Three reasons why Bitcoin could be preparing for a massive dump despite on-going bull rally

- Bitcoin price has hit a new all-time high above $20,000, and it’s currently trading at $23,000.

- There are three main reasons why Bitcoin is on the verge of a massive correction.

Bitcoin has hit a new all-time high of $23,800 on Binance reaching a total market capitalization of $432 billion for the first time ever. The total market capitalization of all coins hit $670 billion and everything is bullish. However, there are some bearish signs on the horizon for Bitcoin.

Investors should be extra careful with Bitcoin price

One of the main factors in the demise of the last Bitcoin rally was how fast it climbed towards $20,000. It seemed that Bitcoin had a much calmer run this time around climbing from $10,000 towards $20,000 in around two months at a steady pace.

However, the past two days have been extremely volatile and pushed Bitcoin price by more than 23% with a ton of trading volume. This is not a healthy push and could be the first red flag of the upcoming correction.

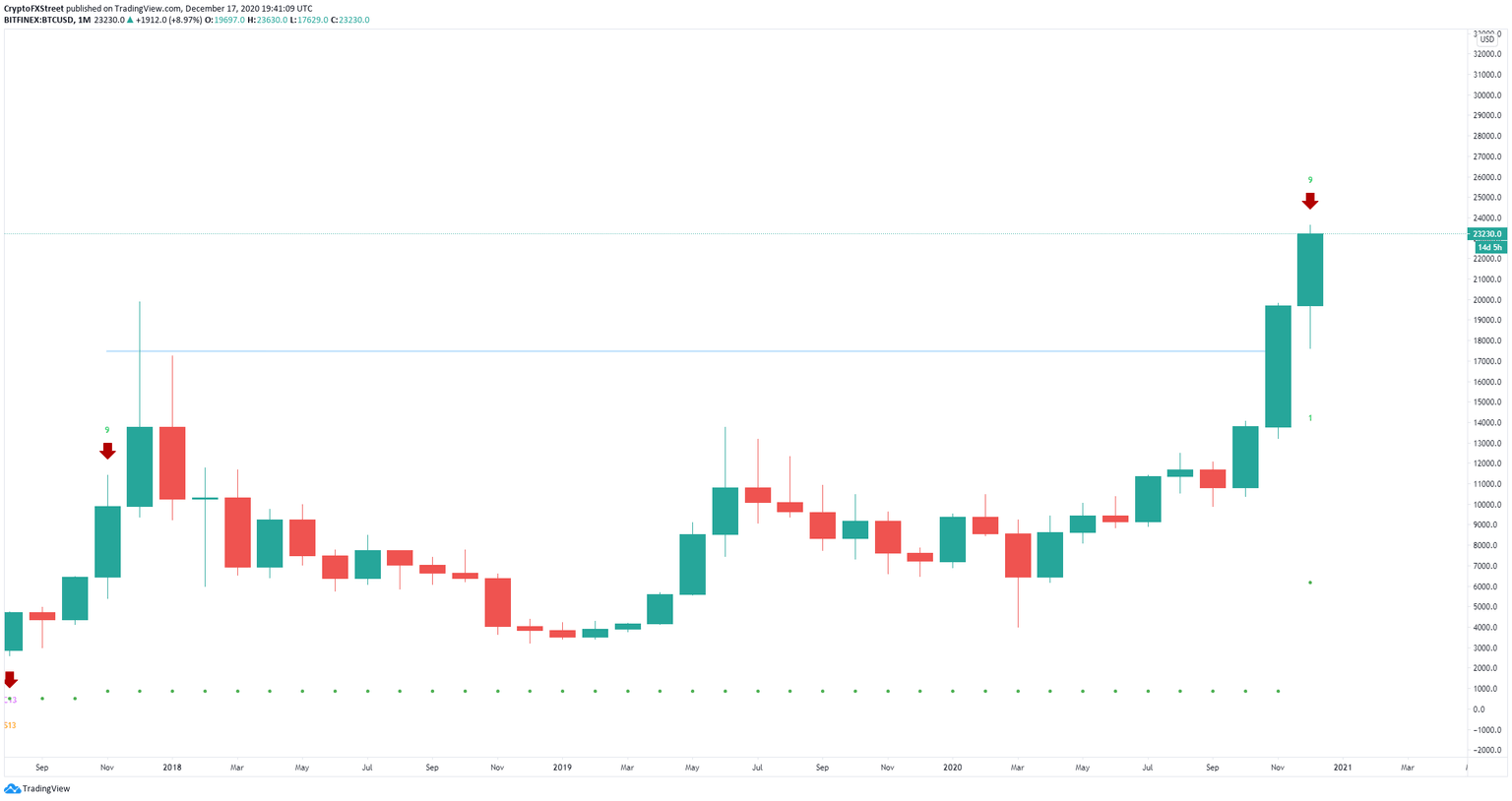

BTC/USD monthly chart

From a technical standpoint, the TD Sequential indicator has just presented a sell signal on the monthly chart for the first time since the last rally. This is a significantly bearish call and it’s the first sign.

Although institutional money is now heavily invested in Bitcoin, traders should remain cautious. If history repeats itself, we could see Bitcoin experience several 30% correction periods just like it happened prior to the last all-time high at $20,000 in December 2017.

BTC Holders Distribution chart

When it comes to on-chain metrics, it seems that the number of whales holding between 10,000 and 100,000 coins has decreased significantly over the past three weeks, indicating that large investors are selling and taking profits rather than accumulating more.

It’s also important to note that a study performed by the Kansas City Fed that compared bonds, gold, and Bitcoin between 1995 and 2020 found that Bitcoin never acted as a consistent safe haven in comparison to gold and bonds which did.

️ The mentions of $BTC and #Bitcoin amongst #Twitter, #Discord, #Reddit, #Telegram, & misc. pro traders reveal that Twitter and Reddit are seeing the most hype generated around this historic all-time high breached. Watch the fluctuations here closely! https://t.co/DpRwLEirKo pic.twitter.com/q6aoclEUL4

— Santiment (@santimentfeed) December 17, 2020

Additionally, it seems that the number of Bitcoin mentions on social media has spiked over the past few days. This is usually an indicative of upcoming volatility and not necessarily a bullish sign, but rather an indication of a potential correction.

Even Brian Armstrong, CEO and Co-Founder of Coinbase has warned investors that 'cryptocurrency markets rise and fall over time' and it's important to be on the lookout for volatility.

We believe that crypto is a truly game-changing innovation and, at Coinbase, we take a long-term view of the market. While it’s great to see market rallies and see news organizations turn attention to this emerging asset class in a new way, we cannot emphasize enough how important it is to understand that investing in crypto is not without risk

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.50.44%2C%252017%2520Dec%2C%25202020%5D-637438317539896203.png&w=1536&q=95)