- Dogecoin price is on thin ice from a technical perspective as it hovers around the $0.159 support level.

- A breakdown of this barrier could lead to a 50% crash to $0.082 or lower.

- On-chain metrics indicate declining interest in DOGE, supporting the bearish outlook.

Dogecoin price needs to tread lightly as it is on a vital level, a breakdown of which could lead to a steep correction. This crash could take DOGE back to levels last seen at the start of the 2021 bull run. Therefore, investors need to pay close attention to the meme coin over the coming days.

Dogecoin price exudes bearishness

Dogecoin price crashed 7% on December 13 and produced a daily close below $0.16. This descent marks a breakdown of the $0.16 support level that has kept the DOGE price action bullish since April 23.

The recent price action has indicated a flip of this barrier into a resistance level and theoretically triggered the potential for a massive crash. The volume profile for 2021 shows that no support level could sustain a crash except the $0.086 and $0.078 barriers, indicating a 45% to 50% decline on the cards for the original meme coin.

The recent breakdown of the $0.16 foothold, therefore, is undoubtedly a bearish development. A failure to set up a higher high will further confirm the potential descent that awaits DOGE. In a highly bearish case, the point of control (POC) at $0.057 could serve as the best barrier to reverse the downtrend. A retest of this will occur after DOGE sheds 63% of its value from its current position.

DOGE/USDT 1-day chart

On-chain metrics reveal waning interest in DOGE

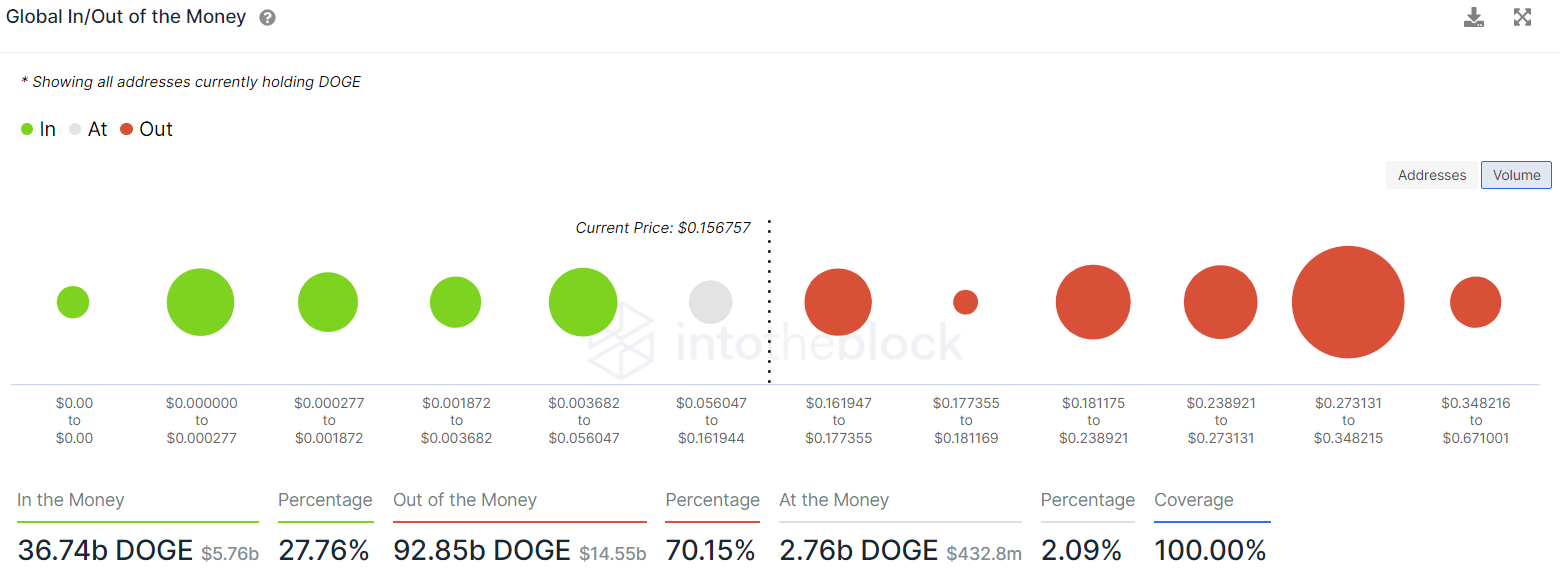

The second reason why Dogecoin price could witness a brutal sell-off is from an on-chain perspective. The immediate support level for Dogecoin price ranges from $0.16 to $0.056. Here, roughly 325,740 addresses purchased 2.76 billion DOGE at an average price of $0.073.

Interestingly, this level coincides with the ones obtained via the volume profile from a technical perspective. This further reinforces the importance of the $0.16 support floor as a make or break level, the penetration of which could see a significant loss in DOGE’s market value.

DOGE GIOM

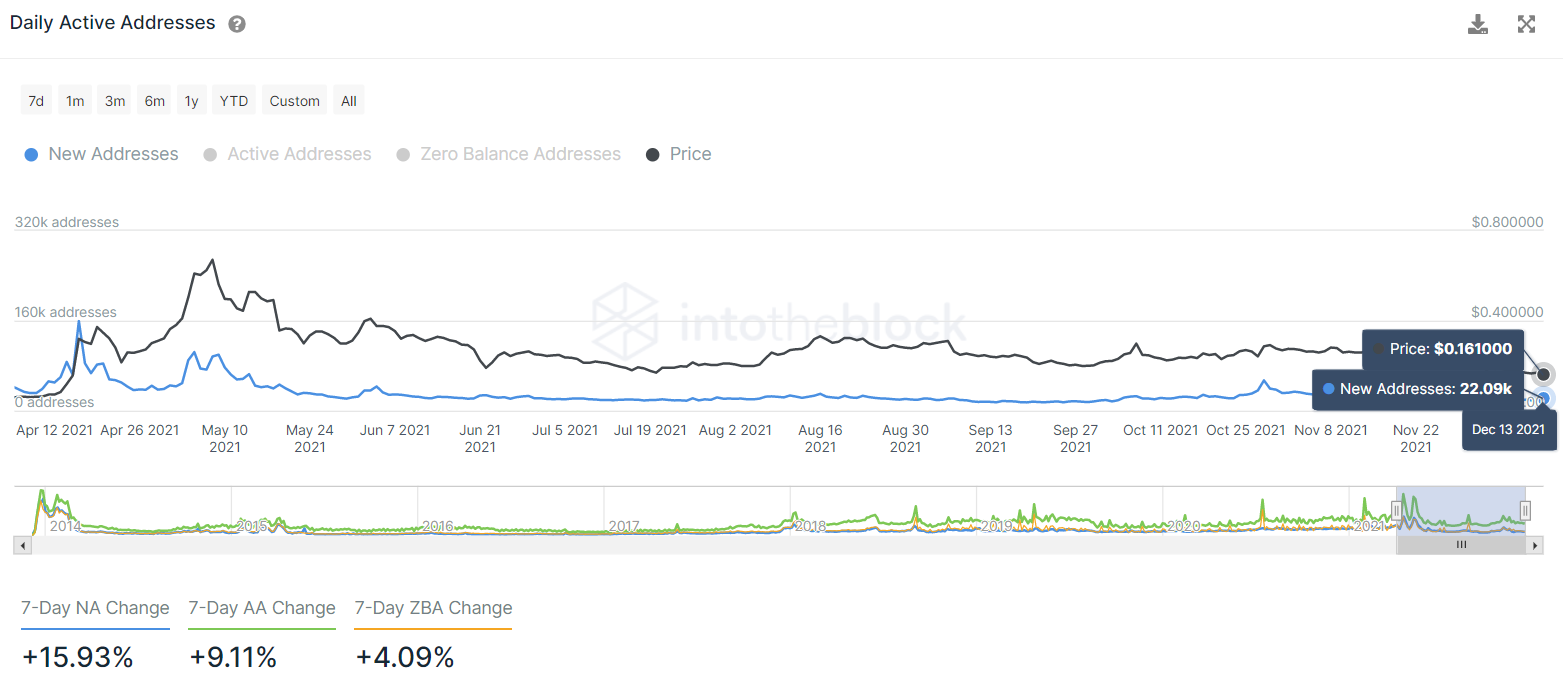

The number of new addresses joining the DOGE blockchain has reduced from 159,390 on April 16 to 22,090 on December 13.

This 86% decline in new addresses indicates that investors have been moving away from Dogecoin and are not interested in the asset at the current price levels.

DOGE new active addresses

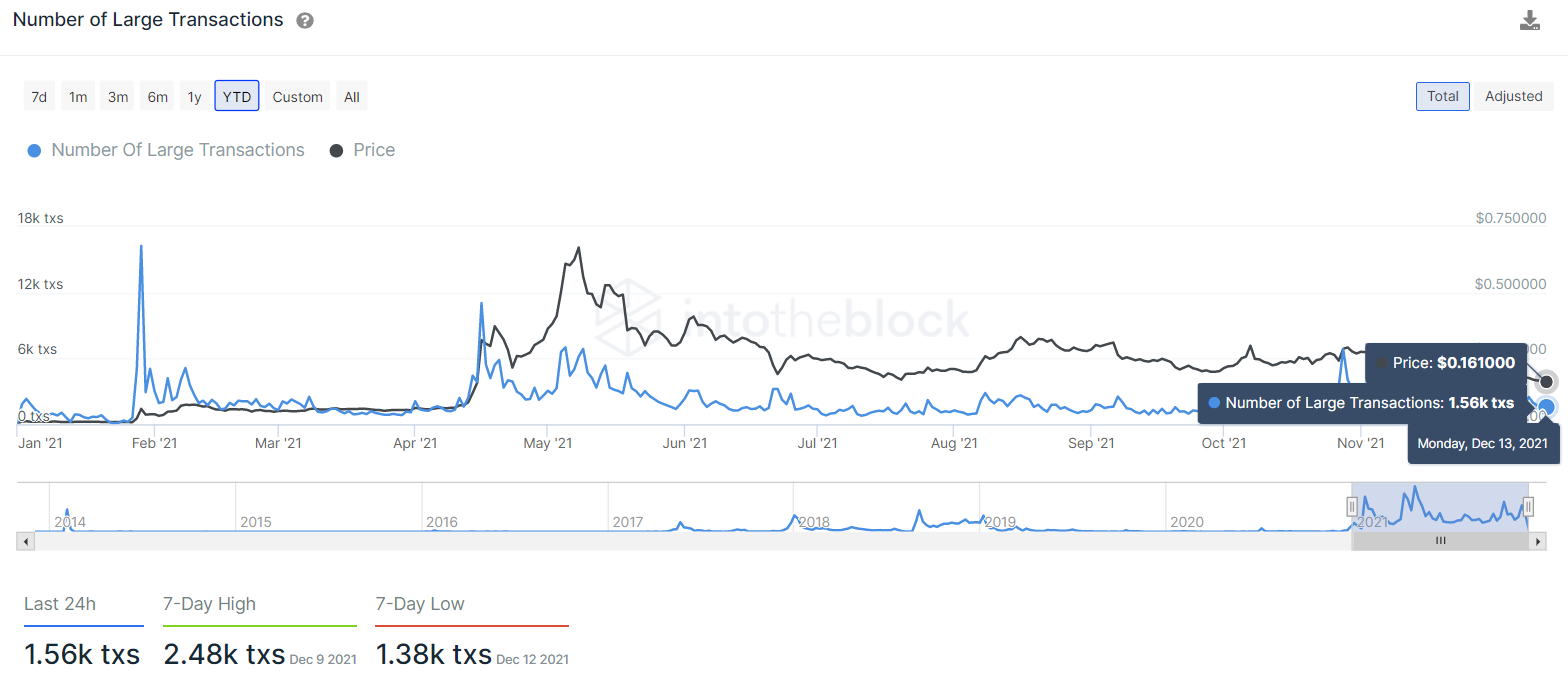

Further building on this line of reasoning is the 85% drop in large transactions with $100,000 or more. Unlike the new addresses joining the network, this on-chain metric gives an idea of the decline in the quality of investors.

The number of large transactions dropped from 11,050 on April 16 to 1,560 as of December 13 and is the third reason why DOGE could be due for a big sell off. This index serves as a proxy for investment interest from whales or high net worth investors. An 85% nosedive of these transfers indicates that these participants are bearish on Dogecoin price and its performance.

The reason for a large-scale drop in new addresses and large transactions could be due to the emergence of a new meme coin - Shiba Inu.

Unlike DOGE, SHIB has rallied 41,054% year-to-date, painting its quality as a superior investment asset. Due to its attractiveness and the returns it offers, one could speculate that investors could have jumped ship to buy Shiba Inu as much as for any other reason.

DOGE large transactions

On the other hand, if the Dogecoin price recovers above the $0.16 support level, investors can breathe a sigh of relief. Supposing increased buying pressure propels DOGE to produce a daily close above $0.215 it will create a higher high and invalidate the bearish thesis.

In this situation, investors can expect the FOMO to propel the Dogecoin price to continue its ascent and retest the $0.30 hurdle.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Ethereum remained just below $2,000 in the Asian session on Tuesday as Standard Chartered's Global Head of Digital Assets Research, Geoffrey Kendrick, updated the bank's 2025 price forecast for ETH.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Canary Capital proposes first-ever Sui ETF following S-1 filing with the SEC

SUI saw slight gains on Monday as Canary Capital submitted an S-1 application with the Securities & Exchange Commission (SEC) to launch a Sui exchange-traded fund (ETF). This adds to the growing list of altcoin ETF filings awaiting approvals from the regulator.

Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

Crypto exchange-traded funds (ETFs) extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.