- BTC/USD broke below the support level.

- ETH/USD will move lower as it's the path of least resistance.

- XRP/USD jammed between support and resistance areas.

Bitcoin could not hold the ground on Thursday and resumed the downside, while other top cryptocurrencies just followed the lead. Lack of convincing fundamental factors leaves the market to the mercy of technical trading and speculative positioning within the established short-term range. The digital coin No.1 has lost about 5% in August, but it is still can be qualified as a healthy correction after a sharp rally in July.

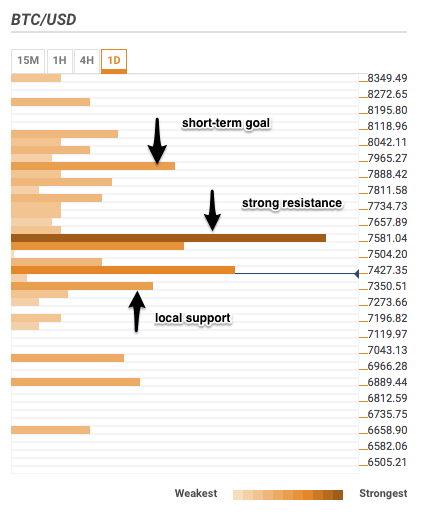

BTC/USD 1D

BTCUSD is sandwiched between strong confluence areas, which means that some period of consolidation may be in store for us. Both bulls and bears have to mobilize energy for a significant breakthrough that will define the momentum for the nearest future.

BTC/USD slipped to $7,285 early on Friday as the support around $7,600 gave way. The coin touched the lowest level since July 23 amid global sell-off on the cryptocurrency markets. Currently, BTC/USD sits at $7,370, while new support is created at $7,350 by a confluence of technical indicators, including Pivot Point one-day Support 1, Bollinger Band 15 min -Middle, SMA10 - 15 min, SMA5 - 15 min.

Once it is cleared, the downside may be extended to Pivot Point one-day Support 3 at $7,7150, though this support can be taken out quickly, dragging BTC towards psychological $7,000, followed by 61.8% Fibo retracement monthly.

Above the current price, the stiff resistance is located on the approach to $7,600. This area includes quite a few critical technical indicators, which include:

Fibonacci 38.2% daily and monthly, and SMA100 (daily) Bollinger Band daily -Middle, with Fibonacci 23.6% daily, Pivot Point one-day Resistance 1, and a host of SMAs on approach.

Area $7,800 is the ultimate bullish goal for the time being. The next hurdle comes at $7,931 with 23.6% Fibonacci retracement and Pivot Point one-day Resistance 2. Once this area is cleared, the upside may be extended towards psychological $8,000.

Click to see the Full Confluence Indicator

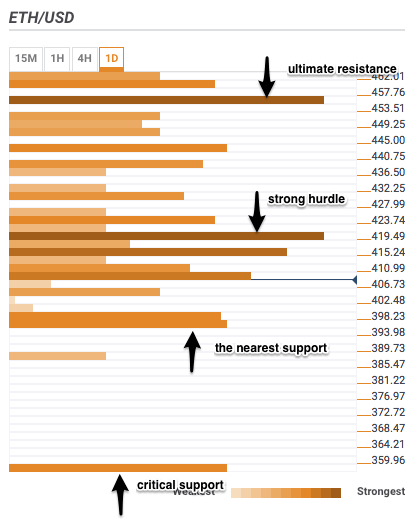

ETH/USD 1D

The second digital coin by market capitalization is trading at $406, down 2.5% on a daily basis and 1% lower since the beginning of Friday. ETH/USD touched $397 low during early Asian hours before stabilizing marginally above $00 handle. A cluster of technical levels below the current price include:

The 4 -hour low, the Bolinger Band 15m-Lower, Pivot Point one-day Support 2, Pivot Point one-month Support 1, and Bolinger Band 4h-Lower

Below this area there are no significant support lines until 2018 low at $352, strengthened by Pivot Point one-month Support 2.

The nearest resistance comes just above the current price, created by a confluence of the one-hour high, 4-hour high, 15 min high, one day high together with Bollinger Band 15 min -Upper and Bollinger Band 1day -Middle. It is followed by 38.2% Fibo retracement daily, SMA10 - 4-hour. SMA50 - 1-hour and SMA200 - 15 min. Then go 61.8% Fibo retracement and last month low around $420. The critical hurdle comes at $460 (SMA10-Daily, 38.2% Fibo retracement monthly.

Basically, all the way up is riddled with resistance levels, which means that the downside movement is the path of least resistance.

Click to see the Full Confluence Indicator

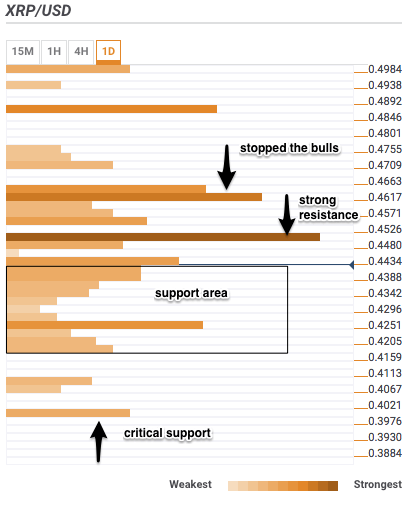

Ripple is changing hands at $0.4576. The third largest coin is mostly unchanged both since the start of Friday and on a daily basis.

Below the current price, the local support area goes all the way down from the current price to $0.4130. The confluence of technical indicators located in this area include:

A host of SMAs, 1-hour low, 1 day low, 4-hour low, last month low, 23.6% Fibonacci retracement daily, 161.8% Fibonacci retracement weekly, Pivot Point one-week Support 2, Pivot Point one-day Support 2, Pivot Point one-day Support 1, Bollinger Band 1-hour -Middle, Bollinger Band 1-hour -Lower, Bollinger Band 4-hour -Lower, Bollinger Band 15-min -Lower.

XRP is well supported on its way down; however, if the above-said area is passed, the sell-off may be extended towards psychological $0.4000, followed by Pivot Point one-month Support 1.

There are also quite a number of resistance levels on the way up: a confluence of Fibonacci retracement levels (23.6% monthly, and 61.8% weekly), Bollinger Band 4-hour -Upper, 1-day high and SMA10-daily) is likely to stop the recovery at $0.4500.

Once this area is cleared, the upside may be extended towards $0.4600. This area stopped XRP during the recent upside. It is followed by 161.8% Fibonacci retracement daily, SMA200 - 4-hour and Pivot Point one-day Resistance 1.

Click to see the Full Confluence Indicator

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.