Three reasons why altcoins could shake off losses this week

- Altcoins are in the opportunity zone per Santiment’s on-chain metrics.

- Altcoin market capitalization has climbed over 75% in the last twelve months, according to TradingView charts.

- Analysts predict capital rotation from Bitcoin to altcoins will likely be soon, per historical trends.

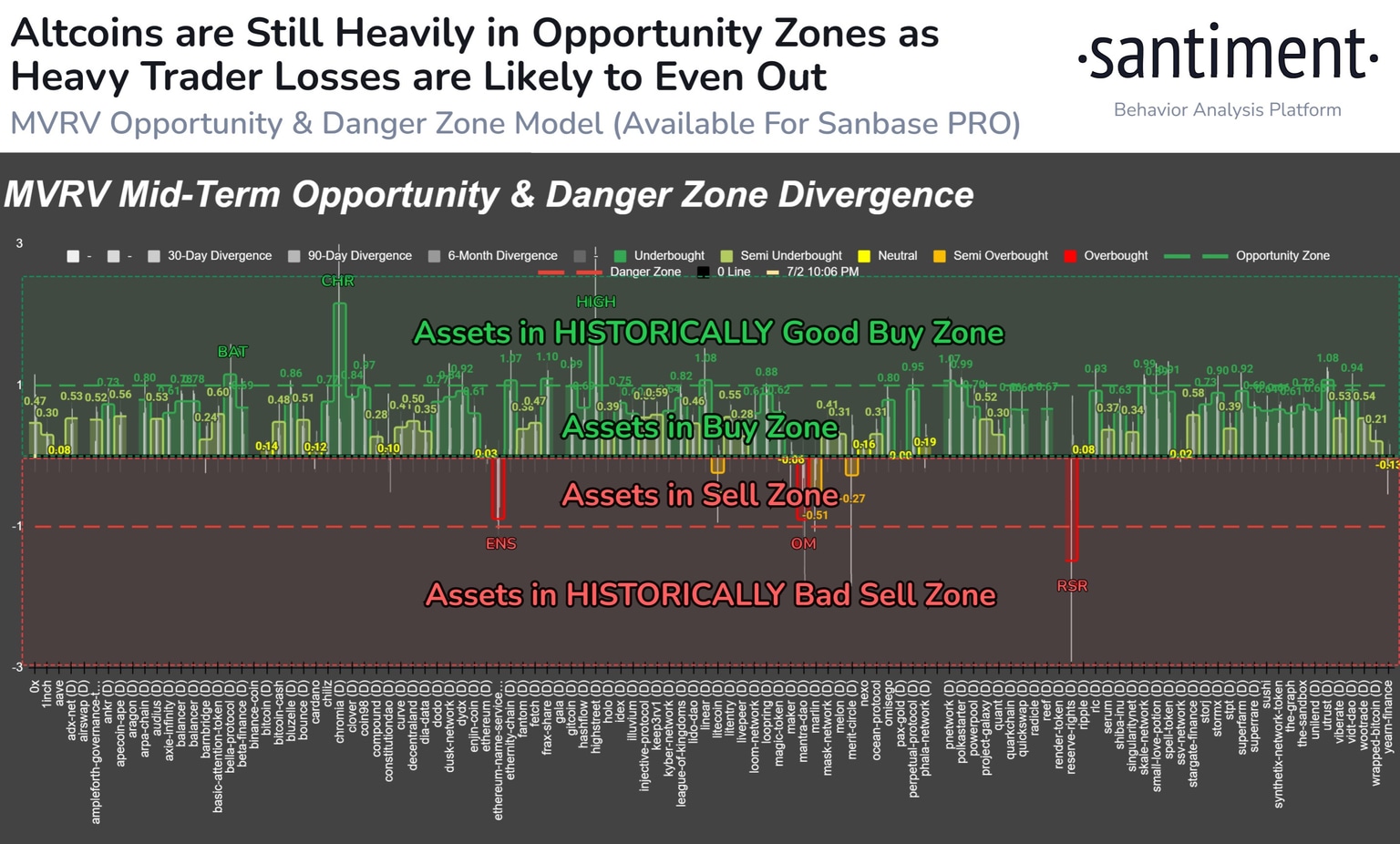

On-chain data from Santiment shows that altcoins are currently in the opportunity zone, or generating buy signals. The top three altcoins in the buy zone are Basic Attention Token (BAT), Chromia (CHR), and Highstreet (HIGH), per Santiment.

Bitcoin profits will likely to be rotated into altcoins at this point in the ongoing cycle, historical trends suggest. The altcoin market capitalization, excluding Bitcoin, has added nearly 77% to its value in the past twelve months, according to TradingView charts.

Three reasons why altcoins generate buy signals

-

Altcoin market capitalization is up over 77% in twelve months

Data from TradingView shows that the market capitalization of cryptocurrencies, excluding Bitcoin, has climbed from $551.9 billion on July 3, 2023, to over $1 trillion on July 3, 2024. Over 77% increase in market capitalization shows the rise in demand for altcoins, their rising dominance against Bitcoin, and interest generated among traders.

A steady increase in altcoin market cap is expected by analysts on X, as historical trends that suggest capital rotation from Bitcoin to alts every cycle.

Crypto market capitalization, excluding Bitcoin

Analyst behind the X handle @CryptoYoddha shares the altcoin market cycle and the “rotation” in a chart:

Altcoin Dominance chart by CryptoYoddha

-

Likely profitable entry for BAT, CHR, HIGH opens

Data from crypto intelligence tracker Santiment compares the mid-term average returns of each wallet across nearly all altcoins, and notes that traders are well “under-water” or sitting on unrealized losses.

The Santiment Mean Value to Realized Value (MVRV) metric is typically used to identify local tops and bottoms. The model shows viable entry points for the three altcoins: BAT, CHR, and HIGH.

MVRV for assets in the buy zone per Santiment data

-

Altcoins in the accumulation phase

The analyst behind the X handle @el_crypto_prof notes that if crypto continues to copy previous cycles, then altcoins have completed only wave 1. Altcoins are in the re-accumulation phase, which is likely to be followed by wave 2.

The analyst likely refers to the Elliott Wave Theory, which identifies impulse waves that set up patterns and corrective waves.

#Altcoins

— ⓗ (@el_crypto_prof) July 2, 2024

If crypto continues to copy the previous cycles, then we have only seen wave 1 so far.

Now in re-accumulation.

Then wave 2.

Remember:

90% of the profits usually happen in the last 10% of the cycle, when euphoria is at max level.

We haven't seen that yet imo.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.