- Bitcoin remains at $6,700 with a target of $7,000.

- Ethereum is looking to get away from the $460 to go for the $500.

- Ripple needs to exceed $0.497 to go for $0.53 at the top of the range.

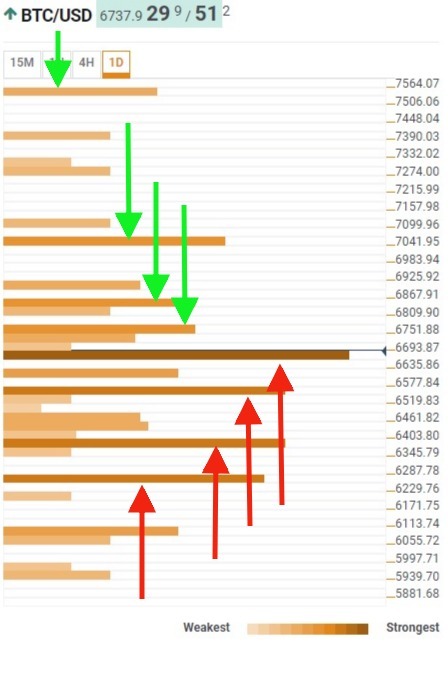

BTC/USD 1D

Bitcoin is currently trading at around the $6720 price level, within a range of around $6,700 from which is causing the BTC/USD to move away. It rests on a powerful confluence formed by the weekly R1 Pivot Point and the daily 23.6% Fibonacci retracement.

Below the spot price level, Bitcoin finds three major confluences that would support it. The first at $6,570 was formed by the weekly 61.8% and the monthly 38,2% Fibonacci retracements. The second confluence is at $6,360 and is built with the sum of yesterday's high plus the weekly 38.2% Fibonacci retracement. Finally, at $6,250, the support formed by the confluence of the weekly and monthly 23.6% of Fibonacci retracement.

Above the $6,700 price level, Bitcoin has also three confluences that act as resistance, although of less intensity than those that act as support. The first of these is at the $6,750 price level and is composed of more than 15 indicators ranging from 15 minutes to four hours. The second resistance, at $6,830, has the monthly high as its most important component. Finally, and already at $7,060 is the third resistance, the daily R2 of Pivot Point and the monthly 61,8% Fibonacci retracement.

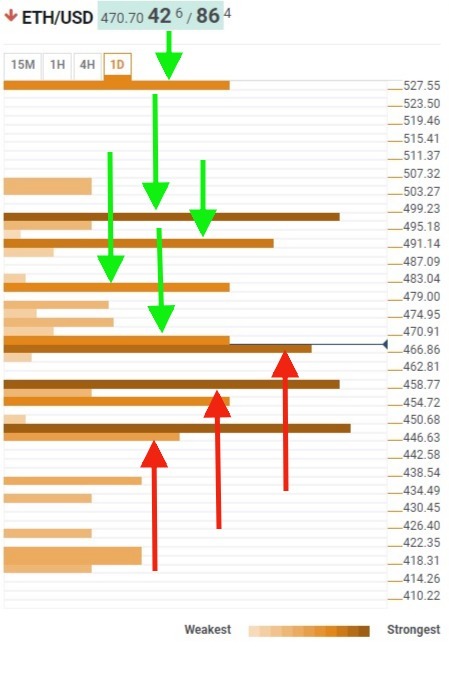

ETH/USD 1D

Ethereum is currently trading around the $469 level, mid-way between a mix of some low strength confluences levels. Ethereum does not enjoy the clarity seen in the BTC/USD, but if Bitcoin leads the way further up, nothing can stop the ETH/USD.

Above the current price, Ethereum has five confluences that play their role of resistance. The first one hit the price at $470 and was made up of six indicators between fifteen minutes and four hours. A little higher at the $480 price level, the second resistance formed by the confluence of yesterday's high and the weekly R1 Pivot Point. Then, at the $490 price level, the monthly 38.2% Fibonacci retracement plus the daily R1 level of Pivot Point. The most intense resistance for ETH/USD is already at the threshold of $500 and is the result of the confluence of the weekly highs plus the influence of the daily Pivot Point R2.

Below the current price, ETH/USD has two important confluences that can provide support in case of falls. The first confluence for the Ethereum, at the $450 price level was made by the monthly 23.6% Fibonacci retracement, the daily 61.8% of Fibonacci and the SMA100 over a four-hour period. A little lower, already at the $446 price level, the weekly 38,2% Fibonacci retracement, the daily SMA5 and the proximity of yesterday's high a few dollars lower.

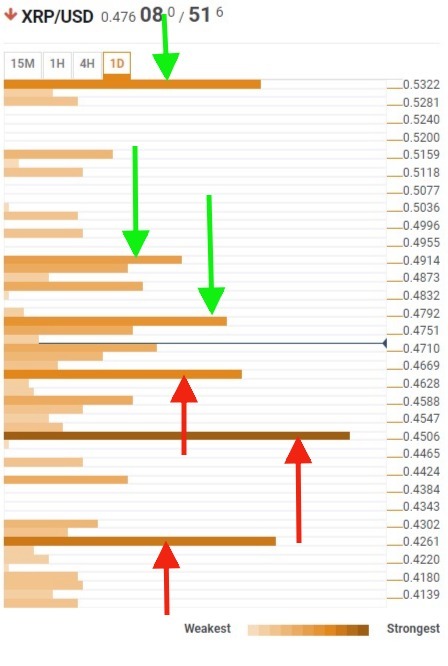

XRP/USD 1D

The Ripple is the one that seems to be having the most trouble getting traction. It reaches $0.476 and is among a series of confluences that provide medium-low level support and resistance but seem sufficient to halt the advance of the less capitalized of the three major crypto assets in the market.

Above the current price level at $0,476, three major confluences await Ethereum. The first of these is located at $0.478 and includes the weekly R1 of Pivot Point, the four-hour highs and the 23.6% daily Fibonacci Retracement. Higher up, in the $0,491 price level the second resistance, formed by the monthly 23.6% Fibonacci retracement among others, is waiting for Ethereum. Finally, at $0.53, the ETH/USD should exceed the confluence of the monthly 38.2% Fibonacci retracement and the daily SMA50.

Below the $0.467 price level, Ripple also has three supporting confluences. The first of these confluences is located at $0.462 price level and includes, among others, the weekly 61.8% Fibonacci retracement and the four hours SMA100. Next, Ripple would find located at $0.45 price level a powerful confluence that despite having "only" the weekly 38.2% Fibonacci retracement at that price, is boosted by the proximity of the daily S1 Pivot Point and the daily 61.8% Fibonacci retracement few dollars higher. Finally, located at the $0.42 price level, the monthly and weekly lows are the last confluence that could support the XRP/USD in the event of a crash.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.