- Five days on the cliff putting pressure on those who came last to the pitch.

- Our "Technical Confluence Indicator" tool indicates less consistent support lines than the challenges that pose the key resistance levels.

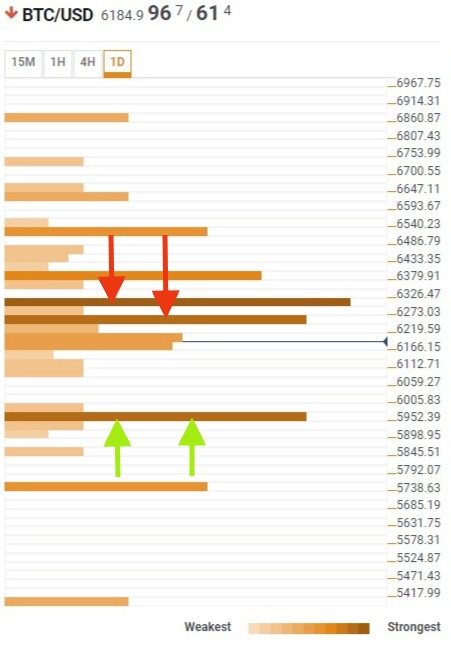

BTC/USD 1D

The Bitcoin trades at $6,166, slightly lower than yesterday’s highs at $6,345. The BTC/USD did not succeed in their attempt to conquer the $6,400 level, and now it is moving straight to the cliff, acutely aware that a short skydive could be close.

Below the spot price, the first remarkable support is the 23.6% Fibonacci retracement on a weekly basis, at the $6,150 level. The S1 level of the Pivot Points calculations on a daily basis is located $45 below, at $6,105. It is not up until $200 below, at $5,940, where the confluence of monthly and weekly lows could provide BTC/USD some reliable support.

Above the current price level, BTC/USD has also much more room to move up until finding a stiff resistance at $6,300 level, where the 38.2% Fibonacci retracement on a weekly basis is waiting. Compared to the analysis published yesterday, this level of resistance has been reinforced with the addition of the 23.5% Fibonacci retracement on a daily basis.

At the Bitcoin bullish end, the daily R1 Pivot Point waits around the $6,350 level and, slightly above, we can find the monthly S1 Pivot Point level.

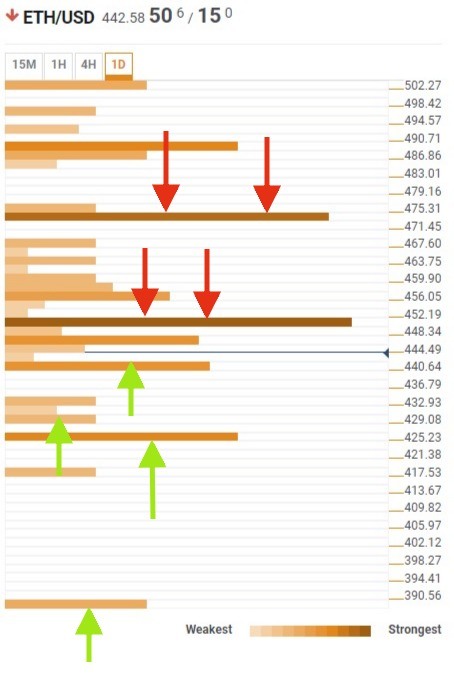

ETH/USD 1D

The Ethereum has some good footholds to avoid falling down, but they are a bit far apart, and that complicates the scenario. ETH/USD trades now at $445, close to the $440 level where Ethereum should find some meaningful support, in this case, the S1 level of the Pivot Point calculation system on a monthly basis. Below this powerful support, ETH/USD will find the S2 Pivot Point on a daily basis and the weekly S1 Pivot Point level on the $430/$425 range. As the ultimate safety net, Ethereum has the weekly S2 Pivot Point below the $390 level.

If there are not many barriers underneath the current price, there are tough obstacles on the upside. ETH/USD would find the monthly and weekly lows above the $450 level also protected by the daily S1 Pivot Point indicator a few dollars below. Only if ETH/USD exceeds the daily R1 Pivot Point level placed at $475, we could think of a more comfortable scenario.

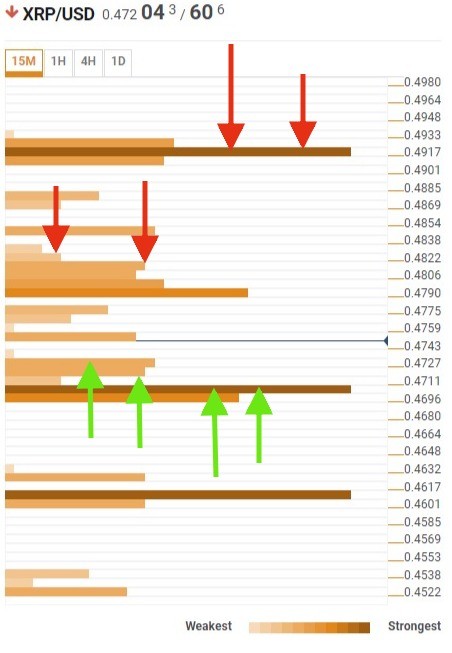

XRP/USD 1D

Among the three assets analyzed with the help of our technical convergence tool, XRP/USD is the one that enjoys the most solid support. XRP/USD trades now at $0.47, only 2 cents above of a strong confluence level, formed by the 1D high, the daily S1 Pivot Point and the weekly and monthly lows, besides some short-term supports.

On the upside, it is not until the $0.48 level that XRP/USD could meet some resistance with the 61.8% Fibonacci retracement level in the daily timeframe, followed by the 38.2% Fibonacci retracement at the $0,485 price level. A little higher, at the $0.492 level, we should expect the day's highs as the level to beat.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin to extend its consolidation between the $75,000 to $88,000 range

Bitcoin price faces a slight rejection around the $85,000 resistance level on Wednesday after recovering 3.16% the previous day. A K33 report highlights that Cryptocurrencies and Equities have largely de-risked going into Donald Trump’s “Liberation Day” on Wednesday.

Maker, Gala and Polygon lead $100k whale transactions, can altcoins defy looming macro uncertainty?

Maker (MKR), GALA, and Polygon (POL) are among the crypto projects that have seen a spike in whale transactions of at least $100,000 in the past week, as revealed by Santiment on-chain data.

Cardano and Binance Coin Price Forecast: Altcoins ADA and BNB show weakness in momentum indicators

Cardano (ADA) and Binance Coin (BNB) prices edge slightly down, trading around $0.66 and $598, respectively, at the time of writing on Wednesday after a mild recovery so far this week.

Public firms turn balance sheets into Bitcoin vaults: Gamestop raises $1.5 billion; Metaplanet adds 160 BTC

Public companies are increasingly converting their balance sheets into Bitcoin reserves. Gamestop (GME) has raised $1.5 billion in capital, with potential plans to allocate part of the funds toward expanding its Bitcoin treasury.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.