- Toncoin price breaks out of a cup and handle pattern, a bullish sign.

- On-chain data suggests growing activity and interest within the TON’s ecosystem.

- A daily candlestick close below $6.01 would invalidate the bullish thesis.

Toncoin (TON) price breaks out of a cup and handle pattern, a bullish continuation configuration. On-chain data indicates a surge in TON's growing activity and interest could propel prices to surge by 24%.

Toncoin price forms bullish technical pattern

Toncoin price closed above the resistance level of the Cup and Handle pattern at $7.70 on Thursday, which signifies a bullish breakthrough. This pattern, crafted by TON's price movements from mid-April to early June, delineates a U-shaped bottom formation, termed the cup, followed by a smaller U-shaped bottom known as the handle.

This breakout of a bullish continuation pattern forecasts a 41% rally to $10.86, obtained by adding the depth of the cup to the breakout point.

Considering the current market conditions, this outlook is extremely bullish and is unlikely to be achieved. Investors can remain conservative and start booking profits around the 161.8% Fibonacci extension level at $9.61, drawn from a swing high of $7.70 on April 13 to a swing low of $4.60 on May 1. This move would constitute a 24% gain.

TON/USDT 1-day chart

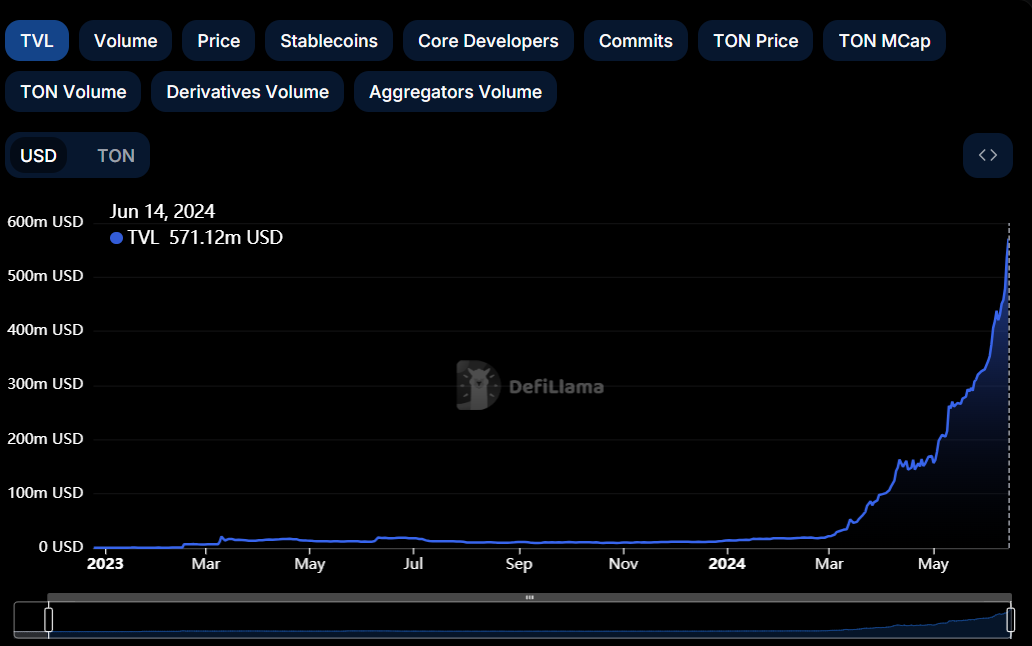

Additionally, crypto intelligence tracker DefiLlama data shows that TON’s Total Value Locked (TVL) has increased from $420.47 million on June 8 to an all-time high of $569.45 million on June 14.

This 35% increase in TVL indicates growing activity and interest within the TON ecosystem. It suggests that more users are depositing or utilizing assets within TON-based protocols, adding further credence to the bullish outlook.

TON TVL chart

Even though the on-chain metric and technical analysis point to a bullish outlook, if TON’s produces a daily candlestick close below $6.01, the daily support level, the move would invalidate the bullish thesis by producing a lower low on the daily time frame. This development could see Toncoin's price fall 23% to the weekly support level of $4.60.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.