Toncoin traders take profits as crypto VCs invest $400M in TON

- Toncoin price dipped to $3.6 on Friday, down 9% from the $4.1 peak recorded on Thursday.

- The correction follows profit-taking after a prominent crypto VC announced a $400M TON purchase.

- Coinglass derivatives data shows $10 million in short futures contracts clustered around the $4 mark.

Toncoin announces $400 million capital inflows from venture capital firms

The Open Network (TON) Foundation announced on Thursday that a consortium of venture capital firms, including Sequoia Capital, Ribbit, Benchmark, and Kingsway, has collectively invested more than $400 million in Toncoin.

"These venture capital firms have invested over $400 million in Toncoin, which is the native cryptocurrency of the TON blockchain, the funding is provided in the form of Toncoin, rather than traditional equity or cash."

- Spokesperson, TON Foundation.

According to the foundation, the TON blockchain's active user base has surpassed 40 million over the past year, while the number of unique Toncoin holders now stands at 121 million.

"The TON team is the best in the world at the intersection of consumer product thinking and crypto infrastructure.

When you combine this with the global distribution of Telegram, we’re very excited to see where they go,"

- Shaun Maguire, partner at Sequoia Capital.

TON serves as the blockchain infrastructure supporting a growing ecosystem of mini-applications within Telegram’s messaging platform.

With the recent convergence between AI and blockchain technologies, the Toncoin ecosystem has drawn global attention in recent weeks.

This investment also comes just days after Telegram’s CEO confirmed his return to Dubai after his recent arrest in France.

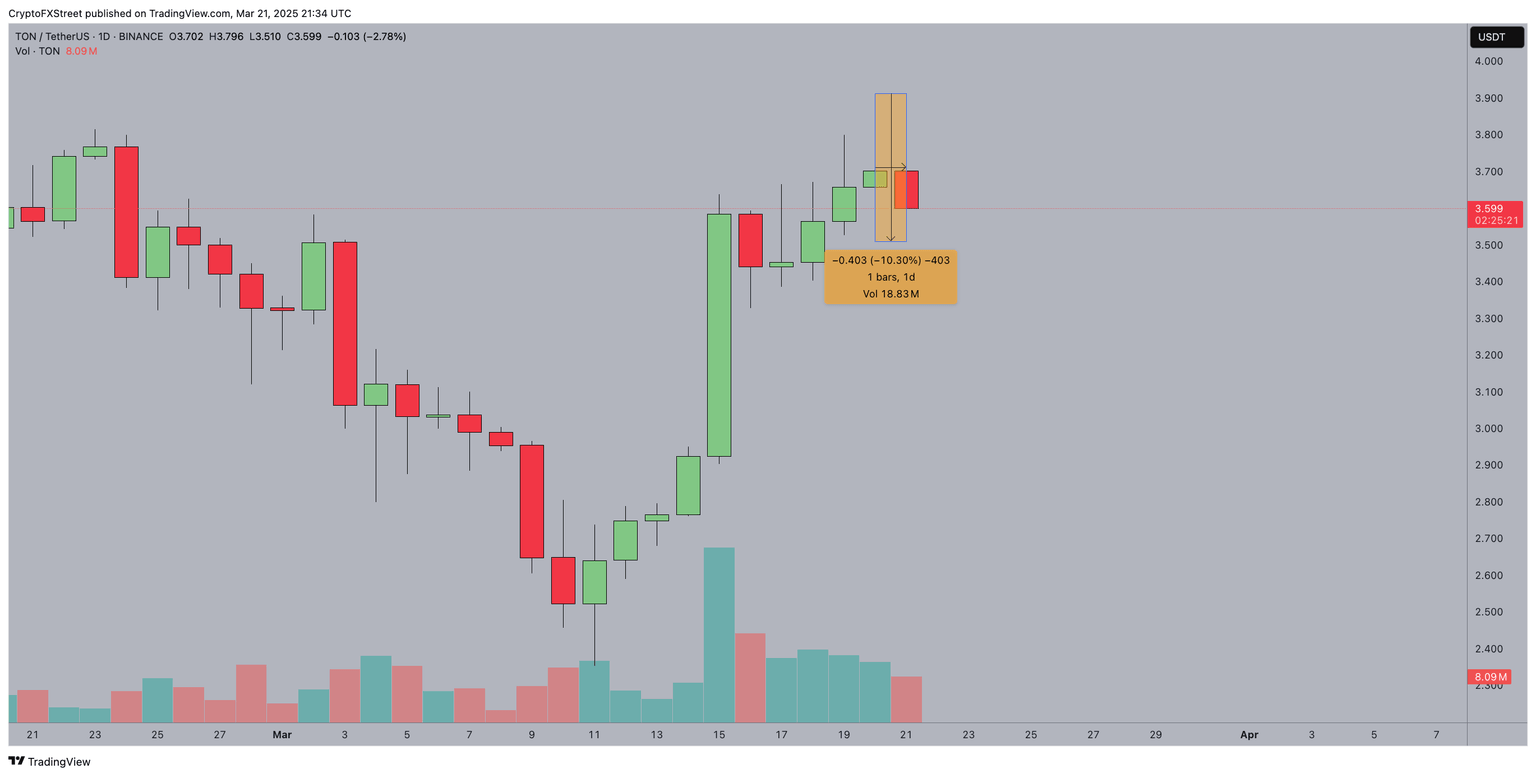

Toncoin price tumbles 9% as major investment triggers profit-taking

The $400 million VC investment sparked an immediate profit-taking frenzy among Toncoin traders.

As a result, TON price experienced a sharp decline on Friday, dropping to a low of $3.50 after reaching a weekly peak of $4.10 on Thursday.

Toncoin’s 10% price correction appears driven by traders locking in profits following the substantial capital injection from venture capital firms.

Toncoin price action | March 20, 2025

Despite the pullback, key technical indicators suggest that bullish support remains strong.

The lower wick on the daily candlestick is slightly longer than the upper shadow, indicating that buyers are actively stepping in to prevent further declines.

This suggests that long-term investors are working to absorb selling pressure as short-term traders exit their positions.

Additionally, Toncoin’s trading volume has remained elevated, exceeding 10 million TON in each of the last four trading sessions.

By noon in U.S. trading hours, TON volume had already crossed 7.92 million, putting it on track to surpass the 10 million mark before the day's close.

These market dynamics indicate that demand for Toncoin remains resilient, with selling pressure being met with substantial buying interest.

If current conditions persist, the ongoing retracement is likely to stabilize near the next psychological support level at $3.00.

Toncoin price forecast: Resistance at $3.90 could hinder bullish momentum

Toncoin's price outlook remains cautiously bullish, despite the recent profit-taking wave following the $400 million VC inflow.

At press time, TON is trading around $3.54, approaching the upper Bollinger Band at $3.90—a key resistance zone that aligns with a significant concentration of leveraged short positions in the derivatives market.

Toncoin price forecast x Liquidation Map | Source: TradingView/Coinglass

According to Coinglass data, approximately $1.2 million in short leverage is positioned at $3.90.

This suggests that a large number of bearish traders are actively defending this level to avoid forced liquidations.

Beyond that, the widening Bollinger Bands indicate increasing market volatility.

With Toncoin pressing against the upper boundary, a breakout remains a likely scenario.

However, for this bullish outlook to materialize, TON must achieve a decisive close above $3.90—either triggering a short squeeze or supported by a positive market catalyst that forces bears to unwind their positions early.

On the downside, the exchange liquidation heatmap confirms significant short positioning, highlighting that bearish traders still hold an advantage in the short-term derivatives market.

If Toncoin fails to break through the $3.90 resistance, sellers could regain control, potentially driving the price back below the $3.50 zone.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.

-638781897067528223.png&w=1536&q=95)