- Bitcoin price had a major 30% sell-off that did not affect DeFi cryptocurrencies as much.

- The DeFi market remains strong which could be an indication of an upcoming alt season.

Uniswap price is currently at around $8.8 after a 9% recovery from the sell-off in the past 24 hours. Aave has performed even better and it’s up 15.6%, as bulls bought the dip, pushing the digital asset to the levels before it crashed. Again something similar happened with SNX, although the digital asset didn’t manage to jump all the way up.

SNX price recovers quickly from the recent dip

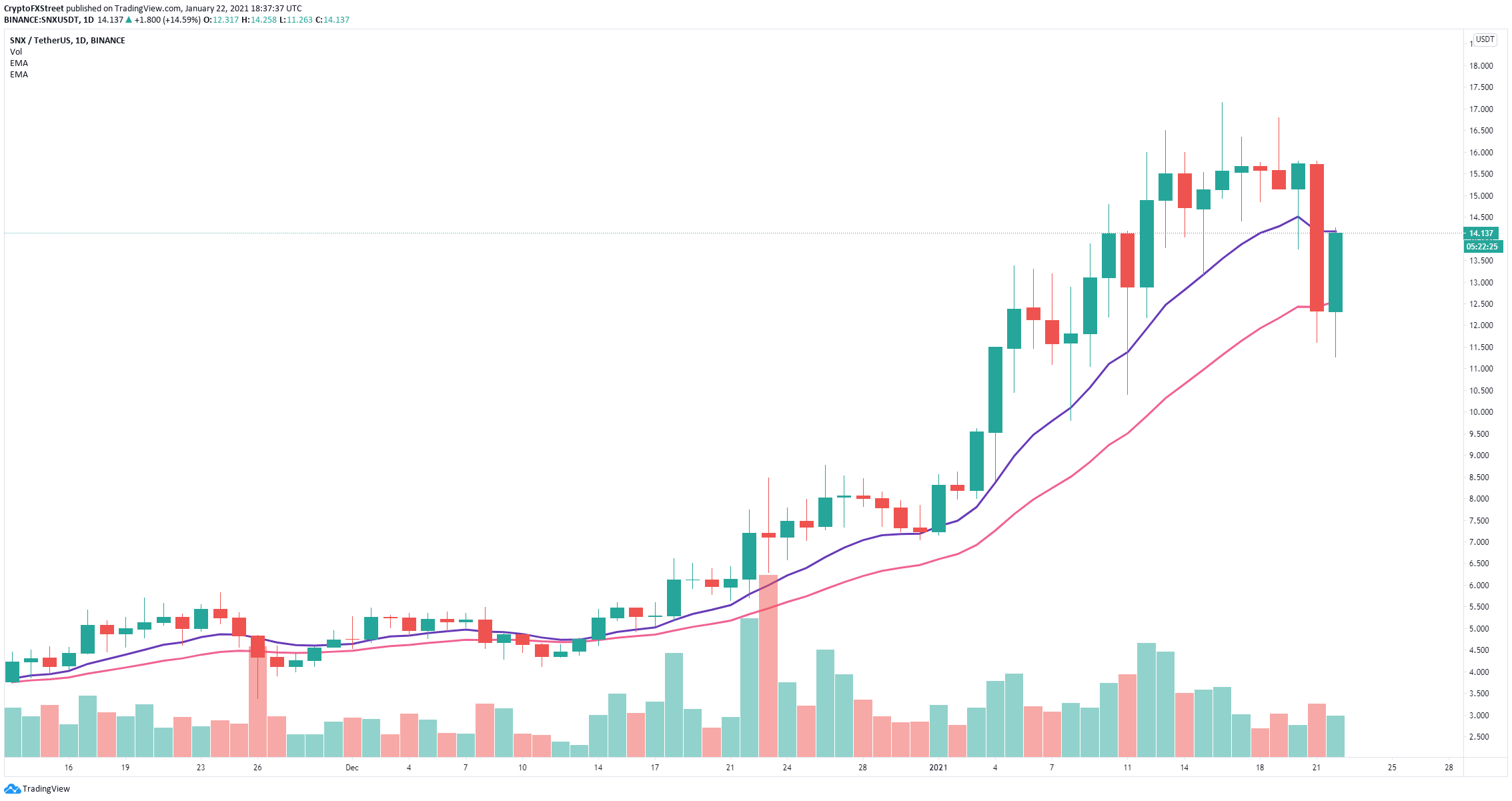

Like the entire DeFi market, SNX bulls have bought the dip in a convincing manner. SNX was trading as high as $15.8 before plummeting down to $11.26. However, in less than 24 hours, bulls pushed the digital asset to $14.14 and above the 26-EMA and are fighting to crack the 12-EMA as well on the daily chart.

SNX/USD daily chart

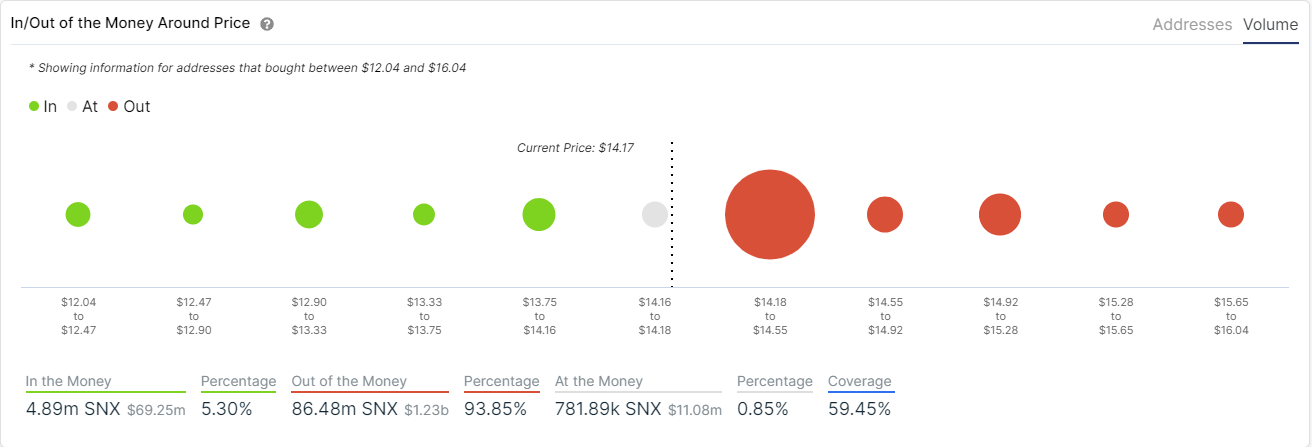

The In/Out of the Money Around Price (IOMAP) model indicates that there is only one crucial resistance area located between $14.18 and $14.55. A breakout above this point would quickly push SNX price towards $16 as there are no other barriers ahead.

SNX IOMAP chart

However, it’s important to note that the support below $14 is also minuscule which means that a rejection from $14.5 could lead the digital asset to a low of $12 again, so investors should be extra careful trading SNX.

Aave price close to a new all-time high

Similar to SNX, Aave bulls bought the recent dip but were even stronger doing so. Aave dropped from a high of $199 to a low of $147 and it’s currently trading at $194 again. Bulls have pushed the digital asset by more than 31% in less than 24 hours which indicates a lot of strength, especially for the altcoin market.

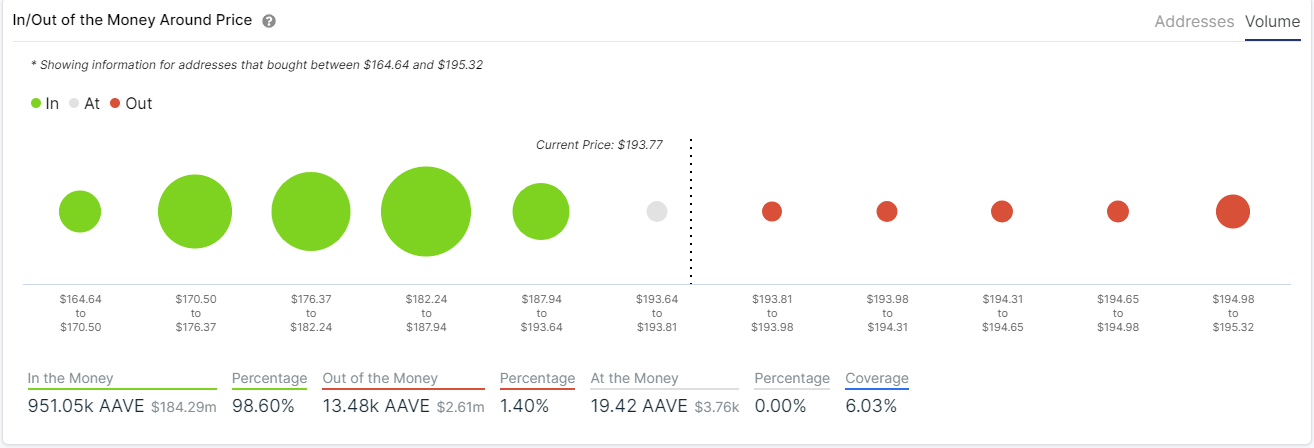

AAVE IOMAP

According to the IOMAP model, there is clearly almost no barriers on the way up to a new all-time high which means bulls can quickly push Aave price above $200.

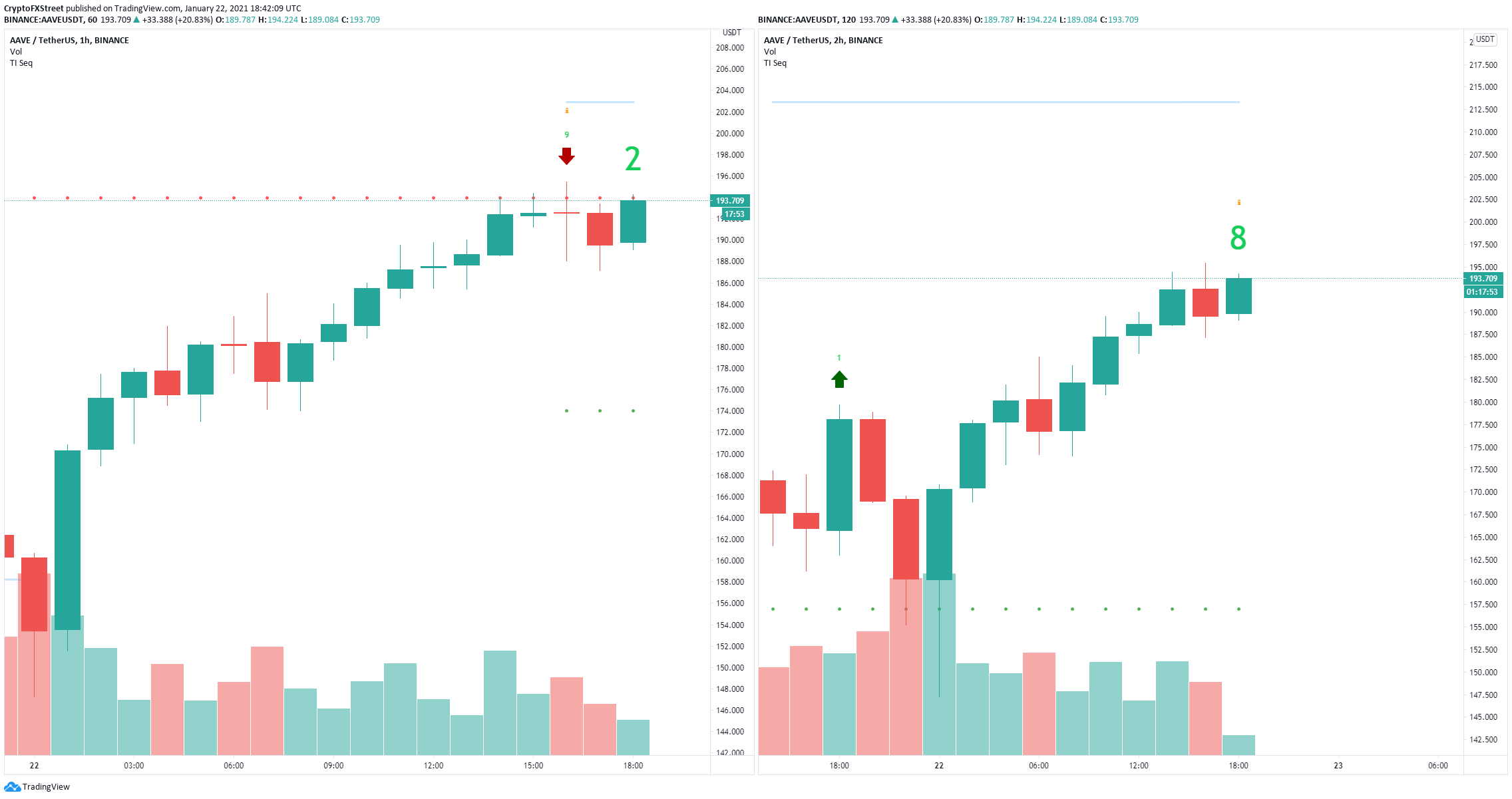

AAVE sell signals

However, after such a significant mini-rally, the TD Sequential indicator has just presented a sell signal on the hourly chart and it’s on the verge of doing the same on the 2-hour chart. A short-term sell-off could push Aave price down to $184 which is the most significant support level according to the IOMAP.

Uniswap price can see a new all-time high as whales accumulate even more

One of the main strengths of Uniswap is the fact that whales have been accumulating a lot of coins in the past month despite its price rising significantly. According to the Holders Distribution chart, the number of large holders with 10,000 to 100,000 Uniswap tokens ($87,000 to $870,000) has increased from 432 to 453.

UNI Holders Distribution chart

Similarly, the number of whales holding between 100,000 and 1,000,000 tokens ($870,000 and $8,700,000) also increased 19, which is really significant and indicates large investors expect the price to rise even higher.

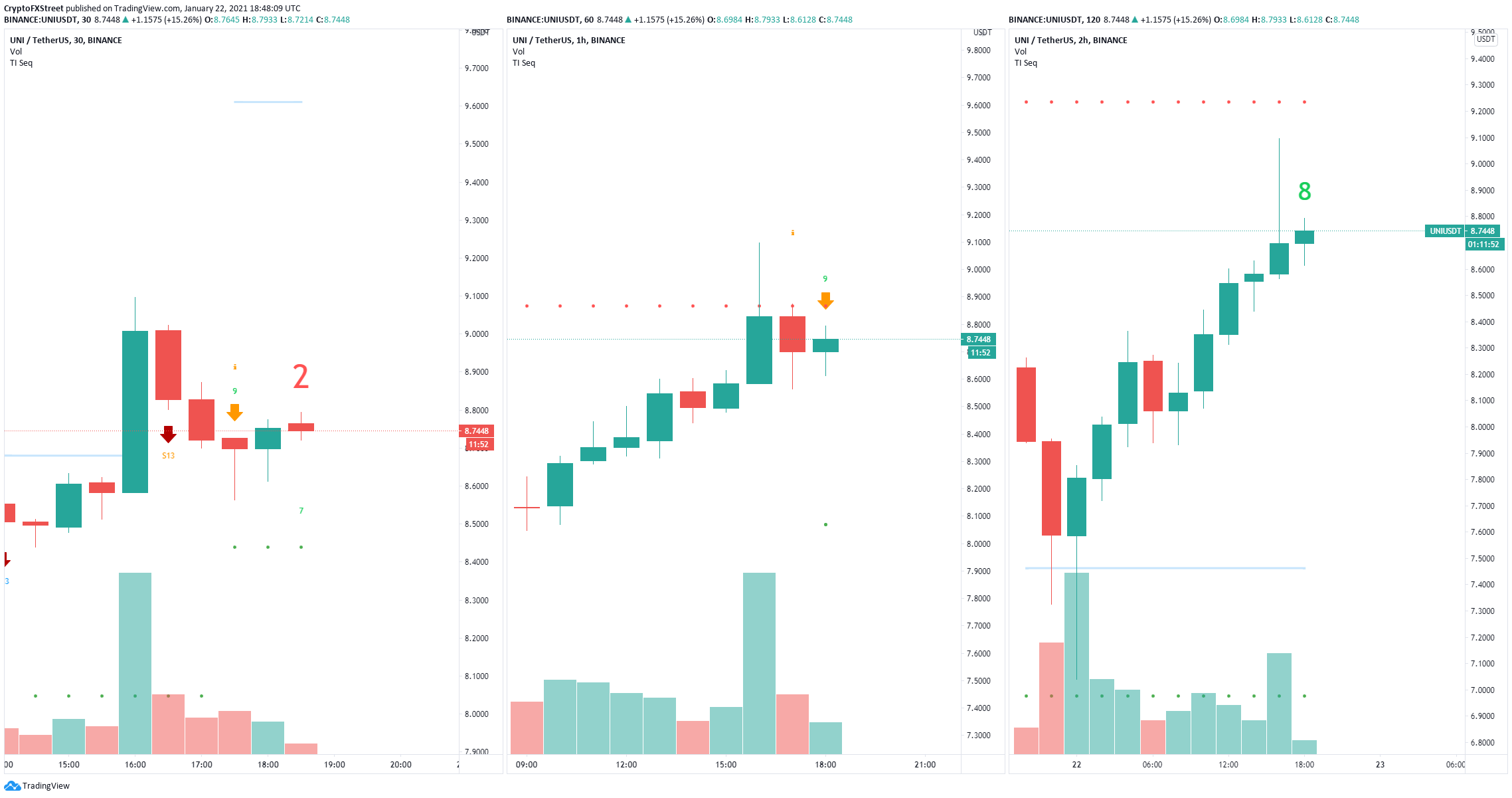

UNI Sell Signals

However, similar to Aave, the TD Sequential indicator has presented a sell signal on the 30-minutes chart and the hourly chart and it’s close to doing the same on the 2-hour chart.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin recovers slightly amid sparse on-chain data signals

Bitcoin trades just above $57,000 on Tuesday after gaining almost 4% on Monday, buoyed by mild ETF inflows, increasing whale buying activity during price dips, a long-to-short ratio above one, and increasing stablecoin holdings on exchanges.

Solana on-chain metrics suggest rising activity and declining fees, supporting bullish outlook

Solana on-chain activity shows signs of growth in the last thirty days. Daily active addresses grow threefold, rising to 3.11 million on Monday. The number of new addresses on Solana in the first ten days of September is more than half of that registered in August for the entire month.

Rocket Pool jumps 23% after Binance announces launch of perpetual contracts

Rocket Pool surged more than 23% as Binance announced a perpetual contract listing on Monday. At the time of writing on Tuesday, it trades slightly up at $11.74. This bullish event is further supported by RPL’s rising open interest, which indicates new buying activity in the market.

ApeCoin set for a surge as on-chain and price trends signal a bullish rally

ApeCoin price validated a double-bottom pattern, signaling a bullish move. On-chain data paint a bullish picture on APE’s rising open interest, negative exchange flow balance, and decreasing supply on exchanges.

Bitcoin: $50,000 on the horizon if it breaks below key support level

Bitcoin (BTC) price tests the key support level at $56,000 on Friday, consolidating over a 1% decline this week. If it drops below this support, a continued downtrend is likely for BTC, as suggested by substantial outflows from US spot Bitcoin ETFs, rising institutional selling, and bearish on-chain indicators.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.

%20[19.46.41,%2022%20Jan,%202021]-637469381876049796.png)