- PayPal’s support for Bitcoin and other cryptocurrencies shoots the price to $13,200.

- Ethereum focused on gaining ground past $400 despite the loss of steam; $390 comes up as short term support.

- XRP social volume drops even after Ripple announced possible relocation from the United States.

Bulls are finally making a comeback into the market and regaining full control of the price across the board. According to the data by CoinMarketCap, a massive $22 billion has come into the market amid Bitcoin’s recovery beyond $13,000.

Selected digital assets followed in the footsteps of the flagship cryptocurrency, adding credence to the bullish cycle. For instance, Ethereum brushed shoulders with $0.26 while Ripple closed in on $0.26, as covered earlier. Litecoin is among the best daily performers, accruing more than 12% in gains.

Bitcoin takes a breather, aiming for $14,000

Bitcoin rallied above $13,000 for the first time in 2020. A broader look at the 4-hour chart shows that the flagship cryptocurrency has been in a long-term bullish cycle since the crash in March. However, up and downs have been part and parcel of the price action, reminiscent of most bullish trends.

Meanwhile, BTC/USD is trading at $12,800 after a retreat from $13,230. The Relative Strength Index (RSI) is in the overbought region, accentuating the influence buyers have on the price. BTC is trading above the selected moving averages, including the 200 SMA, 100 SMA and 50 SMA.

BTC/USD 4-hour chart

InToTheBlock’s IOMAP model reveals the absence of substantial barriers likely to hinder growth above $13,000 in the near term. Nonetheless, for gains eying $14,000, the seller congestion between $13,170 and $13,556 must be overcome.

On the downside, the model shows that it is improbable for a breakdown under $12,000. On the other hand, the most robust support lies between $11,258 and $11,644. Here, roughly 2.24 million addresses previously bought approximately 1.1 million BTC.

Bitcoin’s rally above $13,000 is attributed to the news that PayPal is now allowing users to buy and sell Bitcoin and other digital assets via their accounts. The service will begin with a partial rollout in the United States.

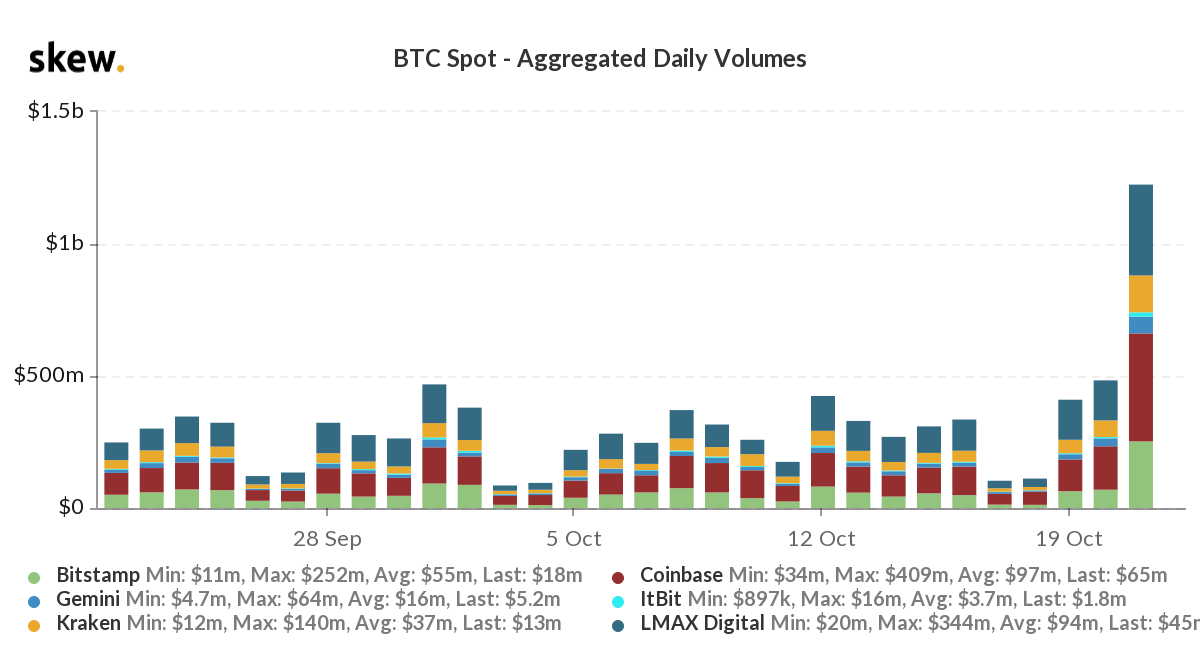

Besides the price action, activity within the Bitcoin network also shot up significantly, as the data by Skew suggests. Bitcoin spot aggregated daily volumes spiked across exchanges with Coinbase leading, LMAX Digital following closely, and Kraken coming third.

Bitcoin spot – aggregated daily volume chart

Ethereum retests $400 again

The smart contract token capitalized on Bitcoin’s price action, also stepping above the crucial $400. Lack of enough volume failed to sustain gains above the critical level, allowing ETH to slide to $390. For now, ETH/USD is trading at $395 as buyers focus on pushing the price higher.

Ethereum’s bullish outlook is reinforced by the Moving Average Convergence Divergence (MACD) action above the midline. A vivid bullish divergence brings to light a growing buyer influence. Trading above $400 might encourage more participants to buy ETH amid the fear of missing out (FOMO).

Ethereum-hour chart

Over the last few days, mentions relating to Ether surged across multiple social media channels. The increase shows Ethereum is becoming attractive to investors who wish to capitalize on the immediate gains.

Similarly, the volume of transactions performed on the network also soared concurrently with the social volume. Whenever these two metrics spike at the same time, a significant price action occurs to the upside.

Ethereum social volume/volume chart

On the other hand, traders need to keep an eye on the same metrics because retracements usually follow spikes. The declining network volume and social volume will negatively impact the price, pointing to a potential correction.

Ripple fights relentlessly for breakout to $0.3

The cross-border cryptocurrency continues to capitalize on recently established support areas. After bouncing off the anchor at $0.24, Ripple went ahead and turned the 200 SMA, 50 SMA, and 100 SMA into support levels. The bullish action gained momentum towards $0.26, but XRP is doddering at $0.256.

Despite the stalling, the RSI emphasizes the bulls’ position in the market as it crosses into the overbought region. If the speculation within XRP’s community, mostly referred to as the XRP army, continues, the volume is likely to build, giving the token a massive push to $0.3.

XRP/USD 4-hour chart

The upward price action from $0.24 succeeded a spike in social volume, as shown by data provided by Santiment. Unfortunately, a retreat is underway from the October 17 peak of 43 to the prevailing 19. If the mentions on social media platforms keep dwindling, there is a likelihood of the bullish outlook being invalidated.

Ripple social volume chart

Daily takeaway

Bitcoin extends price action above $13,000 for the first time in 2020. On-chain data shows increased activity within the network after PayPal announced support for buying and selling of BTC. On the flip side, losses are unlikely below $12,000, but BTC may resume the uptrend.

Ethereum’s bullish action stalled at $400, while $390 functions as the initial critical support. A pike in network transaction volume and social volume suggests the uptrend will keep gaining traction.

On the other hand, Ripple must break the barrier at $0.26 to open the door for gains aiming for $0.3. However, a fall in social media mentions highlights a potential reversal. Fortunately, a myriad of support areas exists to cushion the token from a massive fall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

(51)-637389518755875009.png)

-637389519309202371.png)

- 2020-10-22T112912.721-637389521658763523.png)

VOlume chart-637389521940188310.png)

-637389522985763138.png)

[11.32.17, 22 Oct, 2020]-637389523464110637.png)