- Verge charts a golden cross, up 40% on the week.

- Cardano looks north amid a bullish technical setup.

- VeChain buyers seize control amid bullish crossover.

Crypto markets witnessed massive volatility over the past week, marked by the stellar performance in Bitcoin, closely followed by the altcoins. Among the top 50 widely-traded digital assets, Verge, Cardano and VeChain emerged as the top performers (in that order), with Verge having recorded about 40% weekly gain.

Let’s take a look into the technical charts of these three coins, as they have bucked the corrective trend seen across the crypto space.

Verge: Path of least resistance is up

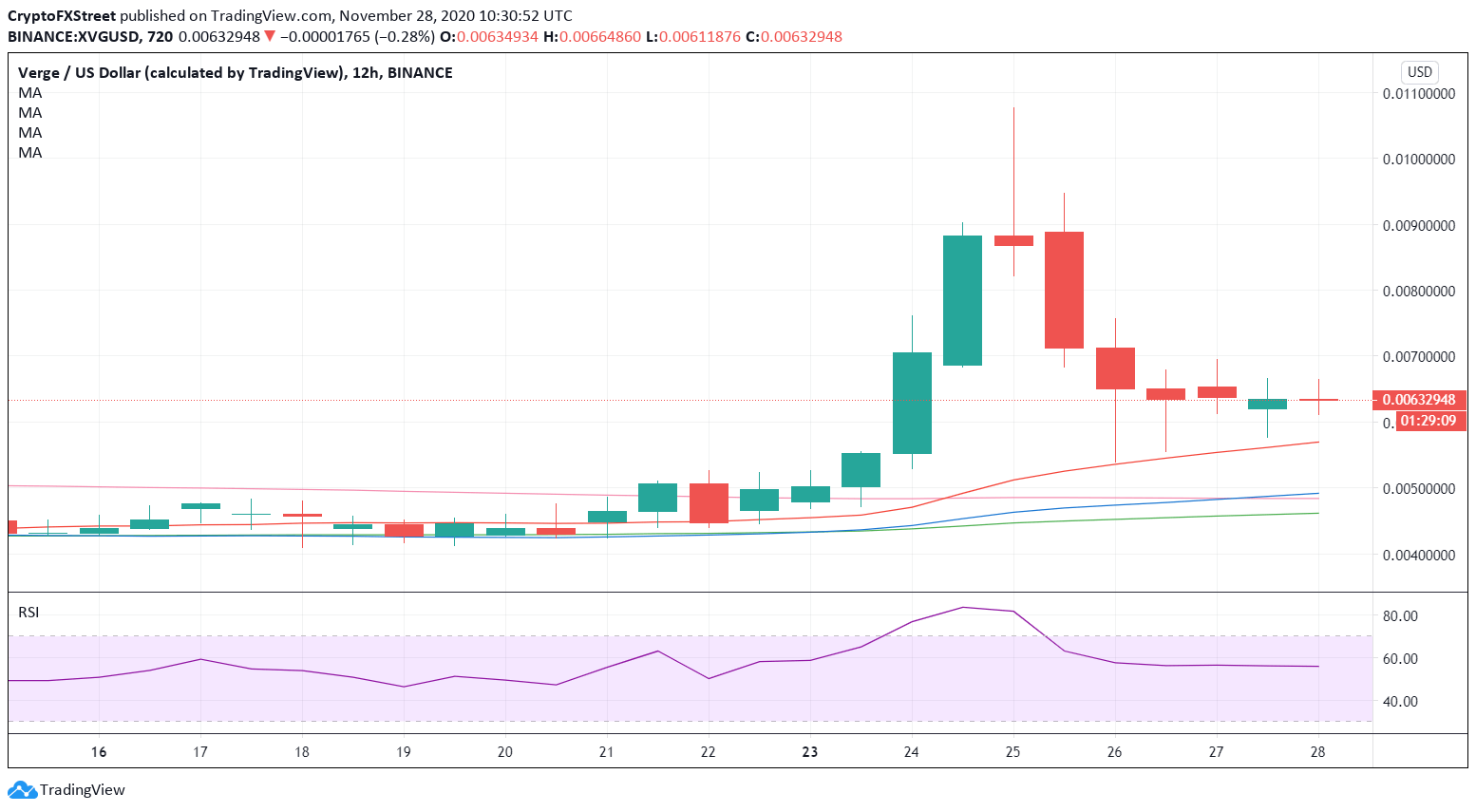

The 48th most widely traded token, Verge (XVG), extends its consolidation into a third straight session following the correction from the highest levels since June 2019 reached at $0.0109 last Wednesday. Despite the retracement, the coin remains on track to book a whopping 41% weekly gain.

XVG/USD: 12-hour chart

The corrective decline from multi-month highs stalled at the 200-day simple moving average (SMA), keeping the buyers hopeful. Meanwhile, on the 12-hour chart, the spot has confirmed a golden cross after the 50-SMA cut the horizontal 200-SMA from below. The bullish crossover combined with the Relative Strength Index (RSI) holding above 50.00, indicate that the further upside remains likely. Therefore, a test of the $0.01 likely remains on the cards. Additionally, XVG/USD trades above all the major averages, adding credence to the upside. Alternatively, the 100-SMA support at $0.0046 is the level to beat for the bears.

Cardano: Triangle breakout calls for a fresh rally

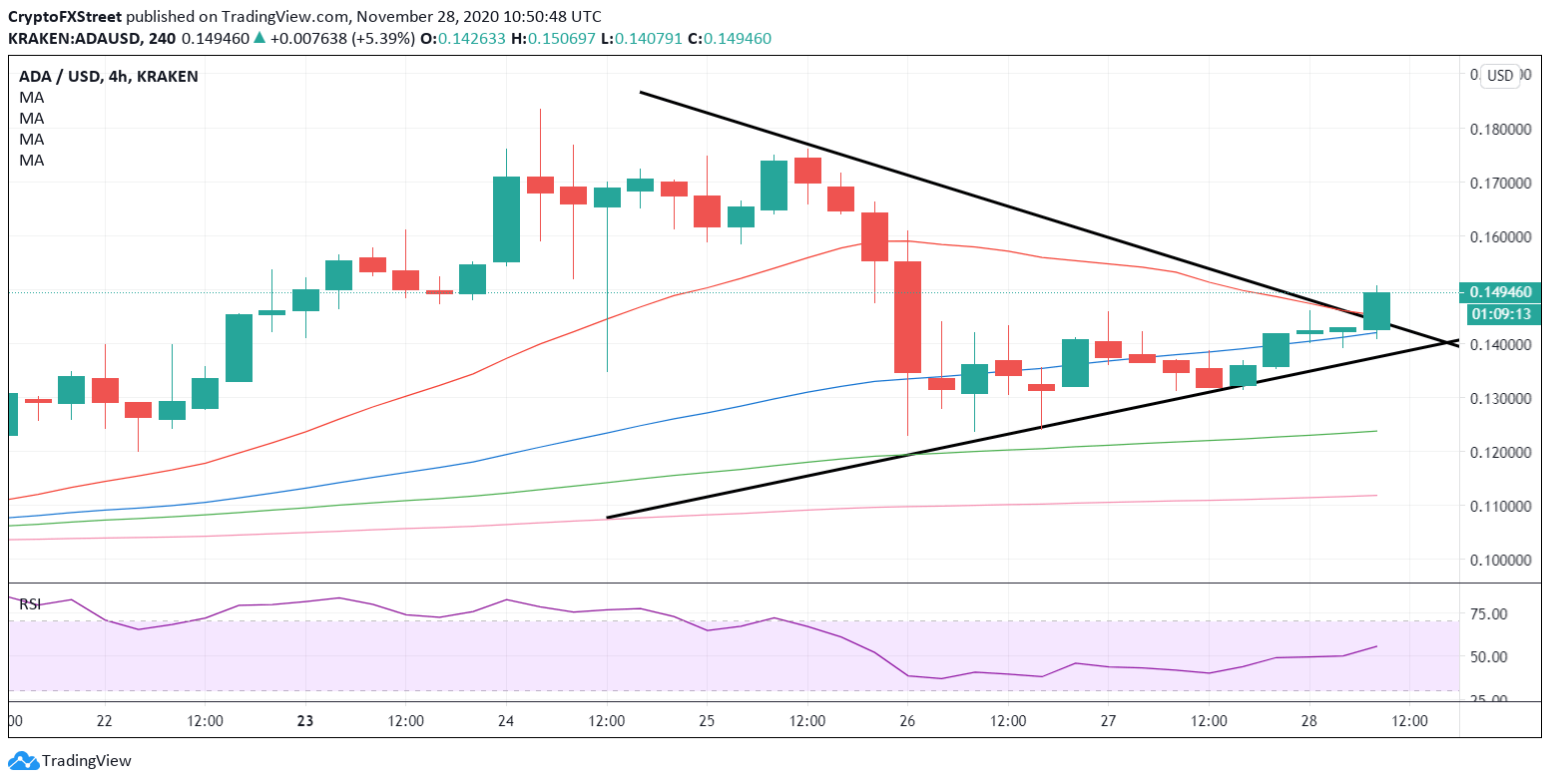

Cardano is the sixth most favorite coin out of the top 50 and emerges as one of the top three weekly gainers, eyeing about 15% rise on the week. The coin resumes its bullish momentum, having stalled its correction from two-year highs of $0.1834 reached earlier this week.

ADA/USD: Four-hour chart

As observed in the four-hour chart, the ADA/USD pair has spotted a symmetrical triangle breakout after closing the candle above the falling trendline resistance at $0.1440. The price has recaptured all major SMAs, as it heads towards the pattern target measured at $0.1960. However, the pattern will get invalidated if the price yields a four-hourly close below the rising trendline (pattern) support at $0.1377. The RSI points north, at 55.80, while the coin trades at $0.1494, as of writing.

VeChain: Further upside in the offing

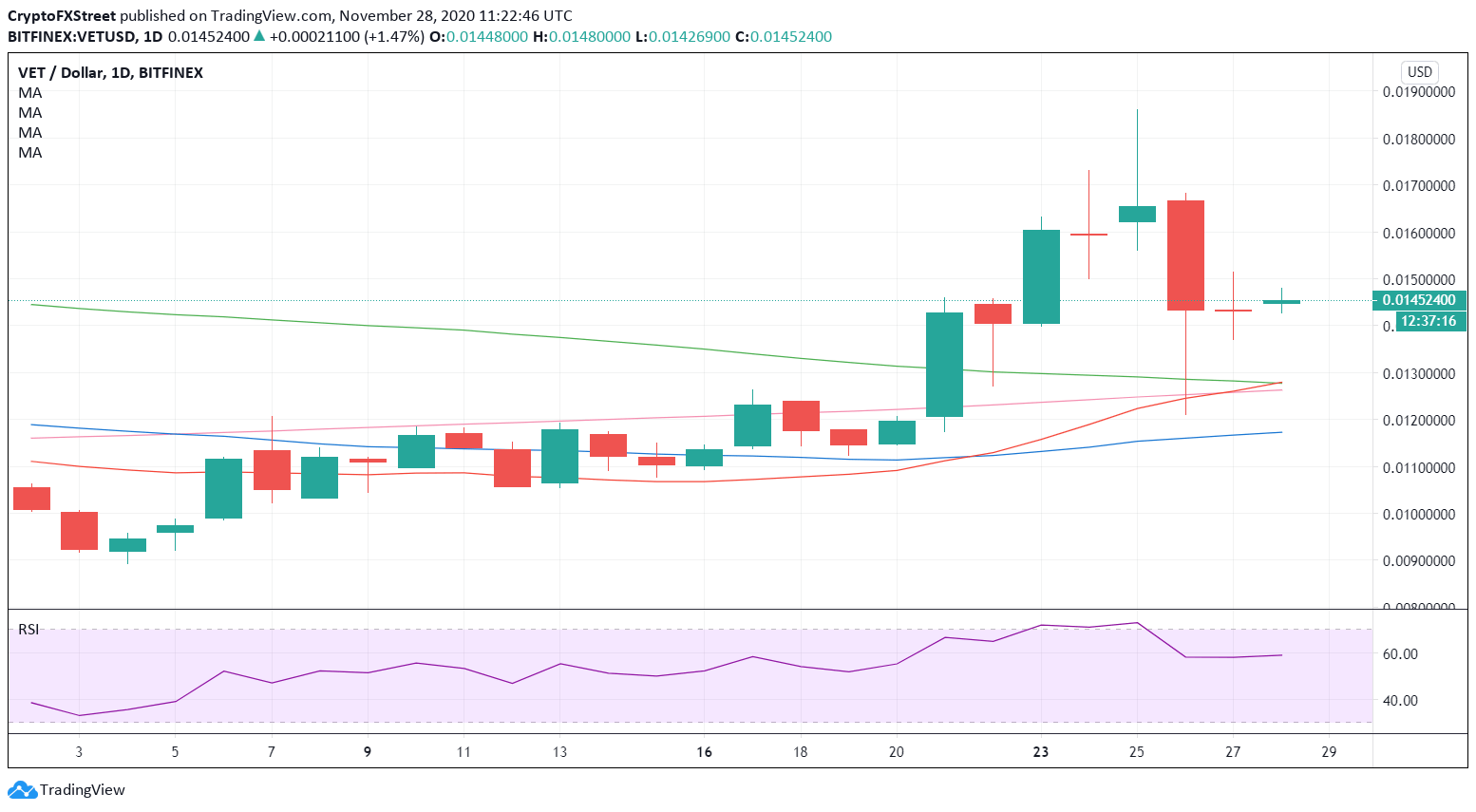

VeChain (VET/USD) is looking to recover ground near $0.0145 following wild swings witnessed in the previous sessions. The No. 20 coin trades within Friday’s doji candle and remains poised to rise 12% on a weekly basis.

VET/USD: Daily chart

VeChain’s daily chart points to likely a bullish reversal after Friday’s doji candle, which suggested that the bears faced exhaustion after Thursday’s sharp correction to $0.0120 from three-month highs of $0.01861. Also, supporting the case for the bullish shift in the sentiment, the chart depicts a bullish crossover, with the 21-day SMA having pierced the 100-day SMA from below. Meanwhile, the RSI trades flat but holds above the 50.00 level, allowing room for more upside. Therefore, Friday’s high of $0.0151 is critical for the bulls to regain control and resume the recent uptrend. To the downside, Friday’s low of $0.0137 will be a tough nut to crack for the sellers.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.