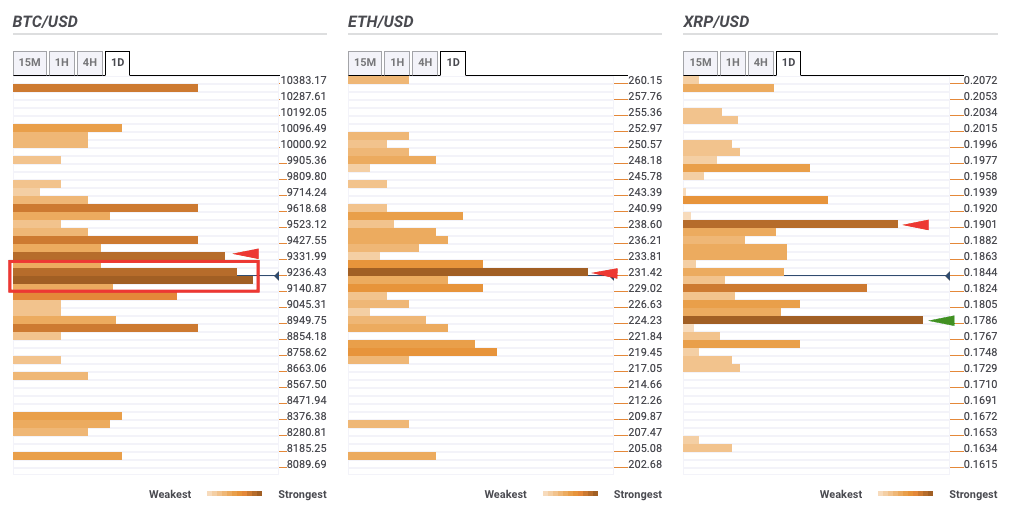

Top 3 Price Prediction Bitcoin, Ethereum and Ripple: BTC/USD and ETH/USD lack healthy support levels – Confluence Detector

Top 3 coins daily confluence detector

Bitcoin

- Open: $9,239.79

- Current Price: $9,171.55

BTC/USD lacks healthy support levels on the downside. On the upside, the bulls face an immediate resistance stack from $9,200-$9,250, which has the 15-min Previous Low, one-hour Previous Low, one-hour Previous High, 4-hour Previous High, one-week Fibonacci 38.2% retracement level, 15-min Bollinger Band upper curve, one-hour Bollinger Band middle curve, 15-min SMA 5, one-hour SMA 5, 4-hour SMA 5, 15-min SMA 10, 4-hour SMA 10, one-hour SMA 50, 15-min SMA 100 and 15-min SMA 200.

Another strong resistance level lies at $9,400, which has the 4-hour Bollinger Band middle curve, one-week 61.8% and one-month 38.2% Fibonacci retracement levels.

Ethereum

- Open: $232.41

- Current Price: $230.25

ETH/USD lacks healthy support levels on the downside. On the upside, ETH/USD has strong resistance at $232. This level has the 15-min Previous High, one-hour Previous HIgh, 15-min Bollinger Band upper curve, one-hour Bollinger Band middle curve, one-month Fibonacci 23.6% retracement level, one-week 61.8% Fibonacci retracement level, 15-min SMA 5 and 15-min SMA 100.

Ripple

- Open: $0.1815

- Current Price: $0.1832

XRP/USD has one strong resistance and support level at $0.191 and $0.1795, respectively. The former has the one-month Fibonacci 23.6% retracement level, one-day Pivot Point resistance-three and 4-hour SMA 100. The $0.1795 support level has the 4-hor Bollinger Band lower curve, Previous Month low and one-month Pivot Point support-one.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.