- Crypto.com downtrend continues, but the 200 SMA support could lead to a reversal.

- THETA's downside is protected by both the ascending trendline and the 50 SMA.

- AAVE settles above the $40 critical support following migration from LEND.

As the week grinds to a halt, we take a look at the gainers and the losers. As discussed on Saturday, Waves, ABBC Coin and Filecoin emerged best-performers. On the other hand, Cryoto.com, THETA and AAVE received a heavy battering from the bears, recording the biggest losses among the top 50.

The news highlight of the week is the suspension of digital assets/cryptocurrencies withdrawals by OKEx, a leading exchange in the market. The incident destabilized the market, raising questions over centralized exchanges' reliability and whether decentralized exchanges are the way to go. The suspended services remain unavailable, but "other functions are up and running."

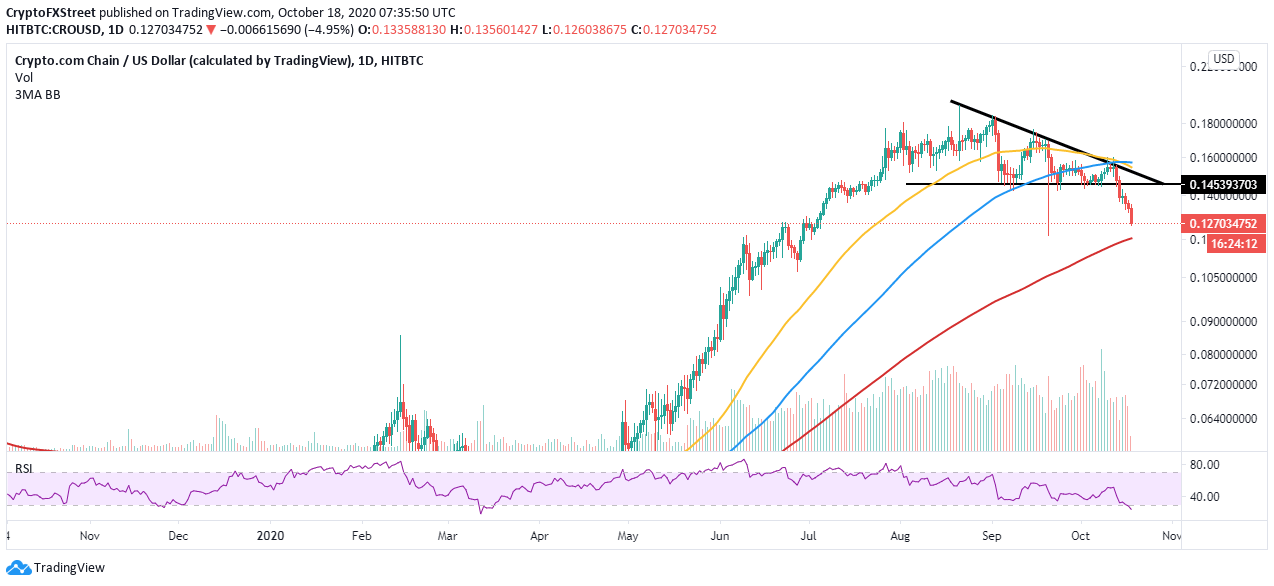

Crypt.com downtrend nears its elastic limit

Crypto.com sliced through the descending triangle support as predicted earlier. Besides, a tentative anchorage at $0.14 did little to cushion the crypto asset from the breakdown. At the moment, CRO is dancing at $0.127 even as the bearish grip intensifies. A glance farther down reveals a last resort buyer congestion zone at the 200 Simple Moving Average in the daily timeframe.

The Relative Strength Index (RSI) stresses the bearish outlook by diving sharply into the oversold territory. Therefore, the anticipated support must hold; otherwise, losses might become unstoppable. On the bright side, an oversold condition is a bullish sign and coupled with the support mentioned earlier, may lead to a reversal.

CRO/USD daily chart

IntoTheBlock's IOMAP model illustrates the absence of resistance to the region between $0.136 and $0.14. Here, 275 addresses previously bought nearly 3.5 billion CRO. Therefore, if the price reverses from the ongoing downtrend, room for growth exists until CRO hits this resistance range.

On the flip side, the model reveals the lack of strong support for the token. In other words, the breakdown could continue, mostly if minor support at $0.125 and $0.121 is shattered. Here, 360 addresses previously purchased 8.81 million CRO.

Crypto.com IOMAP chart

THETA recovery in the offing

After losing 15% in the last seven days, THETA seems poised for a reversal. It is trading at $0.63 while the 50-day SMA protects its immediate downside. THETA has not traded below this moving average since May. Therefore, a correction might come into the picture. Besides, a long-term ascending trendline is reinforcing the support. Similarly, the RSI points upwards after hitting levels slightly below the midline, suggesting that the bulls' turn is nigh.

THETA/USD daily chart

When looking at THETA's network growth, a bearish thesis is brought into the picture. Over the last few days, the number of new THETA addresses joining the network has declined sharply. The number of addresses joining THETA was eight on October 13 but had plummeted to 3 by October 17, representing a 62% drop.

The downtrend in network growth is a red flag for the price of THETA in the near term. The regular inflow and outflow of tokens in the network tend to reduce with a downward trend in network growth, affecting liquidity.

THETA new addresses chart

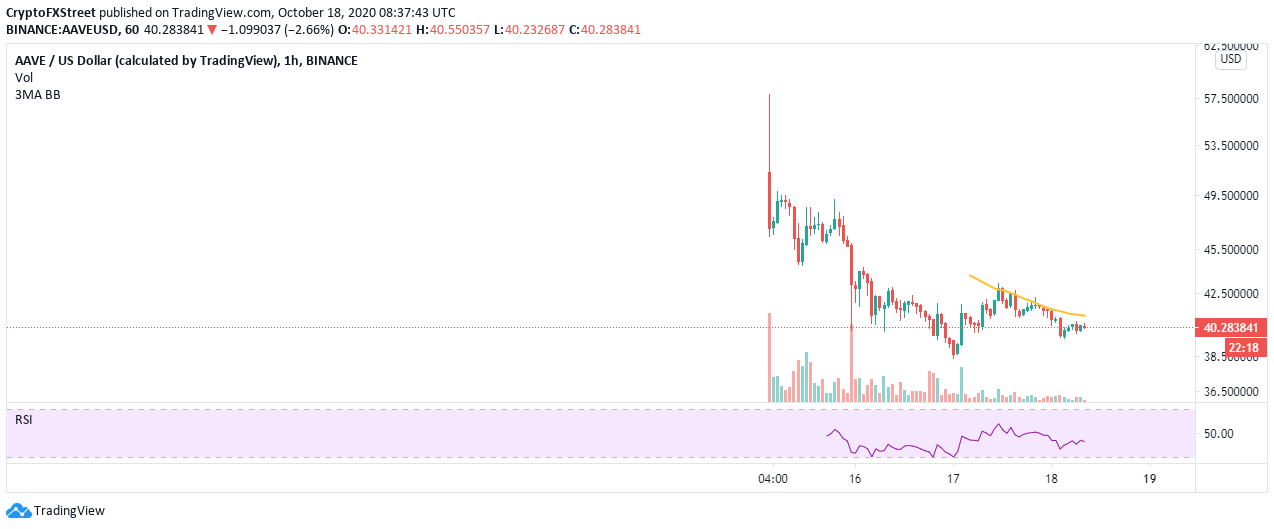

AAVE settles for consolation

LEND recently completed the migration to AAVE following a successful "voting period for the first Aave Improvement Proposal (AIP1)." The move was so that the community governs the new token through systematic voting processes. Consequently, staking has been added to ensure that users earn on their holdings. Moreover, the team says, "the purpose of staking is to act as a mitigation tool in case of a shortfall event."

AAVE 1-hour chart

Following the migration, AAVE shot up to $57. However, a retreat occurred immediately, sending the token on a spiral to $38. A reflex correction also took place, but recovery hit a barrier at $44. Meanwhile, $40 has been established as the initial critical support. The resistance at the 50 SMA in the hourly range must come down for gains to materialize towards the $44 resistance.

AAVE holder distribution chart

According to Santiment's holder distribution metric, uptake of AAVE through migration is still in progress. A significant rise in the number of addresses holding between 1,000 and 10,000 AAVE has been recorded. For instance, whales in this range soared from only five on October 15 to 40 on October 18, representing an 87.5% increase. If buying pressure continues to mount behind AAVE in the coming days, recovery will most likely occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637386089194512420.png)

-637386089987554575.png)

[11.46.50, 18 Oct, 2020]-637386090937157616.png)