Three market catalysts suggest that Ethereum's native token Ether (ETH) is well-positioned to reach $4,000 this month.

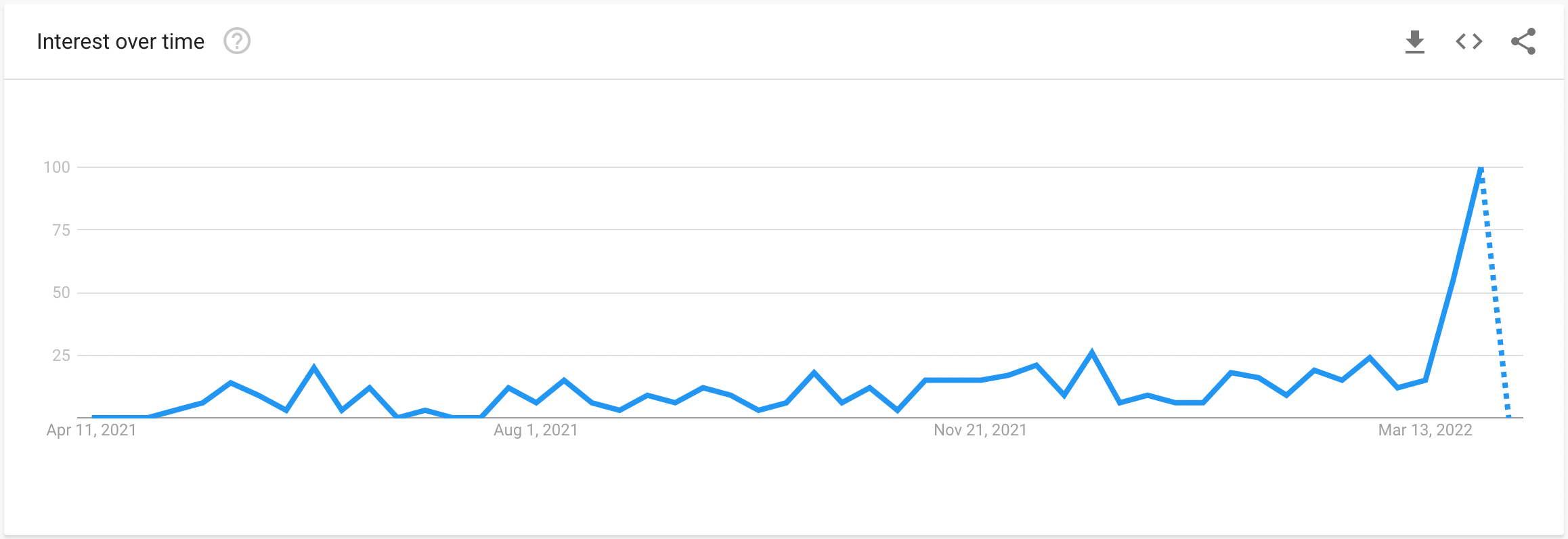

Google searches for "Ethereum merge" spike

Internet users' interest in Ethereum's upcoming network upgrade, dubbed "the Merge," surged substantially in the week ending April 2, Google Trends' data shows.

Searches for the keyword "Ethereum Merge" reached a perfect Google Trends score of 100 on a 12-month timeframe with most traffic coming from the U.S., Singapore, Canada, and Australia.

Internet trend score for the keyword 'Ethereum Merge.' Source: Google Trends

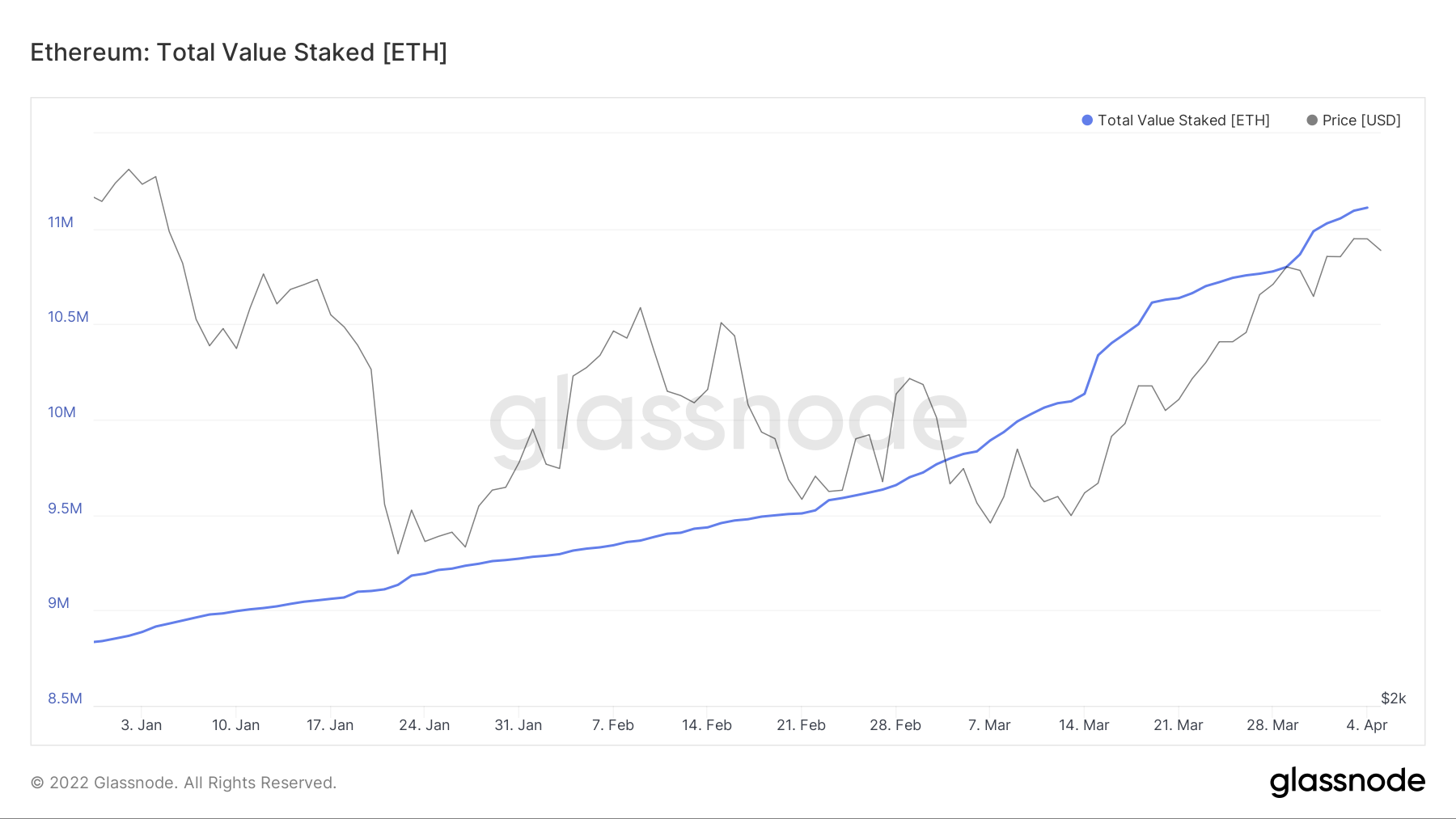

Merge, also called ETH 2.0, refers to the Ethereum network's full transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW), a development that had been touted as one of the major catalysts behind Ether's rebound from $2,500 on March 14 to over $3,500 this week.

The bullish outlook stems from Merge's proposal to reduce Ether's issuance rate, leading to a possible supply peak in the total number of ETH in circulation. With PoW mining, ETH's supply has grown by 3% every year.

Total value staked in ETH 2.0. Source: Glassnode

The spike in public interest for "Ethereum Merge" suggests there is growing buzz among crypto investors and traders as the Ethereum upgrade nears. Last month's launch of Kiln is the final public testnet before the whole network transitions to PoS sometime this year.

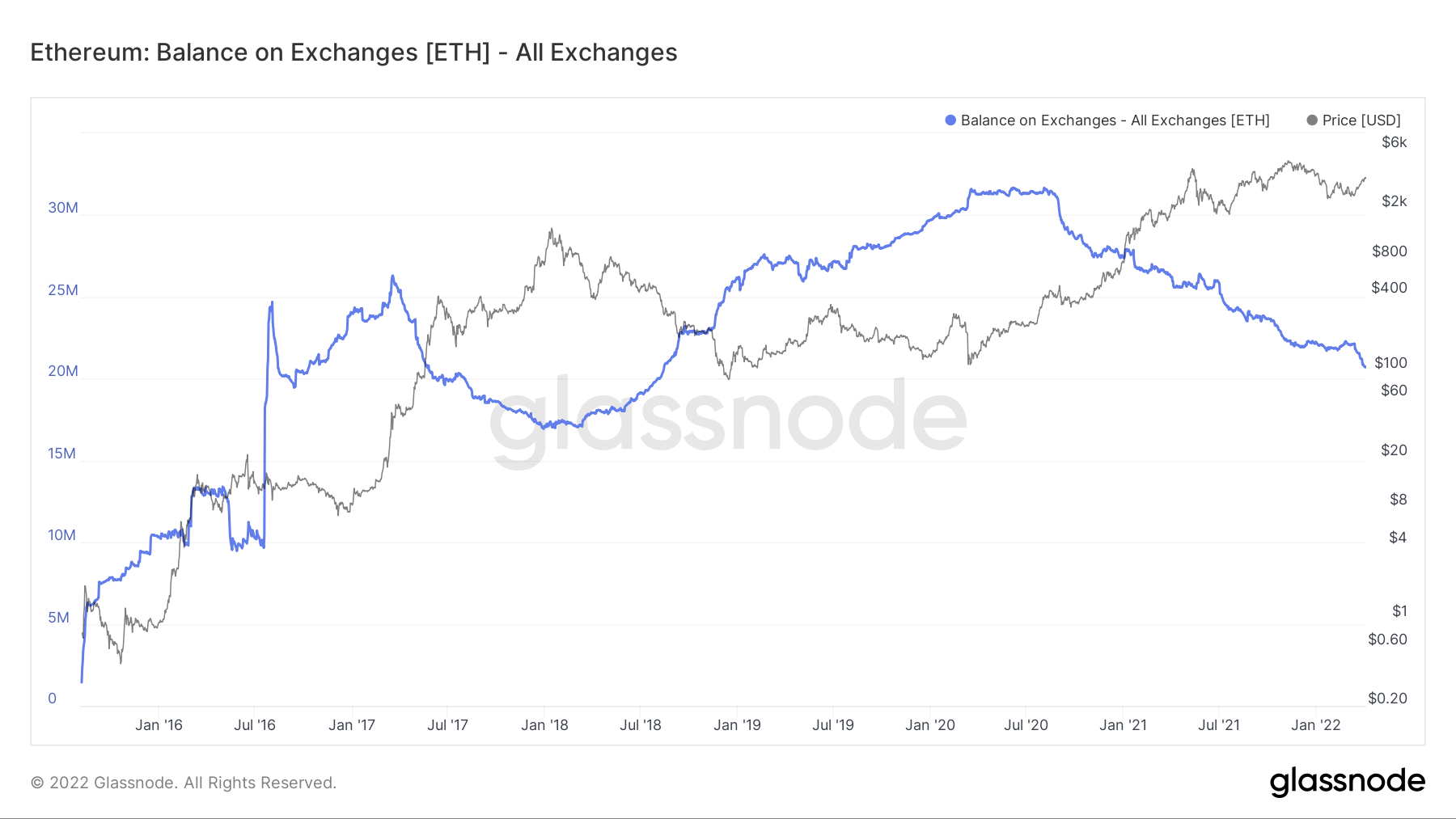

Exchange ETH reserves at three-year lows

At the same time, ETH supply downtrend on crypto exchanges continues.

Notably, net Ether reserves across all the exchanges have dropped to their lowest levels since August 2018, suggesting that traders have been withdrawing ETH en masse to hold them long-term or to stake them across DeFi liquidity pools.

Ethereum balance on exchanges. Source: Glassnode

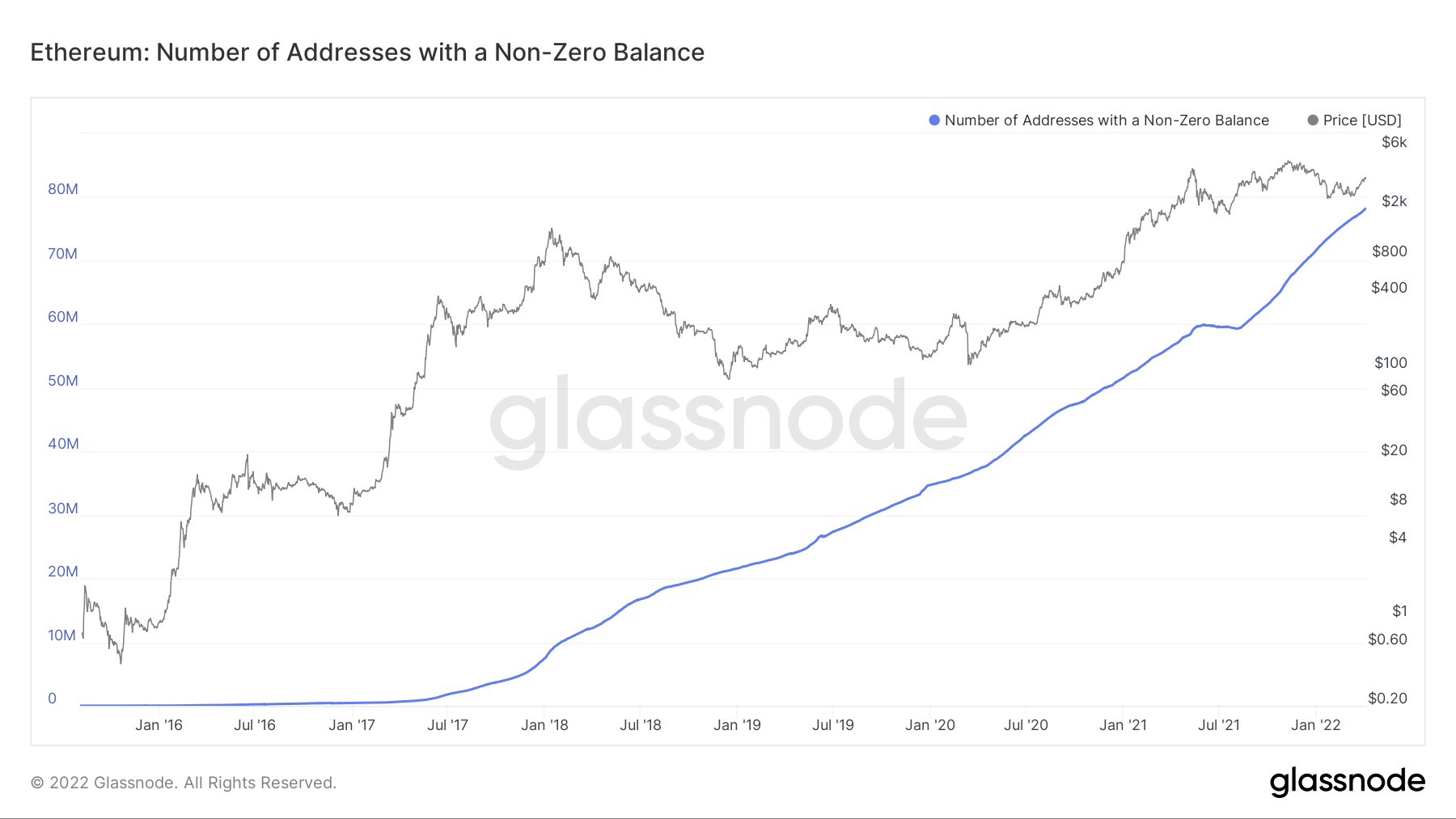

What's more, the number of addresses with a non-zero balance continues to rise, suggesting growing adoption and distribution of ETH.

Ethereum number of addresses with a non-zero balance. Source: Glassnode

Technicals hint at $4K ETH price

Chances of ETH price reaching $4,000 in April are also boosted by a classic technical pattern.

Dubbed "symmetrical triangle," the pattern usually forms when the price consolidates sideways inside a range defined by a lowering upper trendline and a rising lower trendline, following a sharp move upside or downside.

In an ideal scenario, the triangle resolves after the price breaks in the direction of its previous trend, and is thus considered a "continuation pattern."

However, symmetrical triangle breakouts do not necessarily result in a continuation trend. For instance, in the book Technical Analysis of Stock Trends, technical analysts Robert Edwards and John Magee note that about 25% of all symmetrical triangle breakouts lead to reversals, i.e., the price does not break in the direction of its previous trend, thus defying anticipations.

Ethereum's current breakout appears to be a reversal as it bounces to the upside instead of continuing its previous trend to the downside, as shown in the chart below.

ETH/USD daily price chart featuring symmetrical triangle setup. Source: TradingView

A symmetrical triangle's potential breakout target is calculated after measuring the maximum length between the pattern's upper and lower trendline and then adding the result to its breakout point.

This puts the ETH/USD bullish target at nearly $4,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain according to Whale Alert data published Friday.

XRP Price Prediction: XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple (XRP) seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Avalanche Octane update goes live on mainnet, slashes transaction fees significantly

Avalanche (AVAX) Octane update, live on mainnet on Thursday, introduces a dynamic fee mechanism to the C-Chain. This mechanism reduces transaction costs during high network activity by adjusting real-time fees, as per ACP-176.

Dogecoin soars as 21Shares files S-1 for DOGE ETF

Dogecoin (DOGE) rallied nearly 12% on Wednesday after asset manager 21Shares filed an S-1 application with the Securities & Exchange Commission (SEC) to launch the 21Shares Dogecoin exchange-traded fund (ETF).

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.