Three reasons why Ethereum could resist selling pressure even after ETH token unlock in Shanghai upgrade

- Ethereum tokens staked in the Beacon Chain contract would be unlocked after the upcoming Shanghai Upgrade.

- Nearly 60% of staked Ethereum, representing 10.3 million ETH tokens are currently at a loss, selling pressure arises when participants are profitable.

- The largest staking pool Lido holds almost 30% of all staked ETH, at an average unrealized loss of nearly $1,000.

While Ethereum’s token unlock with the Shanghai upgrade is being perceived as a bearish event, new insights that have emerged reveal this may not be the case. Since Ethereum being staked in pools like Lido is at unrealized losses, it is likely that despite token unlock ETH holders may resist the sale of their holdings.

Also read: Will Elon Musk’s master plan for sustainable energy kick off a rally in green cryptocurrencies?

Ethereum staked in staking pools is at unrealized losses, ETH could resist selling pressure

The Ethereum Shanghai upgrade is one of the most highly anticipated ones in the community as it would allow validators to unlock their staked ETH tokens for the first time since the launch of the staking contract.

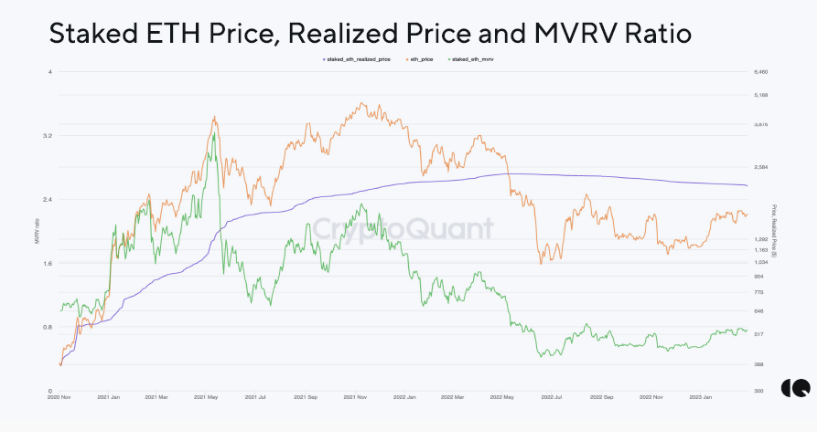

Based on data from CryptoQuant, 60% of staked ETH is at a loss. This represents 10.3 million ETH tokens sitting on unrealized losses. Typically, the selling pressure on an asset increases when holders of the token are sitting on unrealized profits.

Staked ETH price, Realized Price and MVRV Ratio

Since this is opposite in the case of staked ETH tokens, the typical expectation is that unstaked Ethereum would stay off exchanges and holders would move it to liquid staking pools instead of realizing losses. Therefore the fear of ETH flooding the market and increasing selling pressure on the altcoin could be irrational.

What’s more, Ethereum price is currently 66.56% away from its all-time high of $4,878.26. ETH hit its all-time high on November 10, 2021. After unstaking Ethereum tokens, holders are therefore likely to restake or resist selling.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.