Tim Draper’s portfolio expands with the addition of Tezos, Aragon and TRX

- Timothy Cook Draper is an American venture capital investor who supports Bitcoin and cryptocurrencies.

- In a recent interview, the investor stated that he is a believer and owns XTZ, TRX, Aragon, and others.

Tim Draper became extremely popular among the cryptocurrency community back in 2014 after thousands of Bitcoins were seized from an operation to take down the Silk Road website, a black market for selling illegal drugs.

On June 27, 2014, Draper paid close to $19 million to purchase 30,000 Bitcoins. Tim Draper is a firm believer in the cryptocurrency industry and Bitcoin going as far as predicting the flagship cryptocurrency to reach $250,000 by 2023.

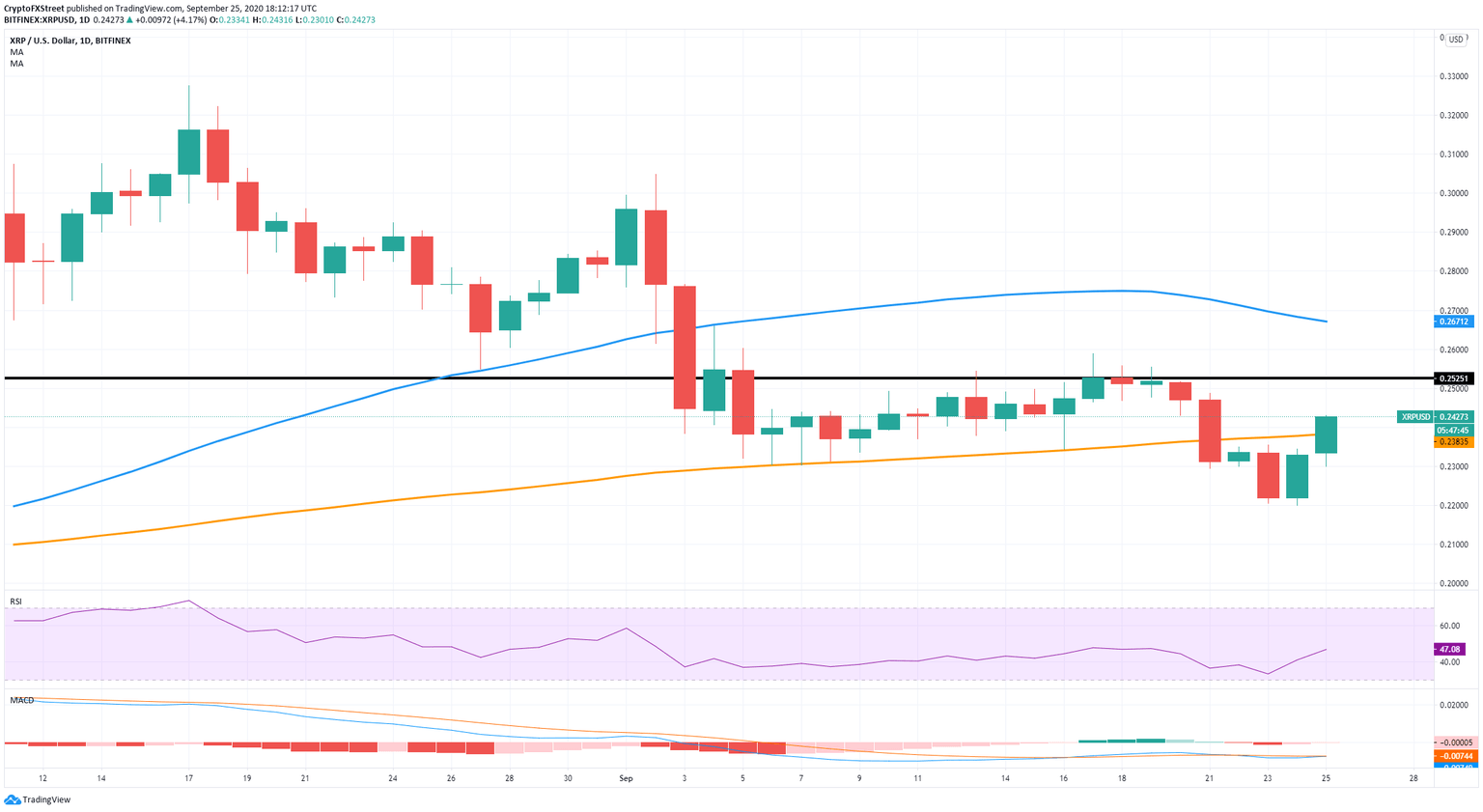

XRP/USD daily chart

XRP price is currently right above the 100-MA at $0.238. If bulls can defend this level and confirm it as support, the MACD will also turn bullish within the next 24 hours.

XRP Holders Distribution

Looking at the holders distribution chart for XRP, we can see whales with at least 10,000,000 XRP coins are ready to hold. The number of whales increased from 304 to 312 since August 30. This indicates a significant interest in the digital asset and eases up selling pressure.

XRP/USD 4-hour chart

The TD sequential indicator has painted an ‘8’ on the 4-hour chart, indicative of an upcoming sell signal in the short-term. The price of XRP climbed above the 50-MA and it’s right at the top of the 100-MA at $0.242. If bulls can manage to convert both MAs into support levels, the digital asset will look at $0.254 as the next target.

A rejection from both MAs, however, would indicate weakness and further validate the upcoming sell signal. The next short-term bearish target would be $0.23

Tim Draper has stated the following about XRP:

Looking at the three-time growth of Bitcoin over the past 5 months, one would expect a similar result from XRP

ANT/USD daily chart

On the daily chart, the TD Sequential indicator presented a buy signal on September 23. The price is currently fighting to stay above the 100-MA at $3.45 and convert it into support. A close above this level would further validate the buy signal and, most certainly, turn the MACD bullishly within the next few days.

ANT Holders Distribution

Unfortunately, looking at the holders distribution chart, it seems that ANT lost a lot of investors around August 12. The number of holders with 10,000 - 100,000 coins plummeted from 260 to 189 on August 31. Although the trend seems to be going up, the number of current holders is still only 199, indicating the interest in ANT is lower than before.

ANT/USD 4-hour chart

The TD sequential indicator presented a sell signal just six hours ago on the 4-hour chart. The price of ANT is getting rejected at the 50-MA and could slip towards $3 again.

A clear rejection from the 50-MA at $3.71 will push ANT to $3, the most crucial support level in the short-term. On the other hand, converting the 50-MA into support would further validate the buy signal on the daily chart with a target of $5.26 in the form of the 50-MA on the daily chart.

XTZ/USD daily chart

Things aren’t looking great for Tezos on the daily chart as the digital asset is still down 50% from its peak at $4.49 on August 13. The MACD is close to a bull cross, which is bound to happen within the next few days if bullish momentum continues.

The TD sequential indicator presented a buy signal on September 23, which is getting enough follow-through to be validated. The RSI was in the oversold zone and bouncing back up nicely.

XTZ/USD 4-hour chart

Here the TD sequential formed a sell signal right around the 50-MA at $2.21. So far, the price of XTZ remains above it but hasn’t really transformed it into support just yet.

A bearish breakout below the 50-MA will push XTZ down to $2. On the other hand, if bulls can continue defending it, the buy signal on the daily chart will be stronger, creating a target price at $2.38 at the 100-MA.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B20.10.44%2C%2025%20Sep%2C%202020%5D-637366547708669325.png&w=1536&q=95)

-637366548272458182.png&w=1536&q=95)

%20%5B19.48.09%2C%2025%20Sep%2C%202020%5D-637366548361214688.png&w=1536&q=95)