Three indicators that tell you when Bitcoin will bottom

- Analysts identified key Bitcoin indicators that predict a bottom in the asset over the next few weeks.

- Based on Bitcoin’s recent major pullback, analysts believe BTC could drop lower than $25,000 before it hits bottom.

- $40,000 continues to remain a possibility for Bitcoin price in continuation of the 2018 pattern in the asset.

Analysts have evaluated Bitcoin’s indicators and identified a bottom in BTC. Experts believe Bitcoin price could wipe out its losses and eye a $40,000 target in the next few months based on the indicators.

Bitcoin price could bottom soon, according to these indicators

Bitcoin price plummeted below $30,000 yet again as sentiment among investors turned bullish. The asset has struggled to make a recovery and wipe out losses from the last four weeks. Benjamin Cowen, a leading crypto analyst, identified three key indicators that offer insights on when Bitcoin will bottom.

One indicator used to identify Bitcoin pullbacks and predict the occurrence of a cycle bottoms is the Bitcoin one year running ROI calculated as a profit multiple on holding BTC for a year.

A drop to 0.4 or 0.3 in the one-year running ROI implies the asset is close to a market cycle bottom. The current value of Bitcoin one year running ROI is 0.647 which means Bitcoin price has yet to hit bottom, and the asset is unlikely to hit the level in May 2022.

Bitcoin 1 Year Running ROI

Another indicator identifying a market cycle bottom for Bitcoin is the percentage of supply in profit and loss. Separate lines indicate the two percentages on the chart. Every time the percentage of supply in profit crosses the supply in loss, it indicates that Bitcoin has hit a market cycle bottom.

Analysts have observed the occurrence of the pattern in the last two Bitcoin cycles. This event has yet to occur, however, the two lines are headed toward one another. A Bitcoin bottom, therefore, could be a few weeks to months away.

Percentage of Bitcoin supply in profit and loss

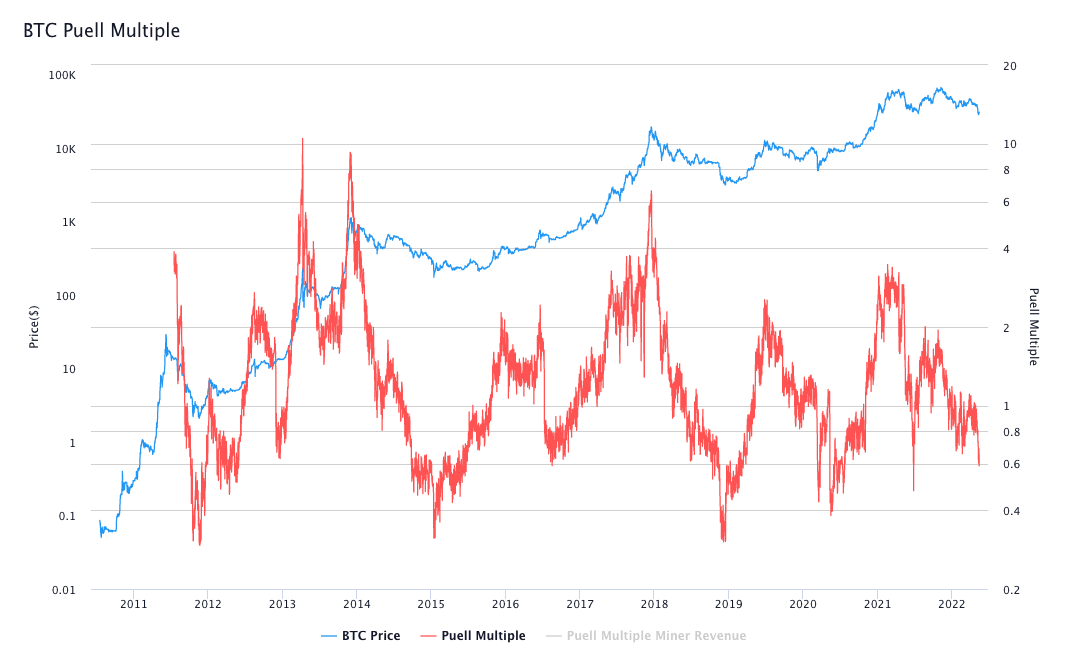

The Puell Multiple, calculated by dividing the daily issuance value of Bitcoin by the 365-Day Moving Average, is a metric used to estimate the level of sell pressure on BTC from miners. Historically, miners sell Bitcoin to cover their operating costs, and their revenue consists of block subsidies awarded to them. The USD value of block subsidies changes nearly every day, with volatility in Bitcoin prices.

Benjamin Cowen noted that a market cycle bottom is generally indicated by a drop in the Puell Multiple to 0.4 or lower. The BTC Puell Multiple value is currently above 0.59, indicating that we are close to a bottom but not yet quite there; therefore the asset’s price could plummet further to below $25,000.

Bitcoin Puell multiple

Three leading indicators signal that Bitcoin bottom is not in. Therefore, Bitcoin price could plunge further in the current market cycle before it finally hits bottom.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.