Top 3 cryptocurrencies to focus on in July 2023 and their targets: SOL, OP, COMP

- Ripple’s partial victory against the SEC could be the catalyst that kickstarts a new-found rally for altcoins.

- Layer 1 tokens like Solana and Compound could see interest among investors, as will MATIC and other Layer 2 tokens.

- Investors are likely to see their portfolio grow if they stick to the buy-and-hold strategy as opposed to risk leverage trading.

Ripple’s win against the United States (US) Securities and Exchange Commission (SEC) caused a short-term spike in bullish momentum, which was soon followed by profit-taking, causing cryptocurrencies to pull back. But the partial win that Ripple scored could have long-term ramifications and could catalyze a larger move by the end of the weekend.

Read more:

DeFi and Layer 2 cryptocurrencies could be next to run

As explained above, the capital inflow that caused XRP and other altcoins to pump and the subsequent profits realized from the rally will be looking to head elsewhere. Observing the cryptocurrencies that are pumping could give a clue as to what is next.

Currently, the Compound platform’s COMP token is seeing a spike in buying pressure. A popular Twitter user with the screen name Hsaka tweeted that this rally could be the start of a bull rally for the Decentralized Finance (DeFi) sector.

The coin that catalyzed DeFi summer with its liquidity mining program is now trying to frontrun the prophesied end of the 3 year DeFi bear market.

— Hsaka (@HsakaTrades) July 15, 2023

Time is a flat circle. pic.twitter.com/gWa7KhkIfk

Likewise, as Ethereum’s Improvement Proposal (EIP) 4844 picks up steam, Layer 2 tokens could also see a similar influx of capital, causing a massive run-up..

Here is a quick look at COMP price, OP price and MATIC price and important levels to watch for each altcoin.

COMP/USDT 1-day chart

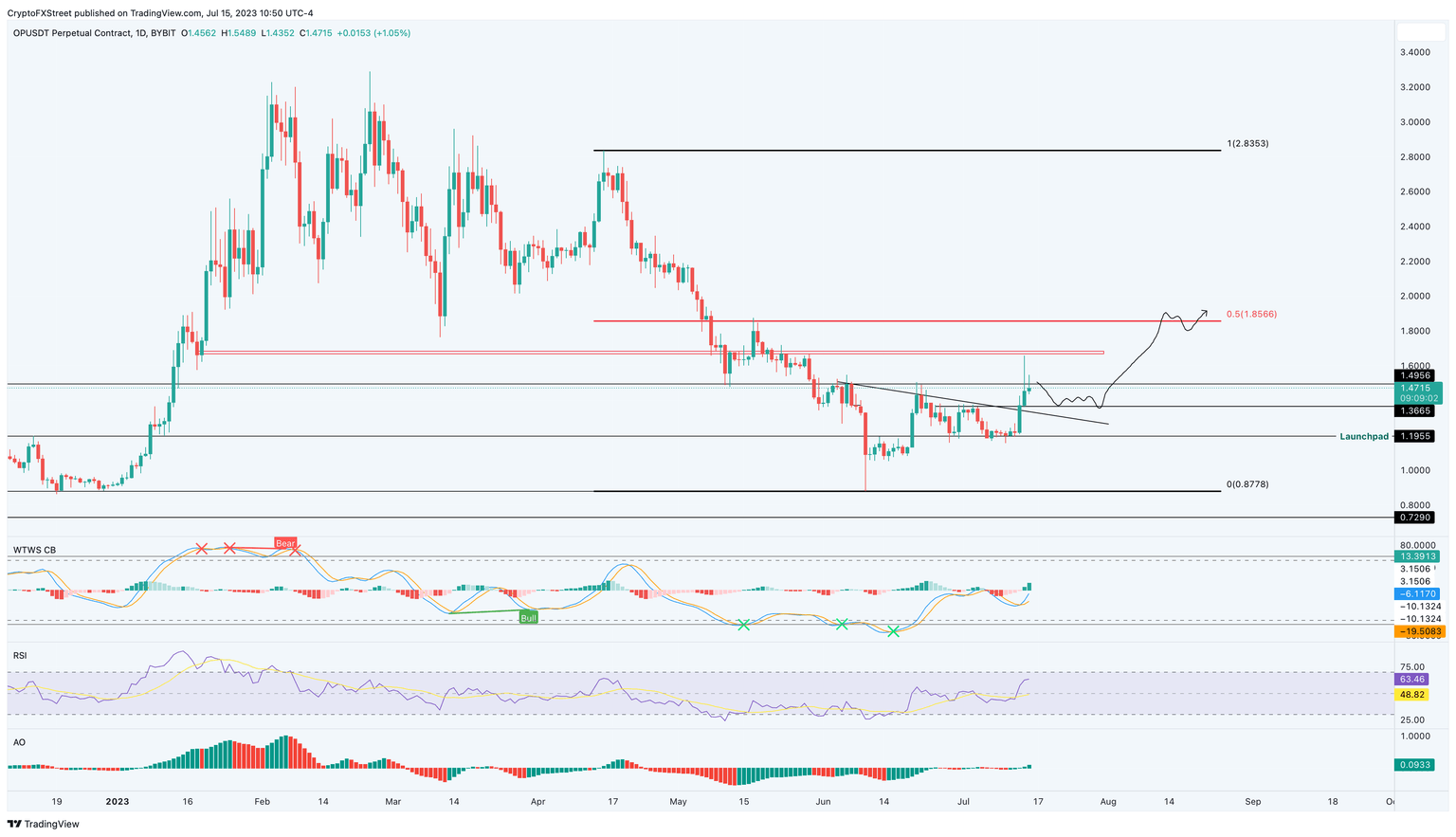

OP/USDT 1-day chart

MATIC/USDT 1-day chart

With the way things are on the lower timeframe, investors need to be patient and wait for a pullback over the course of next week(s) for a better level to accumulate. The attached chart can be monitored for key take-profit levels.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.