Three reasons why Cardano price could tank to $0.50 in the coming days

- Cardano price has been on a parabolic expansion without any reasonable corrections since late December 2020.

- The number of underwater investors who purchased ADA at a local top has grown in number.

- Retail holders are increasing, while whales are offloading their holdings.

Cardano price has been a top performer that was leading the bull run. IOHK developers pushed out several major upgrades to the blockchain, which has improved its utility drastically.

However, what is interesting is that ADA has not seen a healthy pullback relative to its massive and explosive run-up. Therefore, investors should be wary of this coin, especially if significant support gives way.

Cardano price struggles to make headway

Cardano price saw a humungous upswing from $0.10 in late 2020 to more than $2 in 2021. In hindsight, ADA received some of the most critical upgrades to its blockchain during this period, like the Mary hard fork, Goguen upgrades and so on, which have played a role in its exponential growth.

ADA price hit an all-time high at $2.51 on May 16 and has been on a downswing ever since. So far, the so-called “Ethereum killer” has dropped roughly 41% and shows signs that it could go lower.

The reason behind the bearish sentiment around Cardano price stems from two reasons, the cryptocurrency market structure and weak recovery after recent crashes and ADA’s on-chain metrics.

Bitcoin price is eyeing a potential head-and-shoulders pattern that could send the entire market spiraling. Considering ADA’s strong correlation with BTC, if the overall market takes a nosedive, Cardano price is likely to follow suit.

Additionally, Cardano price appears to be correcting after failing to rally higher. As ADA trades above two stable support levels at $1.40 and $0.981, the prospects of a downswing multiplies. Therefore, shattering $0.981 will open the floodgates, triggering a 46% downswing to $0.525 or a 57% correction to $0.414.

The $0.525 to $0.414 range has unfilled price action when ADA rose from $0.345 to $0.663 in the first week of February. Hence, market makers are likely to attract Cardano price to these levels.

From its current position ($1.53) to $0.414, if this drop manifests, Cardano price could reduce more than threefold.

ADA/USD 1-week chart

The first red flag supporting the bearish thesis explained above is based on IntoTheBlock’s Global In/Out of the Money (GIOM) model. This metric reveals that a majority of the holders who purchased ADA did just before the all-time high.

Based on GIOMA, roughly 465,000 addresses previously purchased 7.7 billion tokens at an average price of $1.68. These investors are “Out of the Money” and might be inclined to sell if ADA continues to head lower, adding selling pressure to the current bearish outlook.

The three immediate support clusters hold only 7.35 billion ADA, relatively fewer tokens than the underwater investors at $1.68. This contrast suggests that the potential downswing will be brutal.

ADA GIOM chart

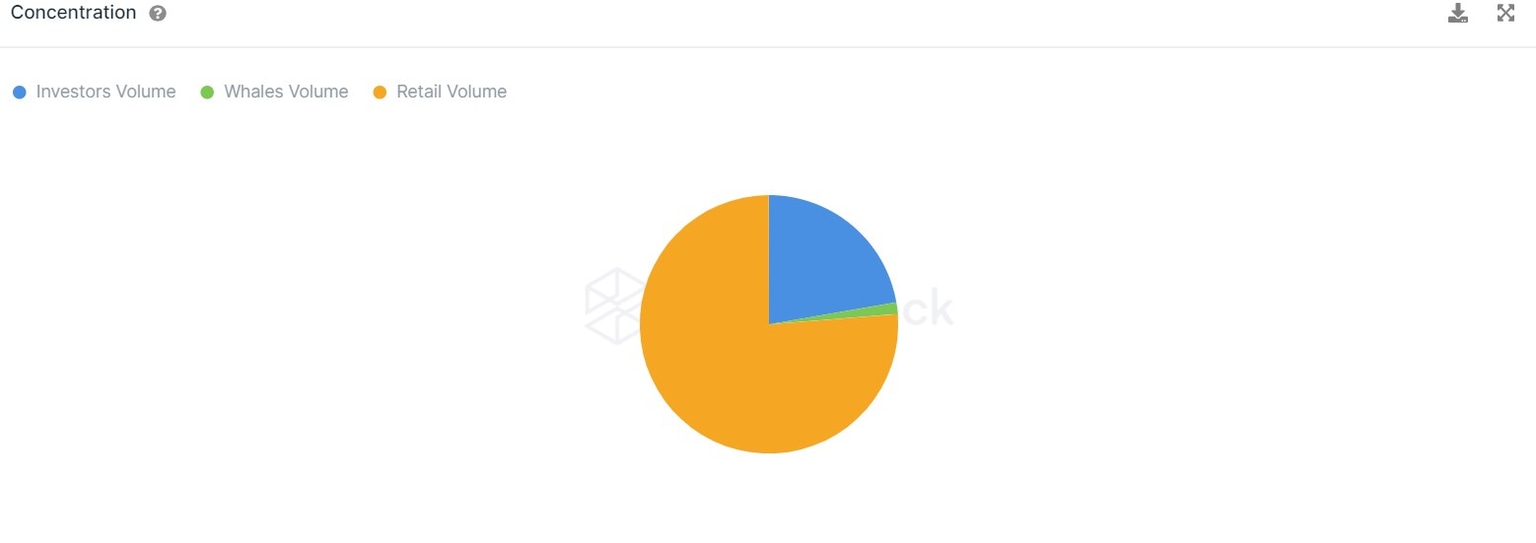

Addresses that hold less than 0.1% of Cardano’s circulating supply are defined as retail. These investors own 27.03 billion tokens or 76.28%. In contrast, whales that own greater than 1% of the supply constitute roughly 1.44% or 511 million ADA.

Retail investors are not known for their patience and usually panic-sell during times of upheaval. Therefore, if the potential sell-off does occur, these holders might add to the selling pressure.

ADA concentration chart

Further painting the grim nature of ADA distribution is the sharp decline in holders or investors holding ADA for more than a year. The addresses of these market participants have dipped from 213,000 in June 2020 to 170,000 to date.

This 20% nosedive indicates that long-term holders are not confident in the future performance of ADA price.

ADA ownership by time held chart

Therefore, investors need to keep a close eye on the support levels at $1.40 and $0.981. A breakdown of these barriers might trigger a massive sell-off.

Fundamentals and optics for ADA are improving exponentially

While the technical and on-chain perspectives are overly bearish, the fundamental outlook is warm and promising. Throughout 2021, Cardano blockchain has received vital upgrades that have transformed it for the better and improved its utility.

Some of these updates include the Shelley, a milestone implemented in July 2020, that was recently improved in 2021, shifting the block production from federated to completely decentralized.

Similarly, the Mary hard fork added multi-asset functionality, allowing users to develop assets native to the ADA blockchain and opening the floodgates to DeFi.

Furthermore, the Goguen era, which is yet to gain traction, will bring smart-contract capability to the Cardano blockchain.

Another critical development is the IOHK team’s partnership with the Ethiopian government to build a blockchain-based, student-teacher solution known as Atla PRISM. Adding a tailwind is their collaboration with Tanzania’s World Mobile Group to democratize access to digital, financial and social services in Africa, leveraging the capabilities of the ADA blockchain.

To conclude, Cardano’s fundamental development tries to balance the bearish prospect that awaits ADA price. With the crypto market looking weak and ready to collapse, the bullish scenario seems less favorable.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.