Top 3 Bitcoin, Ethereum, Ripple Prediction Prices: Bitcoin points to $10450, awaiting the Halving

- Bitcoin and Ethereum confirm terminal structures in the short term.

- Ripple continues to show weakness, but technical details open the door to a possible rebound in the short term.

- Stellar Lumens is facing increased resistance, with major potential gains in the mid term.

The crypto market starts the European session with generalised increases supported by the excellent performance of Bitcoin. The king of cryptocurrencies can have a run-up today to the next resistance level at $9675 in a first move and continue up to $10450 in the following hours.

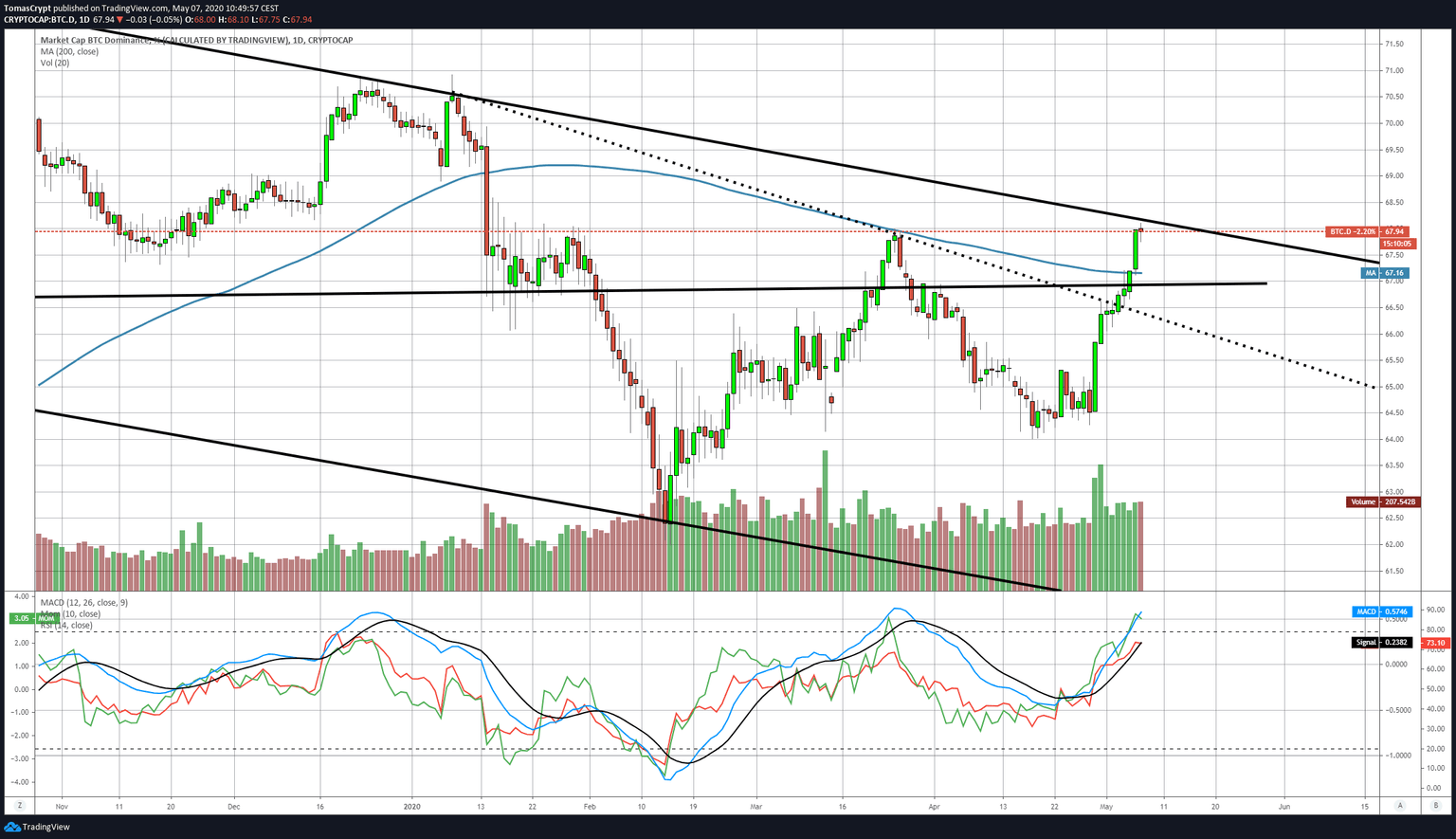

Bitcoin's strength and leadership over the rest are clear from the dominance chart, at least so far. After exceeding the 200-day moving average, the market share level moves to within a few points of the long-term bearish channel ceiling and some selling is appearing, which may indicate a capital movement towards other options on the crypto board. This capital swing does not necessarily imply a drop in the price of Bitcoin.

Applying the Fibonacci retracement system, the series looks like this:

Retracement level 0.236%: $0.2391

Setback level 0.382%: $0.3713

Setback level 0.500%: $0.4781

Setback level 0.618%: $0.5849

Above these setback levels, XLM/USD valuations soar, such as in the 1.618% extension of the Fibonacci retracement system, which would give a value of $1.4899 to each Stellar token.

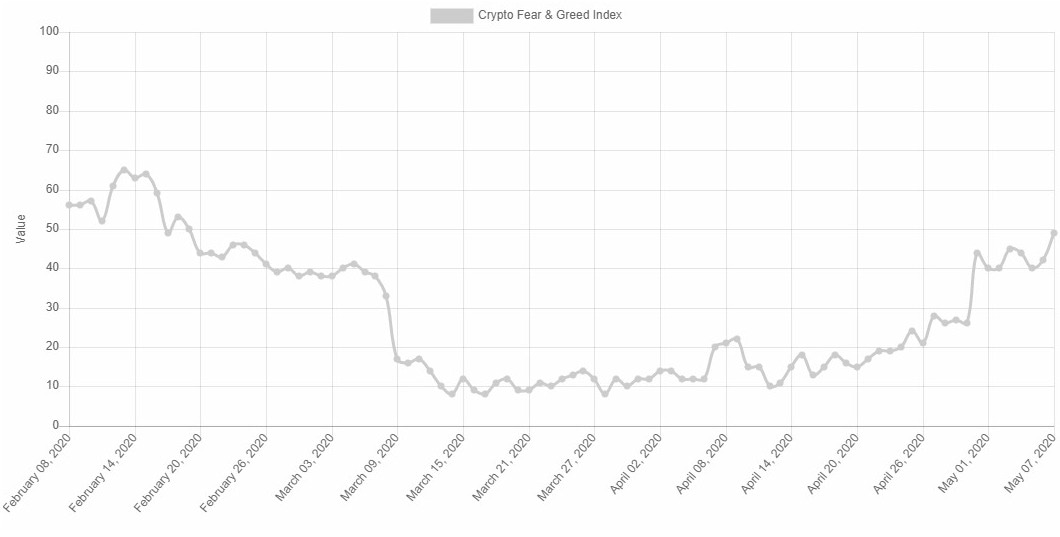

Source: alternative.me

The market sentiment level improves by one point to 49 and marks, for the first time in many months, a "Neutral" sentiment.

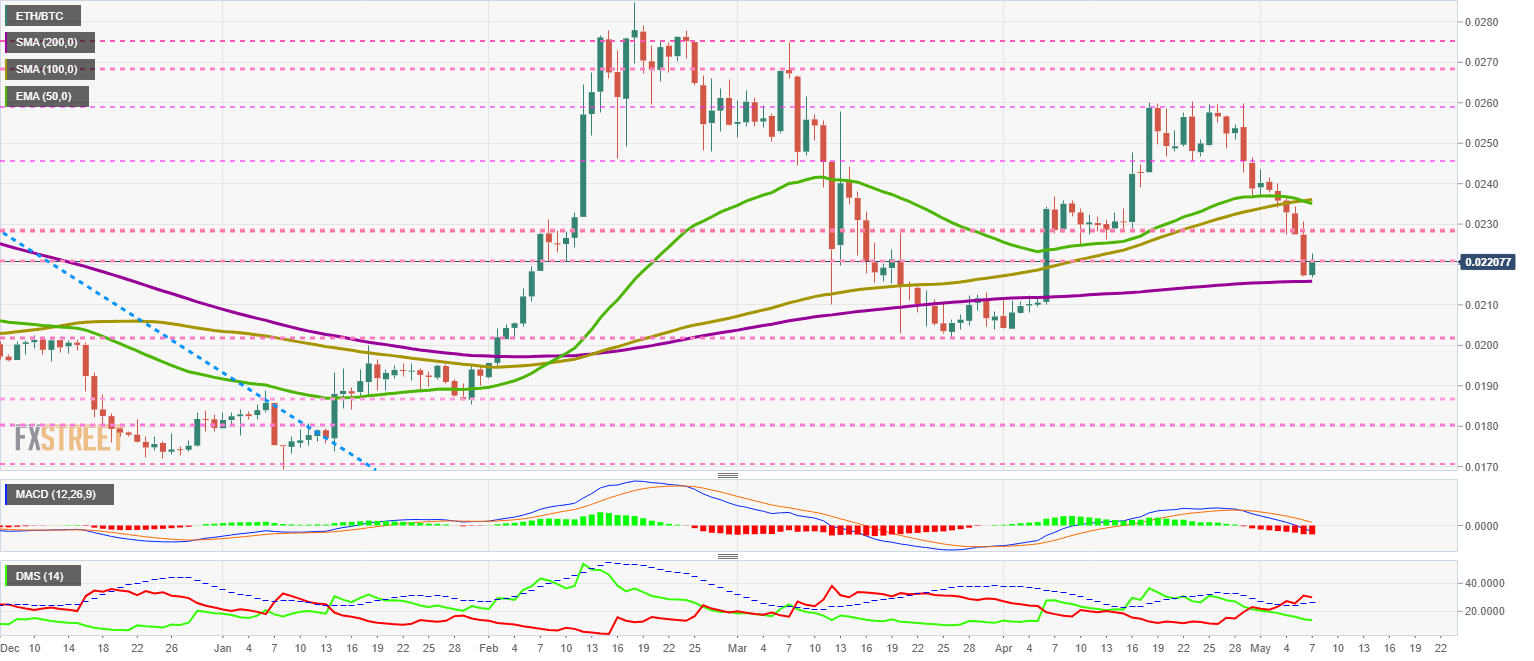

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.02207 and is improving for the first time after five consecutive days of declines. The presence of the 200-day simple moving average has worked well as support.

The technical structure of the ETH/BTC pair remains weak, and it is possible a downward ride in the coming days.

Above the current price, the first resistance level is at 0.022, then the second at 0.0228 and the third one at 0.0245.

Below the current price, the first support level is at 0.0215, then the second at 0.0201 and the third one at 0.0186.

The DMI on the daily chart shows the bears losing some steam, but retaining control of the ETH/BTC pair. The bulls are not showing any interest in disputing the lead at the moment.

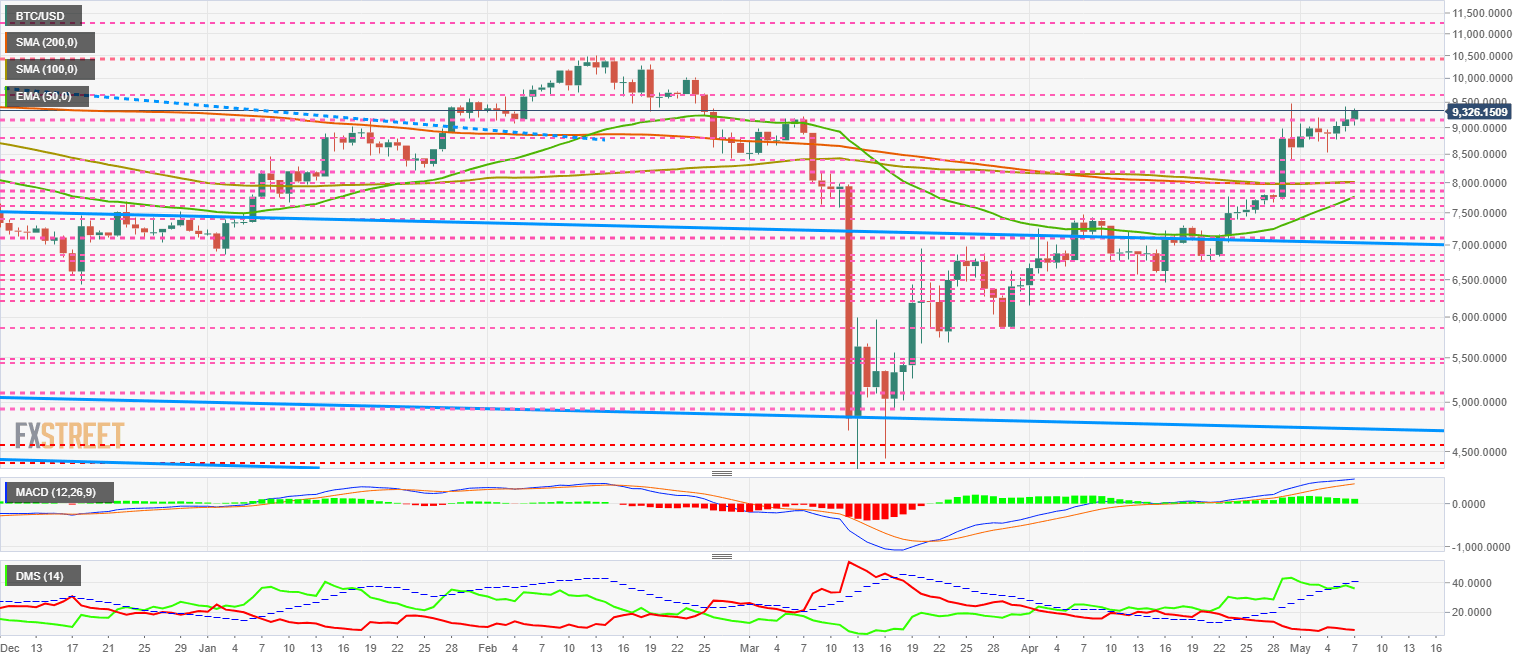

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $9326.

Above the current price, the first resistance level is at $9650, then the second at $10450 and the third one at $11300.

Below the current price, the first support level is at $9200, then the second at $8800 and the third one at $8400.

The DMI on the daily chart confirms the deactivation of the bullish pattern, which would prove a terminal pattern in the coming weeks.

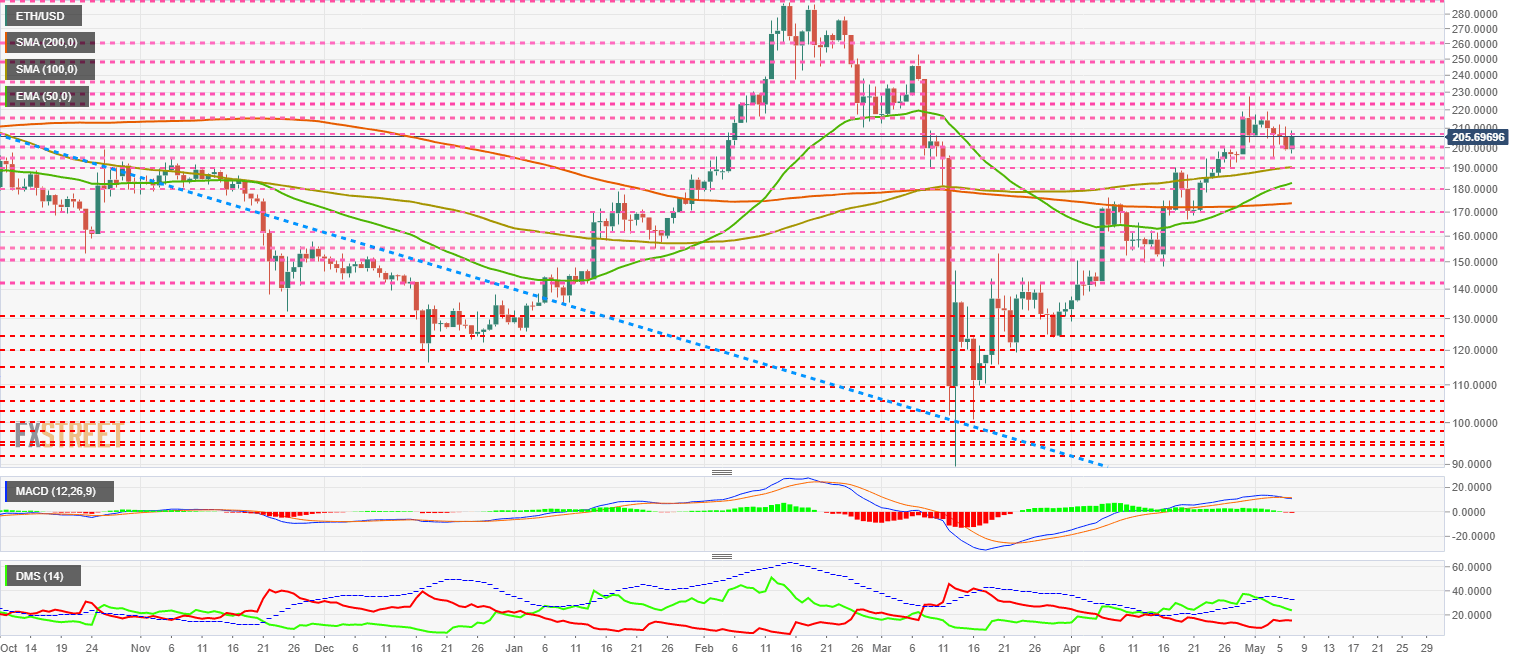

ETH/USD Daily Chart

The ETH/USD pair is currently trading at $205.6 and is rising for the first time in four days.

Above the current price, the first resistance level is at $208, then the second at $216 and the third one at $225.

Below the current price, the first support level is at $200, then the second at $195 and the third one at $190.

The MACD on the daily chart completes the bearish cross and confirms a later bullish scenario for the next few days.

The DMI on the daily chart shows the bulls moving downward and heading straight for a confrontation with the bears, which are rushing higher.

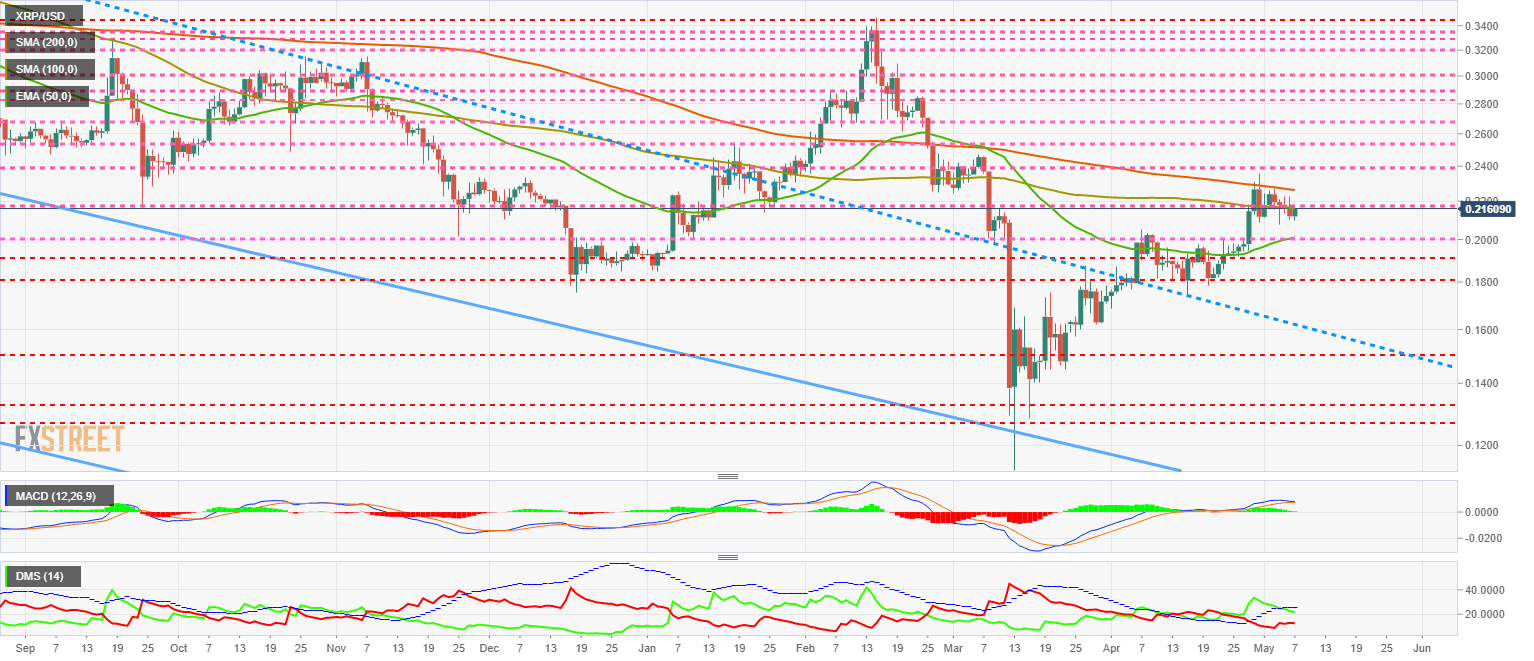

XRP/USD Daily Chart

The XRP/USD pair is trading at the price level of $0.216 and is unable to sustain itself above the 100-day simple moving average. Ripple shows a worrying structural weakness.

Above the current price, the first resistance level is at $0.218, then the second at $0.226 and the third one at $0.24.

Below the current price, the first support level is at $0.20, then the second at $0.191 and the third one at $0.178.

The DMI on the daily chart shows the bulls are moving downward. The bears are reacting upwards, and a collision between the two sides of the market seems inevitable within a few days.

Author

Tomas Salles

FXStreet

Tomàs Sallés was born in Barcelona in 1972, he is a certified technical analyst after having completing specialized courses in Spain and Switzerland.

-637244384150075448.png&w=1536&q=95)