- A bullish ride in the midst of the American session took the main Cryptocurrencies to the positive side of the charts

- A cluster of resistances toughens a quick resolution of the current price action

Two consecutive positive days have taken the main Cryptocurrencies to optimal areas where they now await patiently the moment to look for superior levels. The bullish path is complicated due to important moving averages and multiple resistances being on the way, while the supports below the current price are more spread out, bringing some risk to the bulls.

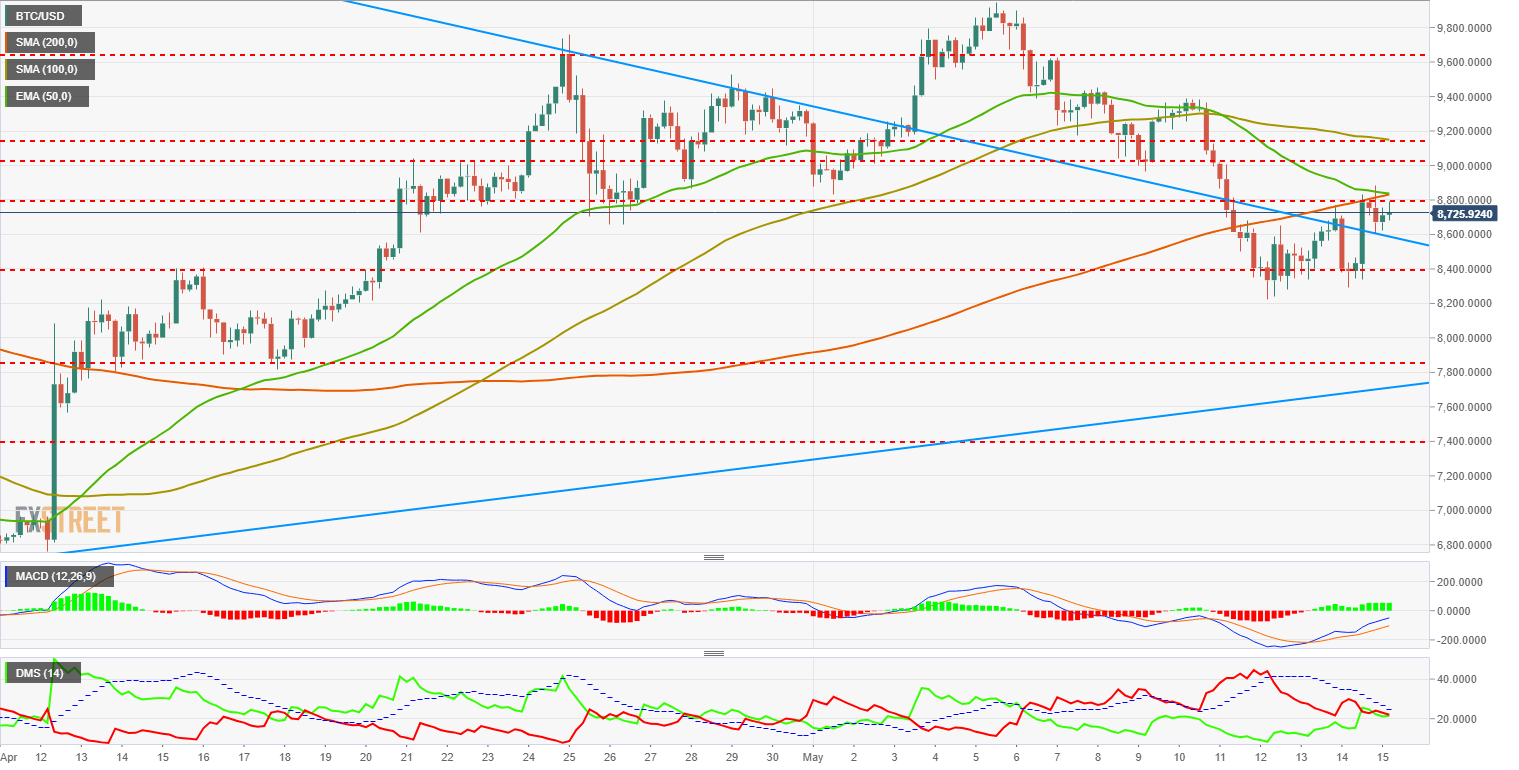

BTC/USD 4H chart

Bitcoin covered in just one period (4 hours) the distance between yesterday's support and today's resistance. BTC/USD reached the $8886 level, but has not been able to consolidate it. Bitcoin has been able to test and consolidate the diamond trendline that had been in play from last April 24th, though.

This price area has a strong congestion, with a big number of resistances and key technical levels that complicate the path for the bulls. The first resistance for BTC/USD is just above the current price, at $8796, followed by the confluence of the 200-SMA and the 50-EMA in the $8832-$8836 area. If that zone is broken, the Bitcoin price will immediately find resistances at $9021 and at $9153, where the 100-SMA and a price resistance now await. As we can see, the Bitcoin bulls' journey is full of challenges.

On the other side, the main support is at $8400, followed by a secondary support in the $8200. Below there, nothing more until $7845. This structure is weakening the position of Bitcoin, as in case of a bullish breakout failure, the fall might be quick and considerably big.

MACD in the Bitcoin 4-hour chart is continuing its path down towards the 0 line, coming from the downside. The opening and inclination are adequate for a bullish continuation, although being so close to the medium line will involve a halt of the current bullish development.

Directional Movement Index in the same chart shows an equilibrium point between the buying and selling forces. ADX is falling strongly, which clearly reflects the current lack of trend strength. The resolution of the current tie between buyers and sellers will certainly be meaningful.

ETH/USD 4H chart

Ethereum is living in its particular scenario, a lot more favorable to the bulls, that should find less barriers, as ETH/USD is trading above the moving averages, with less resistances on its way. That said, Ethereum is following the general market behavior and now rests above $726, the resistance broken yesterday during the American session. Above there, next resistance is at $756, with no more meaningful barriers until the $812 mark.

ETH is diverging from BTC also in the support side, where there are plenty of levels to protect the current bullish bias. The 100-SMA and the 50-EMA are trading between the $723 and the $716 mark. If that were not enough, a mid-term trendline is also meeting the $718 level. If those levels were lost, next supports would be at $695 and $680, although that last one lacks some strength.

MACD in the Ethereum 4-hour chart is trading above the current equilibrium level, proposing a lateral-bearish development that might try to confirm the cross to then continue to the upside.

Directional Movement Index in the same chart is showing a very similar profile to the Bitcoin one, although the ADX has fallen much more in this one, supporting the possibility of some lateral action for a brief period.

XRP/USD 4H chart

Ripple reached yesterday the 50-EMA at $0.75. XRP/USD tried for two times to break above that barrier, but it failed both of them. Ripple did succeed to break the $0.732 resistance, so now that one is its main support. On the upside, the 50-EMA is the first barrier to the bullish movement, followed by a price resistance at $0.768 and the 200-SMA located at $0.785.

Below there, we spot the aforementioned support at $0.732, followed by the $0.7067 level, right where the trendline coming from the monthly highs is located. If that level was lost, Ripple would go straight back to the $0.678.

MACD in the 4-hour chart shows a positive profile both in amplitude and inclination, and it is now meeting the equilibrium area of the indicator. It's likely that it will follow the profile shown by the Ethereum one.

Directional Movement Index in the same chart shows a similar outlook than the other Cryptos analyzed, although here the ADX is at higher levels that will need more time to be able to fully develop its pattern.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-636619729849811764.png)

-636619730153881597.png)