Top 3 Decentralized Finance (DeFi) cryptocurrencies ready for breakout rally: LDO, UNI, AAVE

- Ripple’s decision has finally set off a massive surge in capital influx and could potentially trigger an alt season.

- In June 2020, the introduction of yield farming by the Compound platform kickstarted a DeFi Summer for altcoins.

- Now that the COMP token is rallying when the entire crypto market is either crashing or moving sideways, it could be a hint that DeFi altcoins could pump again.

LDO, UNI and AAVE prices have all breached key levels on the daily timeframe, suggesting a rally around the corner.

The United States (US) Securities and Exchange Commission (SEC) suffered a minor setback against Ripple after the judge announced that XRP is not a security under certain circumstances. This news spread like wildfire on July 13, which caused other altcoins like Stellar Lumens (XLM), Cardano (ADA), Solana (SOL) and Polygon (MATIC) to rally violently. But as the dust settled, only a few cryptocurrencies are rallying.

Read more: A breakdown of alt season and what to expect next?

Compound’s COMP token could set off DeFi rally

Bitcoin (BTC) has been stuck trading in a small range for more than three weeks, causing Ethereum (ETH) and other altcoins to follow its lead. While Ripple’s decision provided a respite, it was all but temporary. As the dust settled, most of the cryptocurrencies that pumped due to the SEC vs. Ripple lawsuit’s decision retraced due to profit-taking. But the Compound platform’s COMP price rallied nearly 31% in under the last 48 hours, showcasing strong buying pressure from interested investors.

Considering that the launch of Yield Farming in June 2020 by the Compound Platform kickstarted DeFi Summer, the recent uptick in COMP price could be signaling something similar. So, investors need to turn their gaze to the Decentralized Finance (DeFi) sector, which could be primed to explode again.

The three cryptocurrencies that will be the focus of this article are - Lido DAO (LDO), Uniswap (UNI) and AAVE (AAVE).

Also read: Top 3 cryptocurrencies to focus on in July 2023 and their targets: SOL, OP, COMP

Lido DAO (LDO) price has bright future

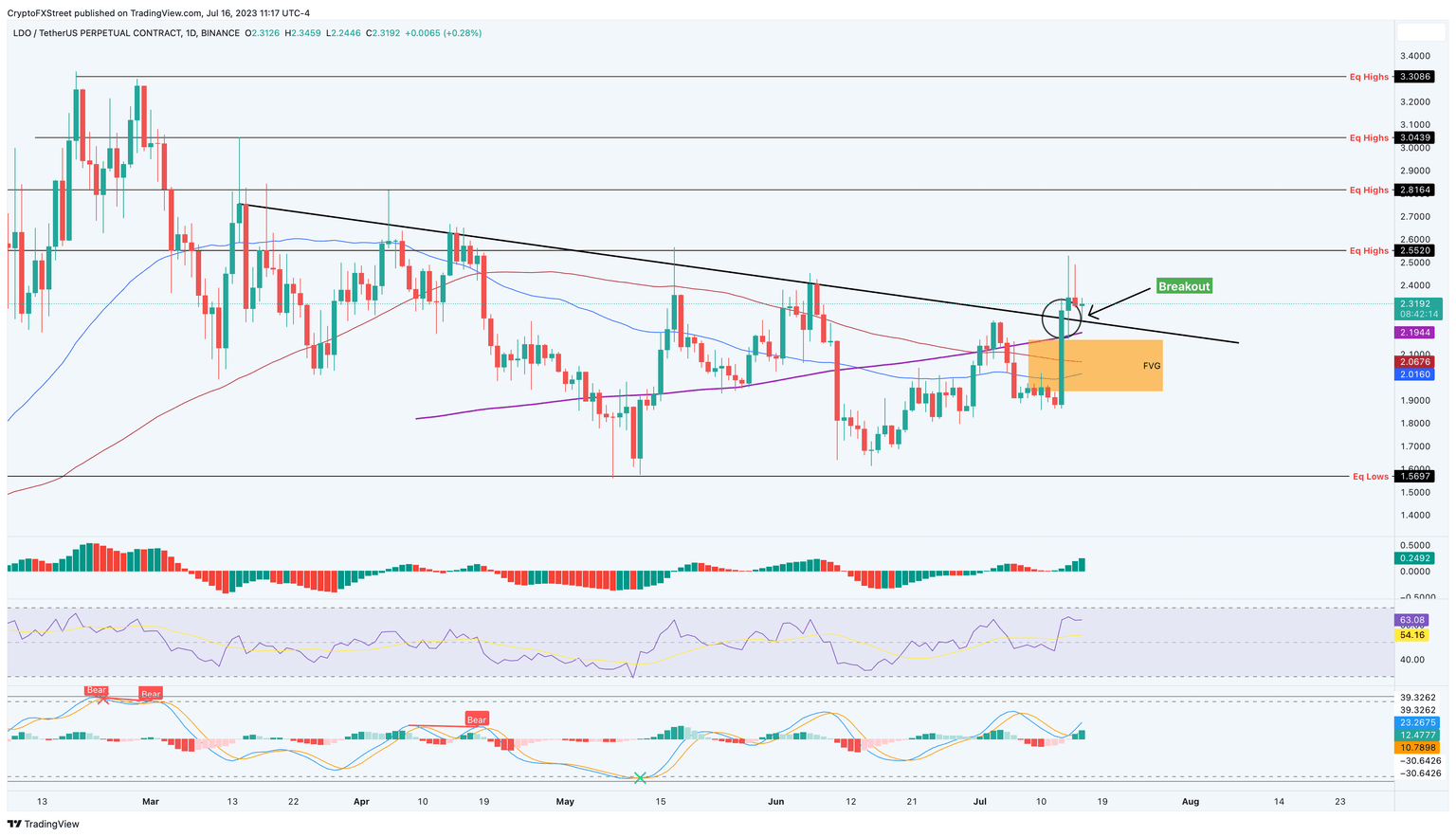

Lido DAO (LDO) price has breached a four-month downtrend by rallying nearly 21% on July 13. As the altcoin pulls back, investors can focus on the buy zone, extending from $2.16 to $1.93 before bulls start reaccumulating and LDO explodes to key take-profit levels.

The targets for LDO include $2.55, $2.81, $3.04, $3.30.

LDO/USDT 1-day chart

Also read: Why Ethereum’s EIP-4844 could kickstart bull run for Optimism (OP), Arbitrum (ARB), Polygon (MATIC)

Uniswap (UNI) price clears critical hurdle

Uniswap (UNI) price has flipped the $5.63 hurdle, which was a major blockade of all bullish attempts from April 21, 2023. This level has been critical since May 12, 2022, flipping into support and resistance levels multiple times. As a result, UNI has been stuck trading inside a range, extending from $3.35 to $9.80.

The recent recovery above $5.63, however, has opened doors for UNI bulls to push Uniswap price to the first target at $6.57, followed by the final target at $8.05.

UNI/USDT 1-day chart

AAVE (AAVE) price needs to overcome one more blockade for quick rally

AAVE (AAVE) price has been on a downtrend since June 2022. Connecting these swing highs using a trendline shows a declining resistance level. The recent upswing between July 11 and 14 overcame this trendline, indicating that the bulls are back.

However, AAVE needs to also overcome the $80.79 hurdle, which is the midpoint of the range, stretching from $45.58 to $116.01. The first target is the $95.77 hurdle, clearing which will allow the buyers to book profits at the $100 psychological level.

AAVE/USDT 1-day chart

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.