Three signs that XRP is a hot buy as Ripple bags another win against SEC

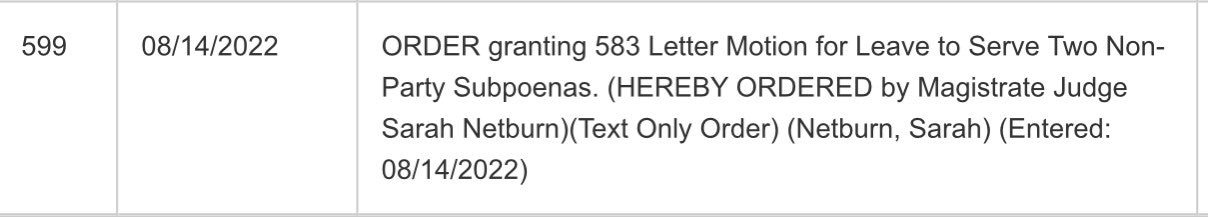

- Judge Netburn granted Ripple’s motion to serve two subpoenas to authenticate videos of seven SEC officials' public remarks.

- Judge Netburn ignored the regulator’s claim that Ripple is trying to reopen fact discovery.

- Ripple price is likely to witness a potential breakout according to the daily price chart.

In the SEC v. Ripple case, the payment giant is set to serve subpoenas and authenticate videos of SEC officials’ public remarks. This evidence could make or break Ripple’s defense against the SEC. Proponents have identified a potential breakout in XRP.

Also read: SEC v. Ripple: Payment giant makes strides to end legal battle

Ripple defendants will serve subpoenas to SEC officials

Judge Sarah Netburn presiding on the SEC v. Ripple case granted the payment giant the motion to serve subpoenas to authenticate videos of SEC officials’ public remarks. The defendant will now serve two subpoenas to seven SEC officials. Judge Netburn ignored the SEC’s claim that defendants were trying to reopen fact discovery. The outcome of the videos’ authentication is make-or-break for Ripple’s defense.

Judge Netburn’s order to defendants

What does the mean for average XRP holder

Proponents expect a positive outcome from Ripple’s lawyers’ subpoenas to SEC officials. Once officials authenticate the remarks made by them, it strengthens Ripple’s defense against accusations made by the regulator.

Ripple’s probable win in the battle against the SEC and expansion of Ripple’s on-demand liquidity platform favors the adoption of XRP. Analysts evaluated the daily price chart and predicted a rally to $0.41. Bob Mason, a leading crypto analyst identified three major resistance levels in XRP price rally.

Mason argues that the first resistance sits at $0.3871, second at $0.3986 and the third at $0.4167. If XRP price fails to break past the second resistance levels and drops to $0.3443, the bullish outlook will be invalidated.

Rudy Fares, a crypto analyst, observed that the XRP price has consolidated between $0.30 and $0.40 for a long period of time now. While other cryptocurrencies like MATIC offered holders massive gains, XRP has lagged behind. Once XRP price breaks past $0.40, it is expected to rally higher and catch up with other altcoins in the market.

XRP-USDT 1-day price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.