Top 3 Gainers of The Week YFI, Waves, XRP: These altcoins defy gravity, gain over 50% on a weekly basis

- These three altcoins capitalized on the cryptocurrency market optimism.

- Waves, YFI and XRP gained over 50%, but the correction may follow.

The cryptocurrency market has been on fire recently. Bitcoin broke above the critical resistance of $18,000 and tested a new high of 2020, with all significant altcoins gaining ground.

The total capitalization of all digital assets in circulation increased to $535 billion, having gained over $80 billion in the past seven days. The market has been driven by speculative sentiments and the FOMO, caused by Bitcoin's clearing essential barriers.

The best performers of the week are Yearn.Finance, Wave, and XRP. These altcoins gained over 50% in the past seven days.

Yearn.Finance hits resistance at $30,000

Yearn.Finance (YFI) hit the area above $30,000 on Friday, November 20, and retreated to $26,300 by the time of writing. The coin has lost over 6% on a day-to-day basis; however, it is still 57% higher on a weekly basis. Yearn.Finance is currently the 32nd-largest digital asset with a current market capitalization of nearly $800 million. The average daily trading volume is registered at $860 million.

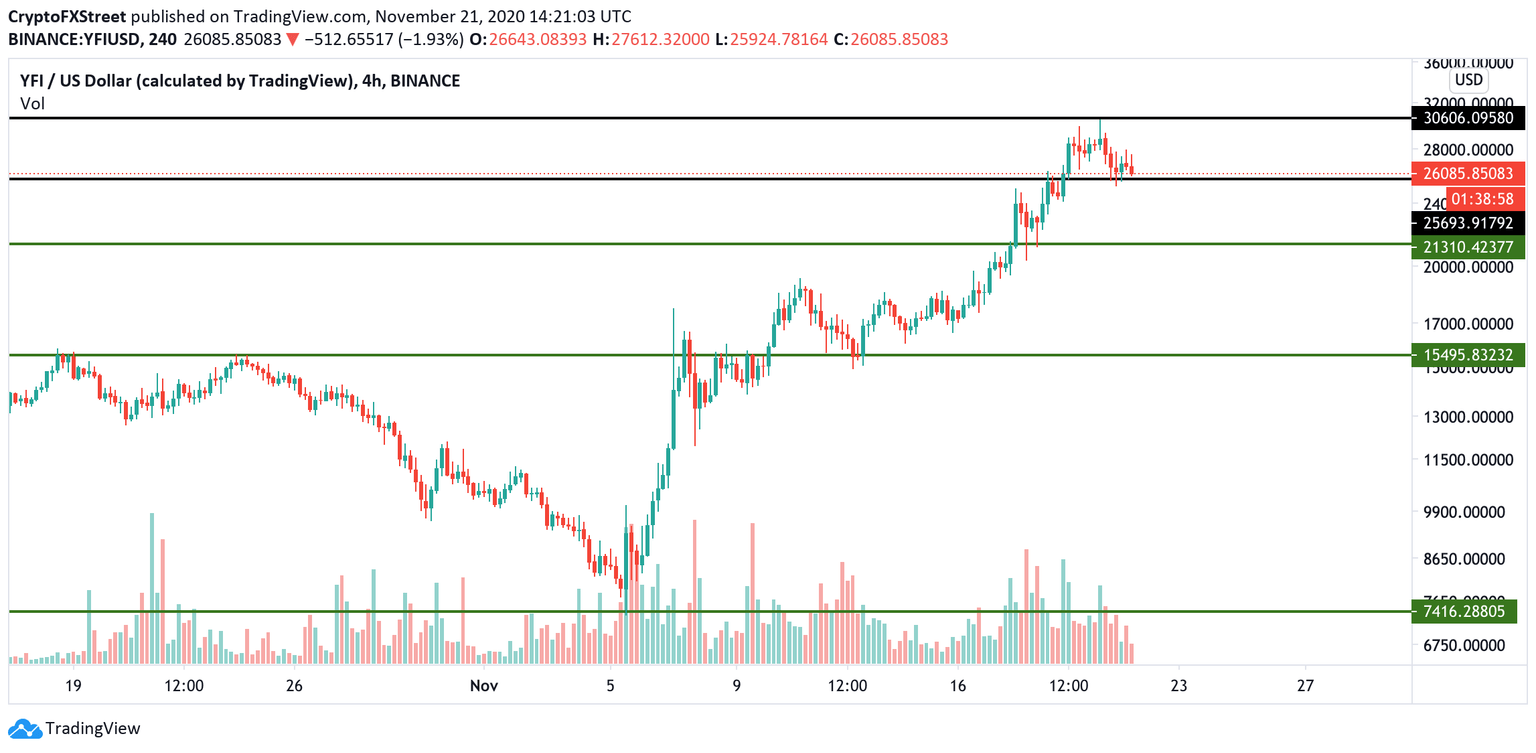

YFI, 4-hour chart

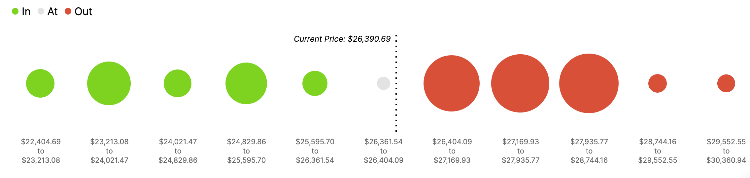

It is worth mentioning that the token is facing an important resistance area. Based on IntoTheBlock's "In/Out of the Money Around Price" model, nearly 2,000 addresses previously purchased over 4,200 YFI tokens between $26,600 and $28,000. The bulls will have a hard time trying to absorb this supply wall. Once it happens, the price may catapult above $30,000 and retest $34,000, the previous recovery high.

YFI In/Out of the Money Around Price

Meanwhile, the way to the South looks like the path of the least resistance at this stage as the first barrier comes on approach to $25,000. IOMAP cohort shows that only 239 addresses purchased less than 1,000 coins around that price. This insignificant supply can be easily smashed by the downside momentum created by the rejection from the resistance area.

Waves bulls aim at $8

Waves is another big winner of the week. The 37th largest digital asset with the current market capitalization of $670 million jumped over 50% in the past seven days to trade at $6.5 at the time of writing.

Waves bottomed at $2 at the end of September. After a short consolidation period, the token resumed the recovery and by the middle of November regained all the losses incurred during the August sell-off.

A strong move above the psychological resistance of $5 reinforced by the August recovery high created significant bullish momentum, and pushed the price to $7.37, the highest level since March 2018.

Waves, 3-day chart

From a technical point of view, the price may return to $5. If the former resistance is verified as support, Waves will resume the recovery and retest the recent high of $7.37, followed by $8. If the support gives way, the sell-off may be extended towards $3.7 and $3.

XRP is the biggest winner out of top-3

Ripple's is another winner of the week. The third-largest digital asset gained over 52%, and the retested area above $0.43 on Sunday before retreating to $0.40 by the time of writing.

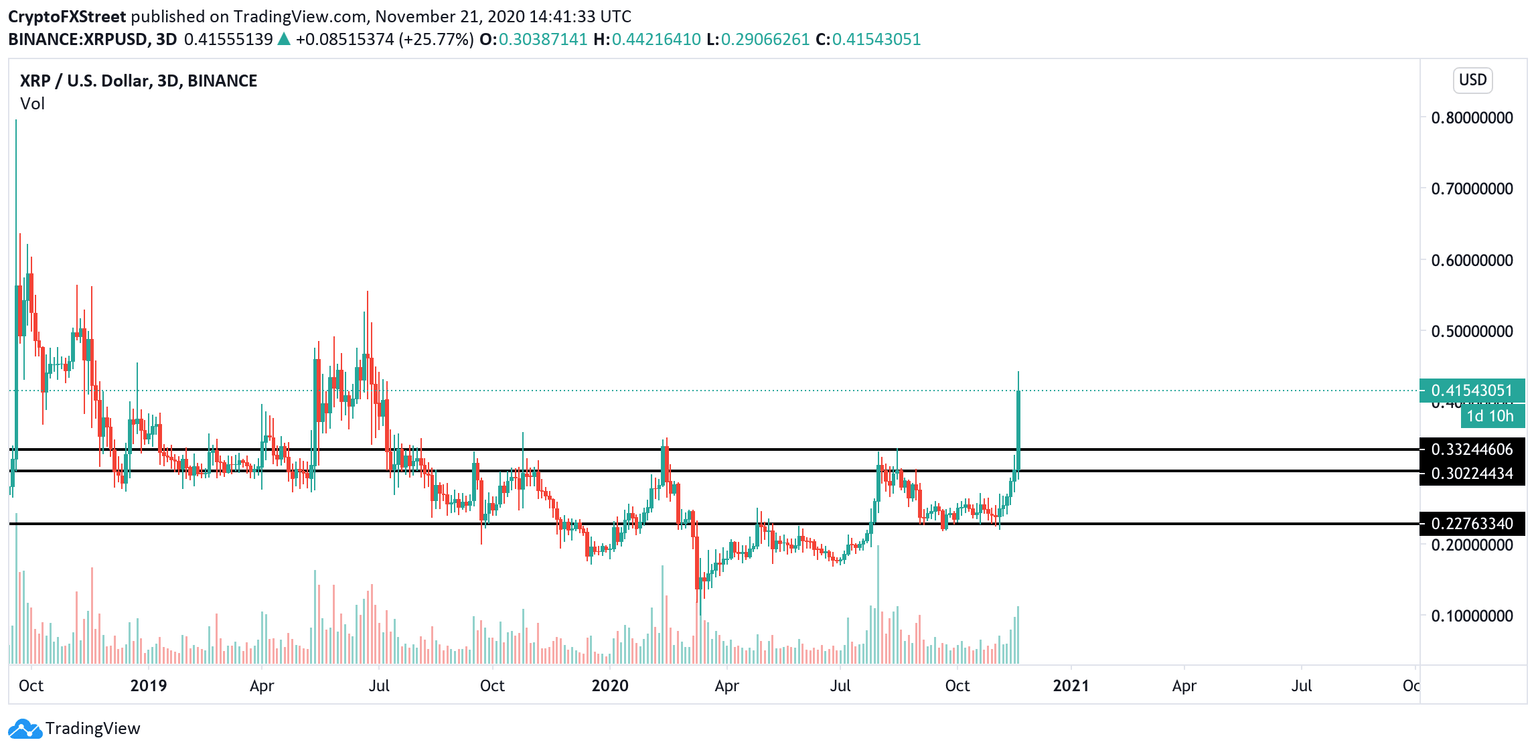

XRP, 3-day chart

The price hit the highest level since June 2019 as the sustainable move above $0.33 created a strong bullish momentum. As FXStreet previously reported, with little to no barriers on the way to the North, XRP/USD has the potential to revisit $0.45 before the end of the week.

Author

Tanya Abrosimova

Independent Analyst