Top 3 Bitcoin, Ethereum, XRP: Cryptos make all-time highs while investors realize profits

- Bitcoin price makes another new all-time high, just shy of $70,000 at $68,444.

- Ethereum price also hits new all-time highs but looks extended at these ranges.

- XRP price faces a test to trade against Bitcoin and Ethereum.

Bitcoin price currently extended from a critical Ichimoku level, indicating a pullback is likely to occur. Ethereum price, like Bitcoin, is likely to face a pullback and provide a dip-buying opportunity. XRP price has finally entered into bullish entry conditions but may be threatened by Bitcoin and Ethereum’s implied retracements.

Bitcoin price to retest $63,000, offering a dip-buying opportunity

Bitcoin price has a common technical condition that affects many cryptocurrencies that have recently made strong moves higher. That condition is a sizeable gap between the current close and the Tenkan-Sen. Significant gaps between the close and the Tenkan-Sen often close quickly, creating mean reversion trading opportunities. For Bitcoin, a projected retracement zone would be near the $63,000 value area, near the former 100% Fibonacci expansion level, and between the Tenkan-Sen and Kijun-Sen.

BTC/USD Daily Ichimoku Chart

Given that Bitcoin has recently made new all-time highs, any slight pullback may be bought up immediately. A retracement to the Tenkan-Sen and Kijun-Sen may not occur. Any pullback projections will be invalidated if Bitcoin closes above $68,000 or moves beyond $70,000.

Ethereum price looks to end a three-day winning streak with profit-taking

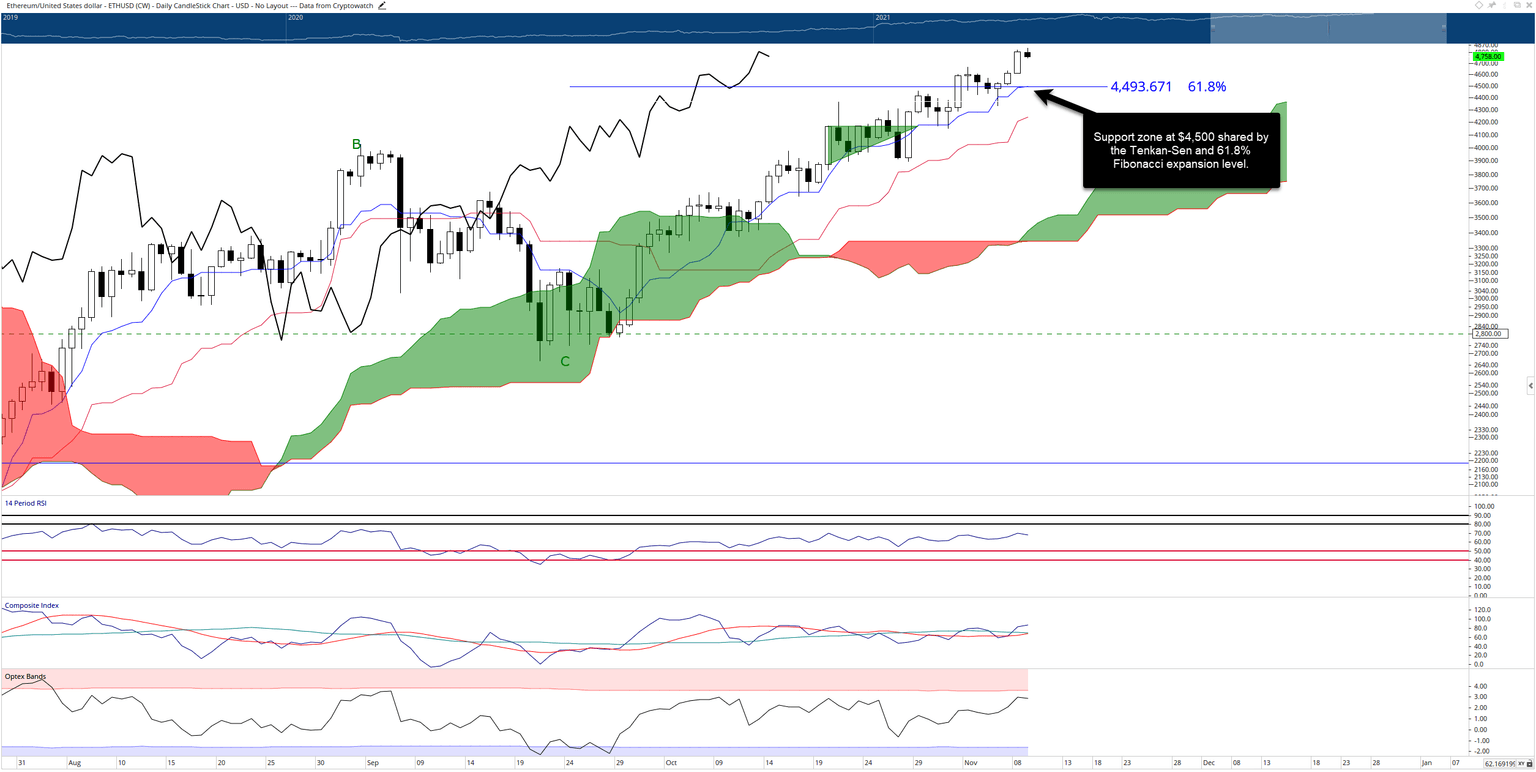

Ethereum price has made substantial gains over the past four trading days, pushing into new all-time highs and trading over 8% higher. The pace and size of the rise in a short period of time have created the same technical conditions seen on Bitcoin’s chart: a large gap between the current candlesticks and the Tenkan-Sen. One condition that Ethereum has that Bitcoin does not is the presence of a Kumo Twist. Kumo Twists are often turning points in markets. That means the current daily candlesticks could be the beginning of a corrective move. The likely support zone for Ethereum is the Tenkan-Sen and 61.8% Fibonacci extension at $4,500.

ETH/USD Daily Ichimoku Chart

However, knowing how volatile cryptocurrency markets can be during price discovery phases, there is no reason why Ethereum could not continue to trade higher despite a time cycle warning of an upcoming turn in the market. Additionally, with Ethereum so close to $5,000, it is very likely that $5,000 would be hit before any significant profit-taking occurs.

XRP price positioned for a bullish breakout; buyers must outperform Bitcoin and Ethereum

XRP price is in another frustrating trading zone. While Bitcoin and Ethereum have made new all-time highs, they look to retrace some of that move. XRP has followed Bitcoin and Ethereum’s price movements for the majority of the past three years and has not shown any recent developments that would suggest that will change. So while the current technical levels are favorable for XRP, it may be at risk of moving south if Bitcoin and Ethereum retrace. A move to $1.00 would be the likely support zone that XRP would find itself at during any significant pullback in the aggregate market.

XRP/USD Daily Ichimoku Chart

Although, if buyers can support XRP price above the $1.18 price level, then the bullish extension towards $2.50 has a high probability of playing out. Profit-taking from Bitcoin and Ethereum may create speculative capital creating inflows into XRP.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.