Top 3 Gainers: COMP, UNI, and CEL jump 5% in the past 24 hours, potentially rising higher

- The entire crypto market had a notable mini-bull rally in the past 24 hours.

- Top gainers include COMP, UNI, and CEL, which all jumped by more than 5% and targeting further bullish action.

The cryptocurrency market gained around $14 billion in market capitalization in the past 24 hours and more than $41 billion this week. Although Bitcoin is leading the way, many altcoins are rising even faster.

COMP targeting $150 as the next stop

COMP was bounded inside a descending parallel channel on the daily chart. Bulls finally managed to break out of the pattern with a 16% price spike above the resistance level at $100. The MACD is bullish and gaining strength.

COMP/USD daily chart

Compound seems to be facing very little opposition to the upside. The next potential price target is $128 where the 50-SMA stands, a longer-term price point would be $150 at the 100-SMA on the daily chart.

Bears looking for a failure to close above $100

Despite the bullish breakout, if COMP can’t close above $100 by the end of the day, it will be considered a fakeout, a significant bearish sign. The digital asset can easily slip towards $80, the lower trendline of the descending parallel channel.

Uniswap gains momentum after forming a double bottom

On October 26, UNI bulls managed to defend a low of $2.47 established on October 7. In the past 24 hours, the price has risen by 7% which is a good continuation move after the rebound. The MACD remains bullish and it’s gaining some strength.

UNI/USD 1-day chart / 3-day chart

On the 3-day chart, the TD sequential indicator presented a buy signal on October 24. The current bounce is trying to validate the signal. A potential price target for UNI would be the high of $3.65.

The $2.7 support level needs to hold for UNI to avoid further downside pressure

Nonetheless, the critical support level and double bottom at $2.7 remains the most important point in the short-term. A bearish breakout below this point can easily drive the price of UNI towards the psychological level at $2.

Celsius on the verge of another major price move

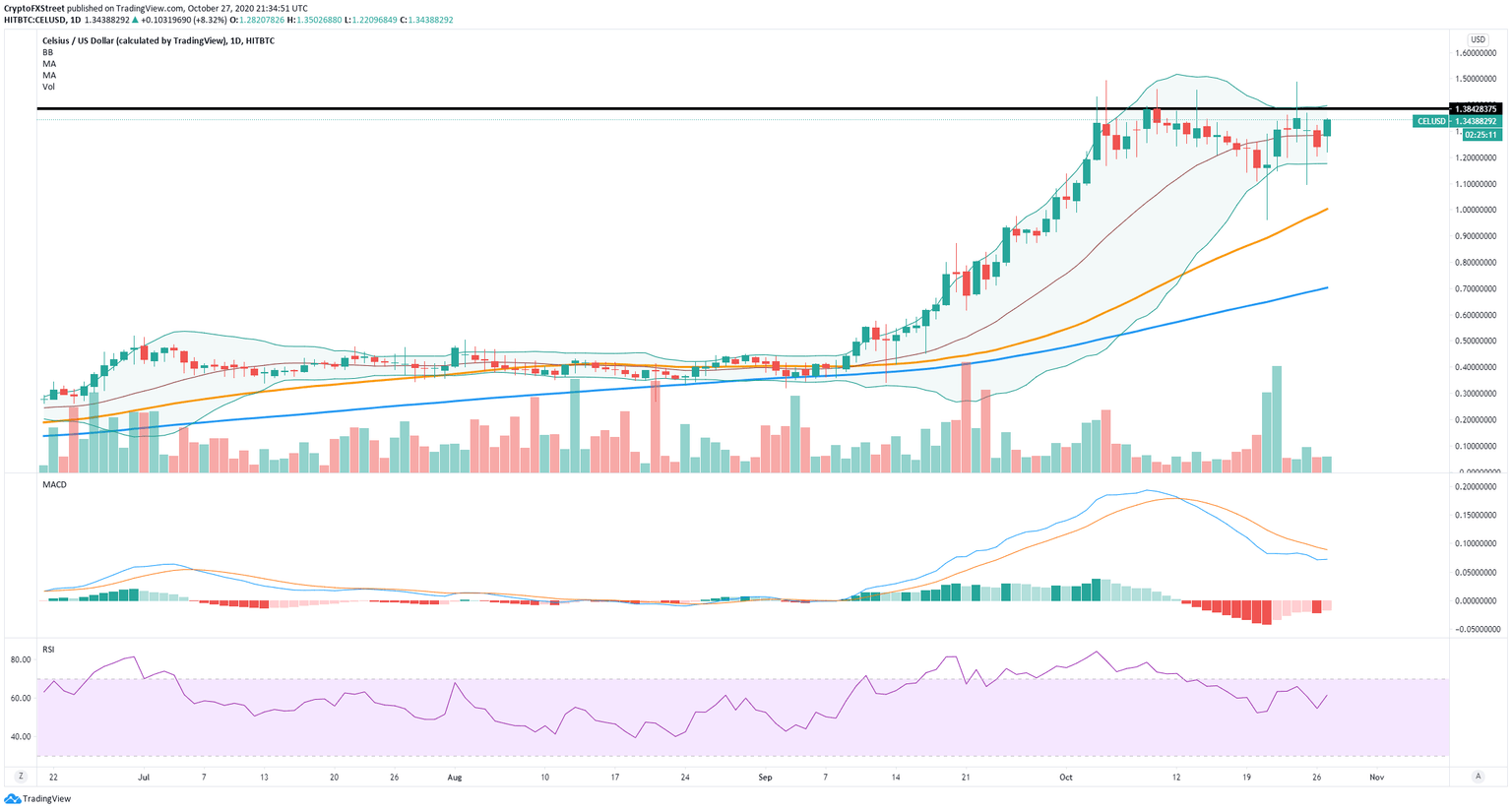

The digital asset had a 10% price increase in the past 24 hours but it’s still on the verge of another massive price move. On the daily chart, the Bollinger Bands are squeezed significantly, indicating that a breakout is bound to happen soon.

CEL/USD daily chart

The resistance level at $1.38 coincides with the upper Bollinger band and represents the most critical point to beat for the bulls. A breakout above this level can drive the price of CEL towards a new high at $1.6.

Rejection from $1.38 would shift the odds in favor of the bears

On the other hand, rejection from the critical resistance level at $1.38 can push the price of CEL down to the middle Bollinger band at $1.28 and as low as the lower trendline at $1.17 in the longer-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.