- Bitcoin is likely to flip bullish in the near-term as PlanB predicts the price rally as high as $288,000.

- Ethereum downswing to intensify if losses extend below ascending parallel channel support.

- Ripple eyes a 44% upswing to $0.71 if the symmetrical triangle pattern matures as anticipated.

Bitcoin corrected at the beginning of the week, sliding under $54,000 support from highs above $61,000. The entire cryptocurrency market was caught in the bearish wave with Ethereum testing support at $1,700. Ripple plunged close to $0.4 before making a reflex recovery above $0.5.

Meanwhile, Cardano (ADA) spiked over 20% following the listing on Coinbase Pro. The aspiring smart contract platform is among the few cryptocurrencies posting double-digit gains. Other well-performing coins include Filecoin (FIL) and Zilliqa (ZIL).

Bitcoin could soon flip bullish

Bitcoin embraced support around $53,150 following the colossal breakdown from the recently achieved all-time high. However, recovery has been lethargic for the bellwether cryptoasset. Meanwhile, higher support is needed for Bitcoin to flip bullish and recover the lost ground above $60,000.

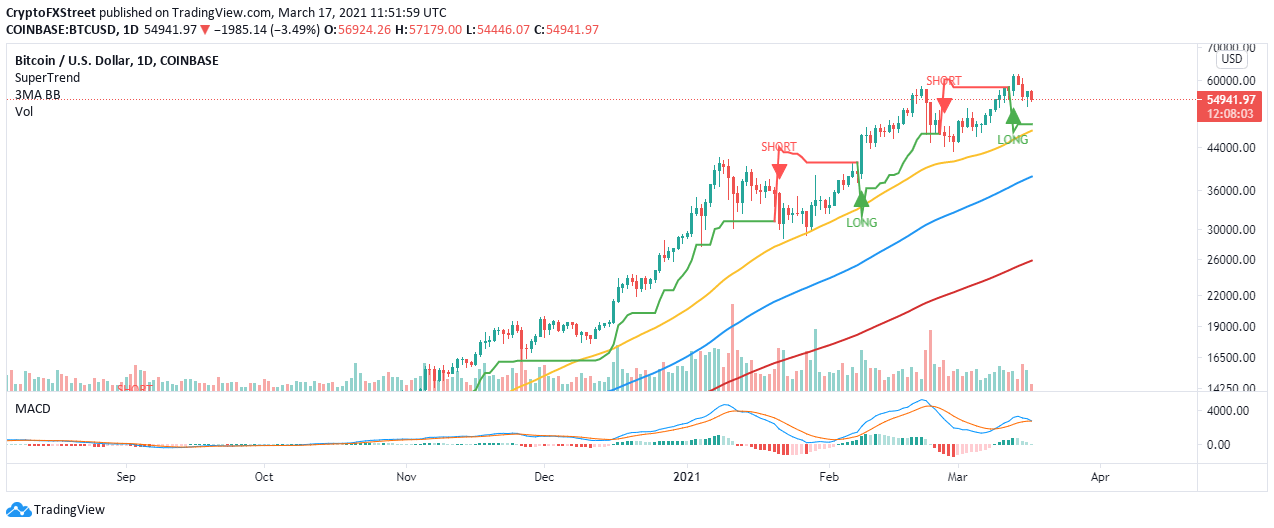

The seemingly imminent bullish outlook has been accentuated by the SuperTrend indicator, as observed on the daily chart. This indicator has just given a signal to traders to go long on BTC. If stability returns to the market, Bitcoin will shift the focus back to $60,000.

BTC/USD daily chart

PlanB, a pseudonymous prominent analyst, believes that Bitcoin is still beginning the bull run. The analyst’s Stock-to-Flow (S2F) model has been quite accurate amid the rally and has a prediction of $100,000 per BTC by the end of the year. However, PlanB says that the bull run will not stop here but will soar to highs around $288,000.

December close: $28,992

— PlanB (@100trillionUSD) March 17, 2021

January close: $33,141

February close: $45,240

March 17 price: $55,000

We are only 3.5 months into the #bitcoin bull market. IMO BTC will not stop at $100K and will continue to S2FX $288K average price level (ATH will be higher). pic.twitter.com/skS6a7pepu

Ethereum losing traction as overhead pressure rises

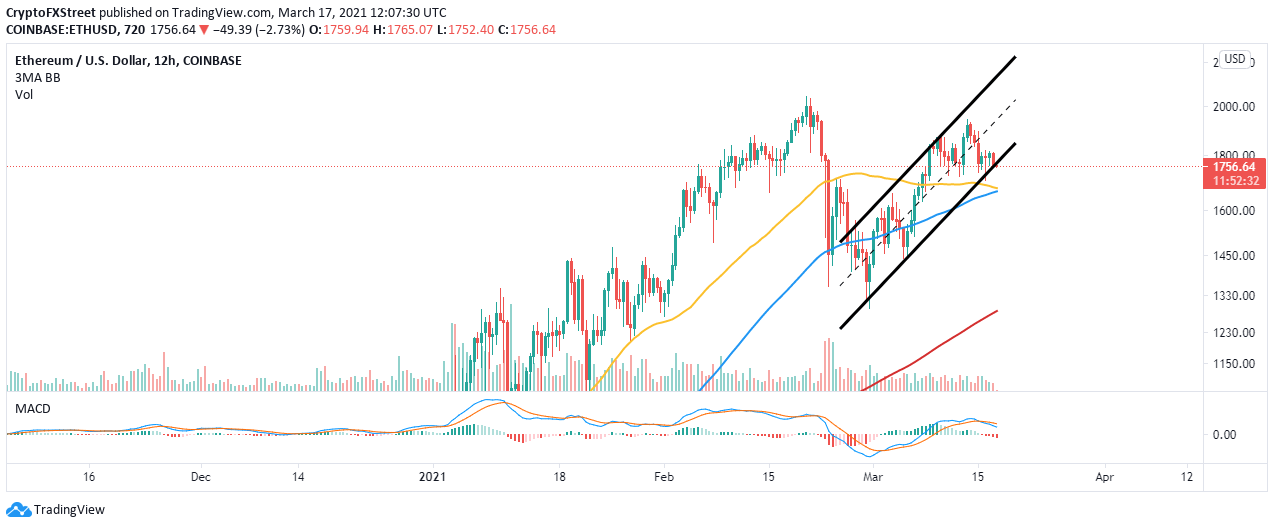

Ether failed in closing the day above $1,800 on Tuesday. This sabotaged the recovery toward $2,000 and opened to ongoing declines. At the time of writing, Ethereum exchanges hands at $1,760 and testing support at the ascending parallel channel lower boundary support.

If the declines extend above this immediate support, massive sell orders will likely be triggered. On the downside, tentative support is anticipated at the 50 Simple Moving Average (SMA) and the 100 SMA on the 12-hour chart.

Note that the downtrend has been validated by the Moving Average Convergence Divergence (MACD). A bearish signal emerged when the MACD line crossed under the signal line. Besides, the indicator is still dropping toward the midline.

ETH/USD 12-hour chart

Ripple moving closer to a 44% move

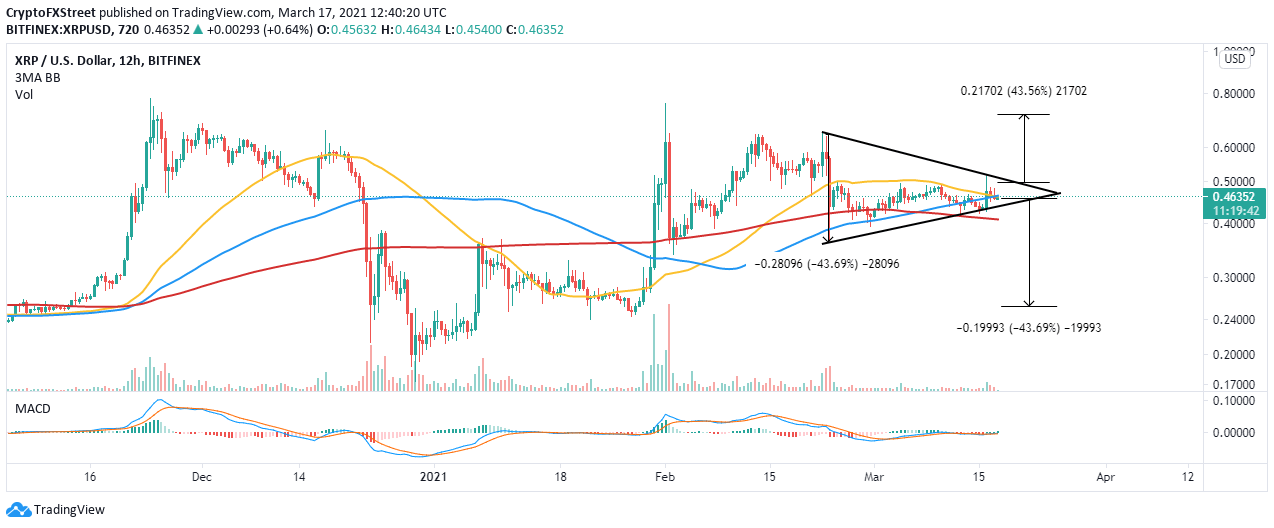

Ripple is back to the drawing at $0.45 after failing to secure support above $0.5. However, bulls are not done with the assault mission to higher highs, considering that XRP is trading within the confines of a symmetrical triangle pattern.

A massive breakout is expected if the price slices through the upper trendline. Triangles have exact breakout and breakdown targets; therefore, Ripple would swing 44% higher and jump above $0.7.

Ripple must sustain the uptrend in the near-term for gains beyond the uptrend trendline of the triangle pattern. The MACD has reinforced the uptrend; thus, it is likely for XRP to make the breakout.

XRP/USD 4-hour hour chart

It is worth mentioning that if Ripple fails to hold above the immediate support provided by the 50 SMA and the 100 SMA, the breakout will be sabotaged. On the downside, the triangle may lead to a colossal breakout towards $0.24.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.