- Several altcoins have been losing ground despite the recovery of the cryptocurrency market.

- TD Sequential indicator is ready to give a buy signal for Crypto.com.

- Filecoin recovered most of the weekly losses, but it is still in the red zone.

- ABBC Coins struggles to clear a significant resistance.

The cryptocurrency market has been on a recovery track recently. Bitcoin settled above $13,000 and tested a new high of 2020; many top altcoins followed the lead showing double-digit gains on a week-to-week basis as the market has been recovering from losses inflicted by the news that one of the most popular cryptocurrency exchange OKEx, suspended all digital assets withdrawals.

However, several altcoins failed to join the fun and stayed deep in the red compared to the levels registered during the previous week.

The outsiders of the week are Crypto.com, Filecoin, ABBC Coin. Let's see if they have a chance to catch up with the rest of the market.

Crypto.com bulls have hope

Crypto.com (CRO) is the 15th largest digital asset with a current market capitalization of $2.1 billion and an average daily trading volume of $63 million. The coin jumped into a top-20 in June 2020 and, for some time, stayed in the top-10.

Crypto.com Coin was launched in 2016 to simplify the transition from fiat to cryptocurrency. The project offers technical solutions for buying or selling digital assets and paying with crypto for their everyday purchases.

Considering that OKEx is one of the most popular exchanges for the coin, the trading platform woes partially explain the coin's sell-off. At the time of writing, CRO is changing hands at $0.1, mostly unchanged on a day-to-day basis and down over 18% on a week-to-week basis.

CRO/USD: The technical picture

On the weekly chart, the TD Sequential indicator implies that the coin may be ripe for recovery. It is developing a buy signal, with red eight candles. If we get the ninth candle, the bullish formation will imply the recovery for one to four weekly candlesticks with the initial target at $0.157.

CRO/USD weekly chart

On the intraday charts, the price has created a bottom at $0.095. Still, the further recovery is limited by the local resistance on approach to $0.105; CRO has been trying to clear this barrier since Saturday, October 24. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.135 and the ultimate resistance of $0.157.

CRO/USD 4-hour chart

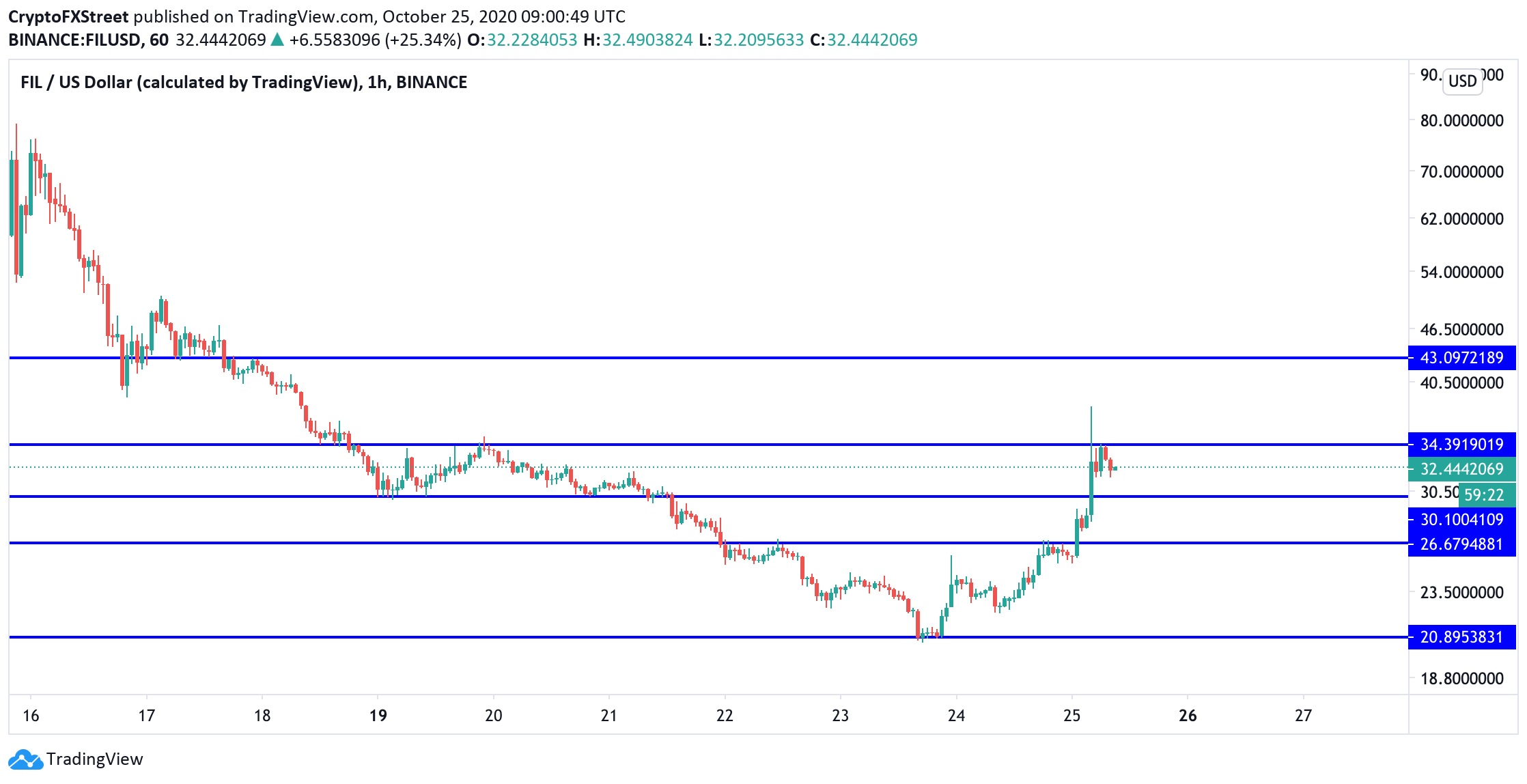

Filecoin: from zero to hero

Filecoin has been pretty wild recently. The team of the project launched its mainnet on October 15 with a year delay from its roadmap. The coin initially jumped to as high as $100 but swiftly retreated to $20 amid miners exodus from the network. Read our in-depth report on what happened to Filecoin miners.

At the time of writing, FIL/USD is changing hands at $32.30. The coin has gained over 36% in the previous 24 hours; however, it is still down over 18% on a week-to-week basis.

FIL/USD 1-hour chart

From the technical point of view, FIL/USD attempted a recovery to the intraday high of $38, but they failed to keep up the momentum and retreated below the technical barrier of $34.4. This line now serves as a local support area that needs to be taken out before the coin can proceed with the recovery towards the next resistance of $43 and a psychological $50.

On the downside, the initial support is created by $30 that served as a backstop for the price on October 19-21, before the increased selling pressure took the price to the historic low of $20.63. A sustainable move below t$30 will bring the former resistance of $26 into focus.

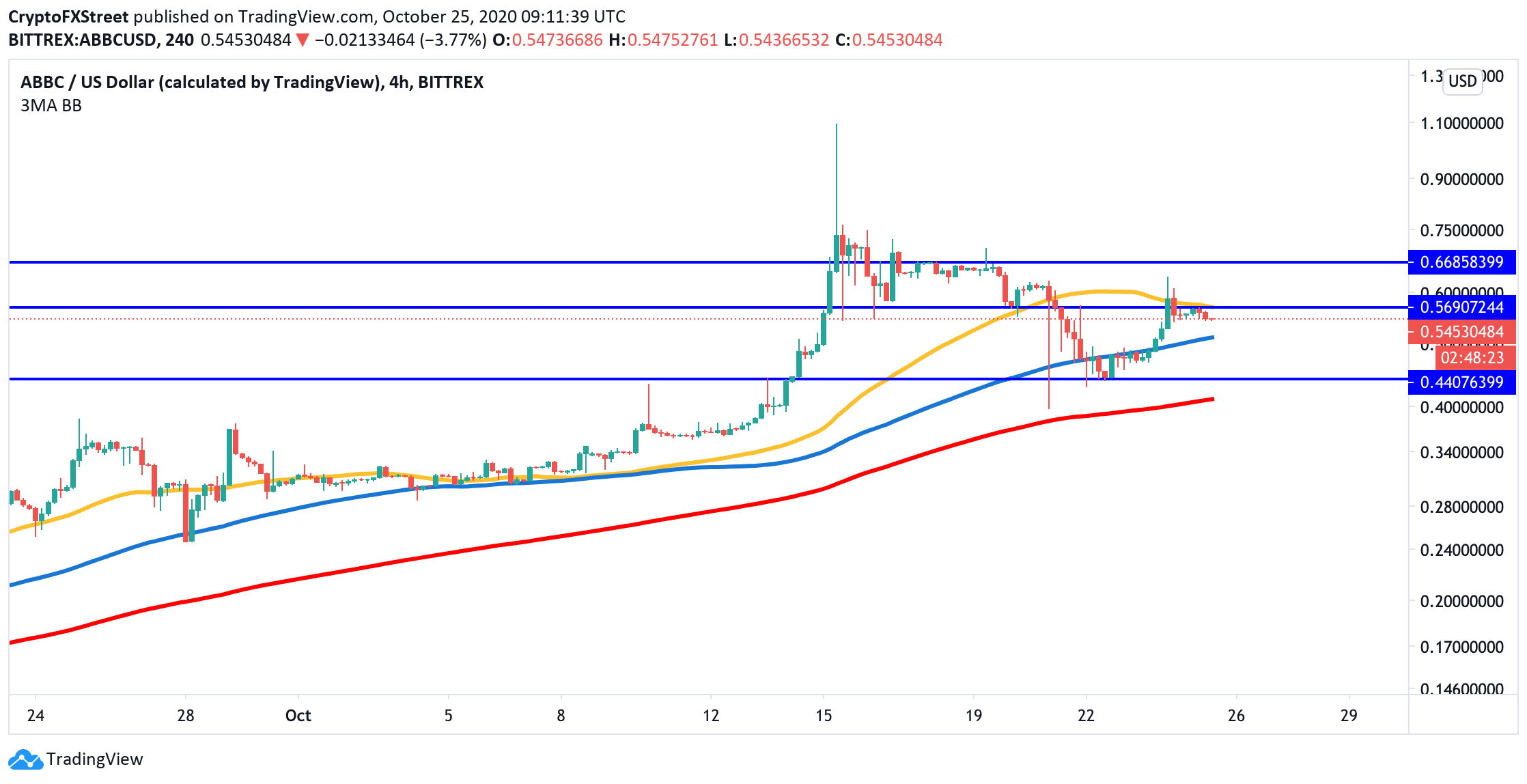

ABBC Coin stalled at critical resistance

ABBC Coin takes the 41st place in the global cryptocurrency market rating with the current market capitalization of $383 million and an average daily trading volume of $48 million. The project positions itself as a blockchain solutions provider in the MENA region to bring the 'future of payment security' to its users. It is based on a Delegated Proof-of-Stake consensus protocol that can process up to 5,000 transactions per second.

At the time of writing, ABBC/USD is changing hands at $0.545, mostly unchanged on a day-to-day basis and down over 14% since this time on the previous Sunday.

From the technical perspective, ABBC/USD bottomed at $0.44; however, the recovery stalled on approach to $0.57 that served as strong support during the previous week. A sustainable move above this area is needed for the upside to gain traction, with the next focus on the previous channel resistance of $0.66.

ABBC/USD 4-hour chart

A failure to regain ground above $0.57 will bring the local support of $51 into focus. The short-term EMA reinforces this barrier. Once it is out of the way, the sell-off is likely to gain traction with the next focus on the recent low of $44, followed by the long-term EMA at $0.41.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.