Three reasons why Ripple price buckle under pressure and crash 20% soon

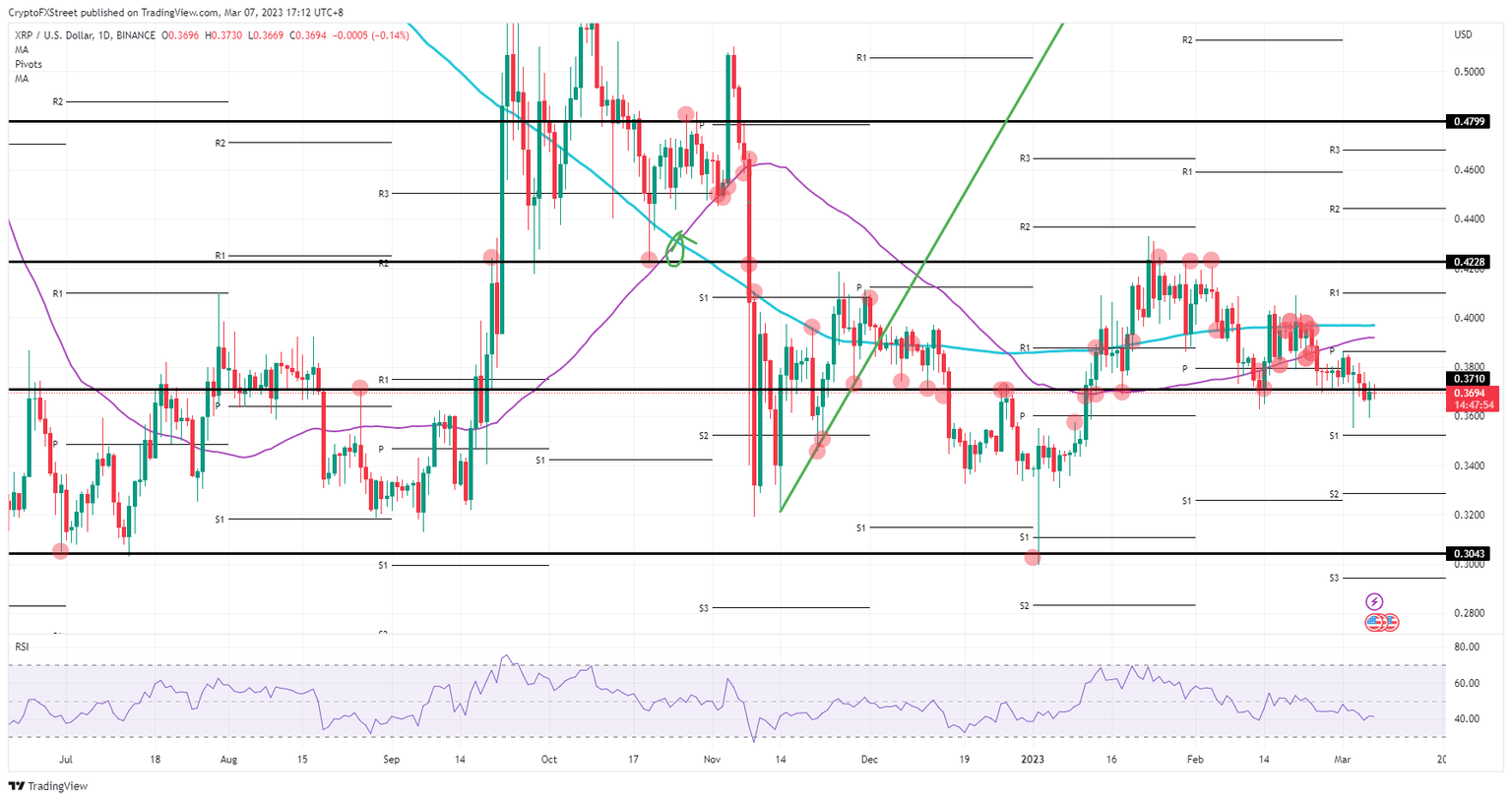

- Ripple price slides below a key support level.

- XRP traders see hope for a quick spike to $0.48 going out the window.

- With the RSI still trending lower, more downside will push XRP toward $0.30.

Ripple (XRP) price sees markets gearing up for some massive risk events on the economic calendar. One could even say that bulls have dropped the ball and did not use the quiet window of opportunity last week to stretch that rally toward $0.42 yet again. Instead, more profit-taking happened along the way, making it very difficult to see any upside as US Fed Chairman Jerome Powell takes the stage twice this week and the US jobs report hits the wires on Friday.

Ripple bulls have set up their own funeral this time

Ripple price was not that long ago primed to hit a new high for this year and even notch that $0.48 level on the upside as a clear recovery rally and uptrend got noticed. Markets, however, can quickly change sentiment overnight as bulls have dropped the ball and started to book gains on the incurred rally since January. With that relentless profit-taking, bulls shot themselves in the foot and tanked XRP lower toward $0.37.

XRP could trade even lower as a few big risk events are at hand this week. For starters, this Tuesday and Wednesday, US Fed Chair Powell will take the stage in the regular US Senate hearings and his message could already be enough to trip XRP toward $0.34 should Powell confirm current inflation levels need a longer restrictive policy. The US jobs numbers coming out on Friday could prove to be stronger and more resilient, triggering expectations that the Fed will hike even more, with XRP primed to hit rock bottom at $0.30 on the back of that news.

XRP/USD Daily chart

The Powell speech this Tuesday and Wednesday does not need to be that big of an issue for markets. When Powell confirms that inflation is still coming down and that the current spikes were just one-offs, XRP will jump higher. Add several times the word “disinflation” and XRP will quickly hit $0.42 and break above it with $0.48 as the profit target for the end of next month.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.