Three reasons why Shiba Inu price could explode to $0.0000180 and how you can get in at the bottom

- Shiba Inu price has been on a downtrend since August 14 and shows no signs of stopping.

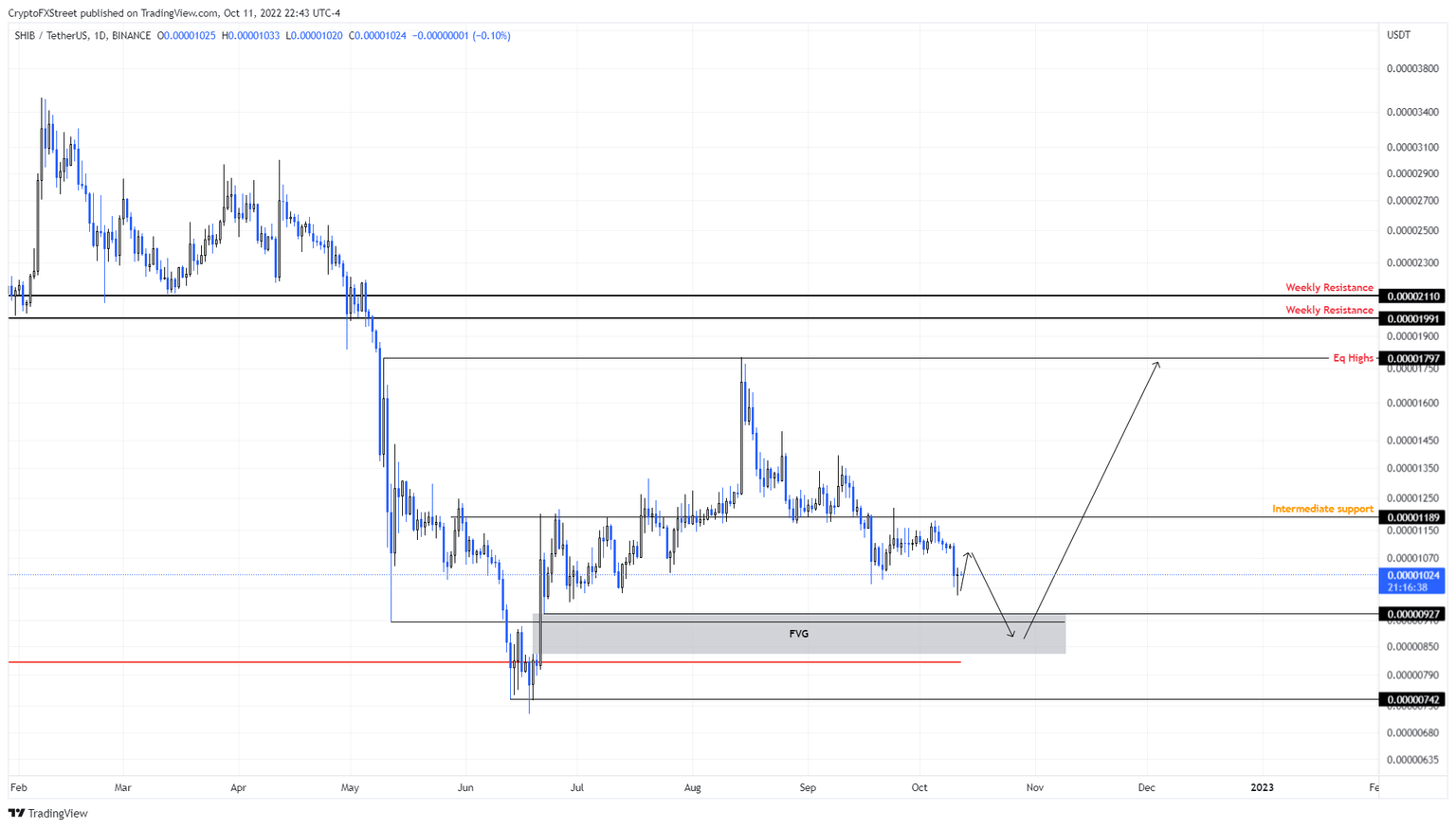

- Investors can expect a reversal to occur after retesting the FVG, extending from $0.0000083 to $0.000093.

- A daily candlestick close below $0.0000074 will invalidate the bullish thesis for SHIB.

Shiba Inu price has been shedding weight since the explosive rally on August 14. This downtrend has one objective: to rebalance the inefficiency created in late June. Fulfilling this objective could be key to triggering another exponential move for SHIB.

Shiba Inu price approaches downtrend’s end

Shiba Inu price set up a second equal high at $0.0000179 on August 14 after rallying 42%. This massive run-up faced exhaustion and triggered a downtrend that is still in progress. So far, SHIB has dropped 46% and is currently hovering around $0.0000102.

Investors should expect a minor recovery bounce to $0.0000109 before ultimately heading down to fill the Fair Value Gap (FVG), extending from $0.0000083 to $0.0000093. This move could even retest the Point of Control (POC) at $0.00000081, which is the highest traded volume level since May 2021.

Interested investors can start their accumulation of SHIB in the aforementioned levels. A reversal here would depend on the market conditions. If the Bitcoin price is in line with a recovery rally, Shiba Inu price will also follow suit.

Therefore, a bounce here has the potential to propel Shiba Inu price to sweep the equal highs formed at $0.0000179, bringing the total gain to 93%. Hence, investors should keep a close eye on dog-themed crypto as it provides a good risk-to-reward ratio.

SHIB/USDT 1-day chart

On the other hand, if Shiba Inu price fails to stay above the POC at $0.000081, it would denote a seller-dominated market and reduce the possibility of a reversal.

If Shiba Inu price produces a daily candlestick close below $0.0000074, it will create a lower low and invalidate the bullish thesis for SHIB. Such a development could see the meme coin retest the $0.0000060 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.