Three warning signs suggest the Bitcoin price rally is overextended

Bitcoin (BTC) faced fresh doubts over the strength of its bull run on Oct. 7 as analysts eyed a potential reversal of Wednesday’s short squeeze.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

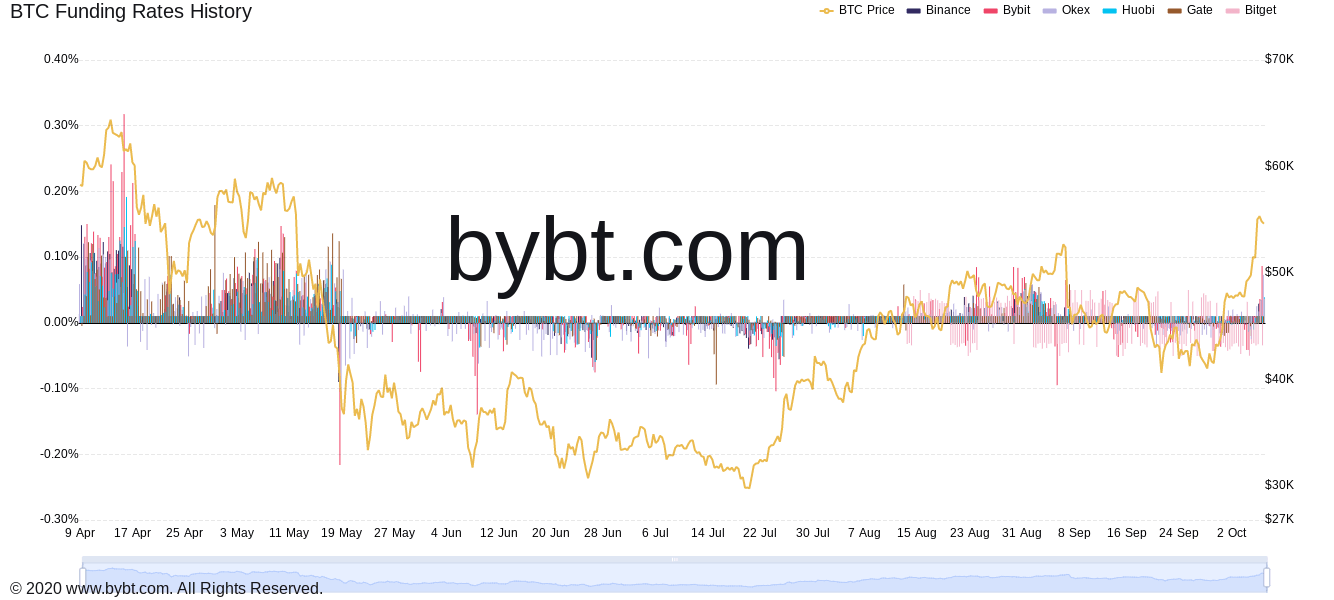

Funding rates in the red zone

Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it hovered near $54,000 after failing to establish support at the $55,000 mark.

The previous day had seen an abrupt surge to highs of $55,700 for Bitcoin, which was accompanied by major buying pressure.

As funding rates flip positive across exchanges, however, concerns on Thursday focused on what could end up being an opposing move lower.

Funding rates turning overly positive suggest that the market is expecting further upside and that significant value is long BTC. Under such circumstances, a mass unwinding of positions could hasten and intensify a downward move, should it begin.

Bitcoin funding rates vs. BTC/USD chart. Source: Bybt

The mood among investors was echoed by sentiment data, with the Crypto Fear & Greed Index hitting 76/100 on the day, representing “extreme greed.”

“Investors are extremely greedy towards BTC right now,” trader and analyst Rekt Capital warned.

Crypto Fear & Greed Index as of Oct. 7. Source: Alternative.me

Preparing for profit-taking

While under $10,000 from all-time highs at one point, Bitcoin additionally faces significant resistance levels at $58,000, $60,000, and more on the way to returning to price discovery.

As Cointelegraph reported, October is slated to close just below the highs, while November could see a return to lower levels before a December finale obliterates current records.

Nonetheless, longtime market participants are already advising an exit strategy this week, among them John Bollinger, creator of the popular Bollinger Bands trading indicator.

Bollinger bands track upward and downward volatility of an asset and are currently hinting that calmer conditions should prevail. When the bands narrow, however, volatility follows.

BTC/USD 1-day candle chart (Bitstamp) with Bollinger bands. Source: TradingView

Altcoins, meanwhile, are not expected to deliver definitive cycle gains until next year.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.