Top 3 gainers of the week Polkadot, Zcash, HedgeTrade: Altcoins defy Bitcoin’s swings, going ballistic

- Polkadot technical levels are healthy despite rallying to a new all-time high at $15.5.

- HedgeTrade is on the verge of freefall to $1, mostly if the support at 42 is shattered.

- Zcash led the recovery among privacy-oriented coins this week, with gains hitting 50%.

The week started with the cryptocurrency market, mostly in shambles. Losses spread far and wide with Bitcoin, tumbling nearly 30% from $40,000 to $30,000. Most cryptoassets could not resist the BTC’s ‘gravitational’ pull, whereby declines were recorded in massive double-digit figures.

However, some selected altcoins ignored the downward pull, consistently rallying to post new yearly price levels. For instance, HedgeTrade launched to the moon with gains exceeding 260%. Similarly, Polkadot (DOT) grew by 56%, trading a new all-time high, while Zcash (ZEC) is exchanging hands 50% higher.

HedgeTrade stalls after a majestic spike to $2.8

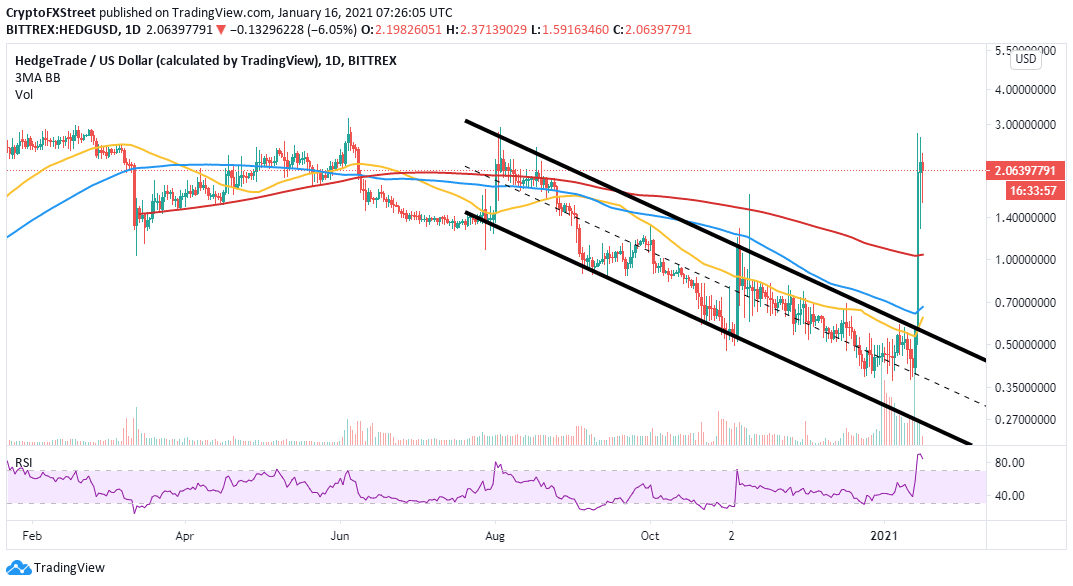

HedgeTrade emerged as the biggest winner this week after breaking out of a descending parallel. Various resistance zones were broken, including the 50 Simple Moving Average, the SMA, and the SMA on the daily chart.

Following the massive liftoff, HEDG stalled before hitting $3 but traded a new yearly high at $2.8. A correction from the recent high is underway at the time of writing. The bulls’ priority is to hold above $2. This way, they can avert potential losses to the tentative support at $1.4 and the 200 SMA support near $1.

HEDG/USD daily chart

Although the cryptoasset is overbought at the time of writing, holding above $2 could sustain the uptrend in the coming days. Higher support will also give the bulls ample time to increase their position in anticipation of a rally to above $3.

Polkadot bullish outlook intact

DOT/USD soared to new all-time highs around $15.5 this week after bouncing off support at $7. The spike to these incredible levels occurred within the confines of an ascending parallel channel. Meanwhile, the token is trading at $14.9 amid the bulls’ push for gains above $16.

The Relative Strength Index suggests the DOT Polkadot is firmly in the bulls’ hands as it returns into the overbought region. The middle boundary limits the immediate upside. However, DOT could spike to a new all-time high if the seller congestion is dispersed.

DOT/USD 4-hour chart

On the downside, a correction from the current price level may try to seek support at the channel’s lower boundary. If losses overshoot this zone, Polkadot is likely to tumble to $12. Other key support levels to keep in mind are the 50 SMA and the 100 SMA, around $10.

Zcash price action leads the way for privacy coins

Privacy-focused coins have generally performed well this week. However, Zcash emerged top performer in this segment. From the robust support provided by the 50 SMA and 100 SMA on the 4-hour chart, ZEC rallied to price levels above $120.

At the time of writing, Zcash is trading at $105 after correcting the 50 SMA support. A bull flag on the 4-hour chart hints at a possible recovery to highs beyond $120 in the near term. The bullish narrative has been validated by the RSI’s motion toward the overbought region.

ZEC/USD 4-hour chart

In the event, the bull flag is ignored, and another correction comes into the picture. We can expect Zcash to retest the support at $100. Losses are likely to extend to the 50 SMA, where a rebound is expected.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren