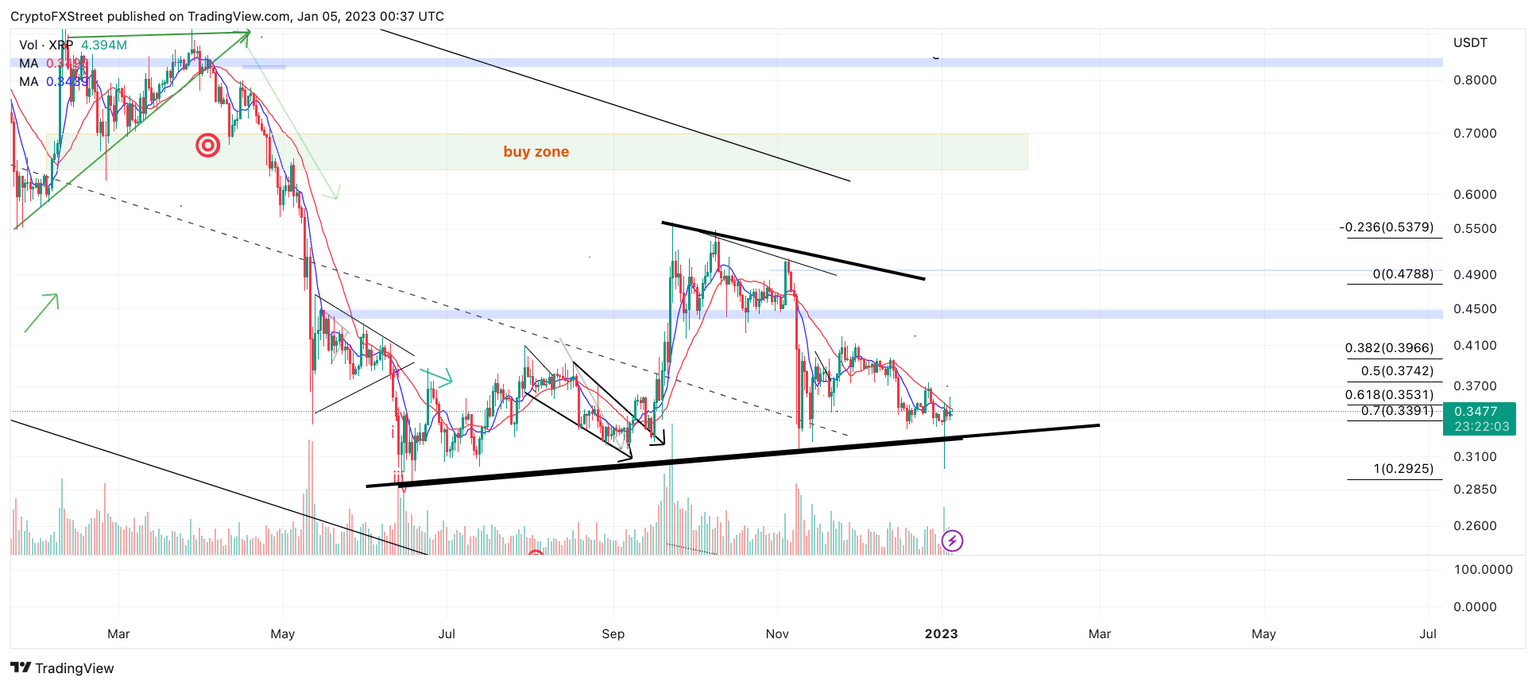

XRP price lags but could be the dark horse among the three

XRP price has not joined the bullish plot witnessed by the other two cryptocurrencies. As of January 4, Ripple coils between the 8-day EMA and 21-day SMA, only garnering a mere 1.5% increase in market value since the start of the year.

XRP price currently auctions at $0.3485. Traders should keep their eye on the recent swing high established at $0.3605. A second attempt to hurdle the barrier could be the move bulls have been waiting for. Key liquidity zones of interest would be the $0.37 a00nd $0.4000 swing highs established on December 13 and 27, respectively. The bullish scenario would create the potential for a 14% rally from Ripple's current market value.

XRP/USDT 1-Day Chart

If the bulls hurdle $0.3600, the uptrend's invalidation point would be the $0.3000 swing low established on January 2. A breach of the low would void the bullish potential and lead the way for the bears to target the 2020 liquidity levels near $0.2700 and potentially $0.2500, resulting in a 30% decline from Ripple's current trading price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.