- The cryptocurrency market has seen a massive increase in traders over the past two years.

- Unfortunately, many new traders fall into several beginner mistakes that can cost them their entire accounts.

It’s not surprising to see many new and young investors joining the cryptocurrency market. This industry offers volatility and the chance to make profits that you can’t find in the traditional stock market. However, it also has its downsides, mainly the risks associated with trading cryptocurrencies. Today, we are going to take a look at some of the most common errors from new traders and how to avoid them.

Avoid these 3 common mistakes to keep your account growing

Although there are plenty of mistakes one can make when trading, we have chosen three of the most common ones to help you avoid them. It’s important to note that even experienced traders make mistakes, but it’s crucial that you learn from them and understand how to avoid them in the future.

Trading with no set plan

One of the most common mistakes new traders make is initiate a trade without an established plan. Perhaps a coin looks extremely promising, and you might be right, but what happens after? Before jumping into any position, you need to have stablished exit points and other potential entry points.

The most critical aspect of trading is to establish clear exit points to take profit and to stop your position from crashing too hard. Once you enter a position, it’s crucial to set a stop loss as soon as possible as the cryptocurrency market is extremely volatile. 5-10% moves are not uncommon and can literally happen in minutes.

Failing to take profit or cut losses

Besides the critical stop-loss we have discussed above, you will also need to know when to take profits. If you are too greedy and expect the asset to go up indefinitely, you will most likely make less money or perhaps end up hitting your stop-loss. It’s important to establish several ‘take profit orders’ along the way to minimize risk.

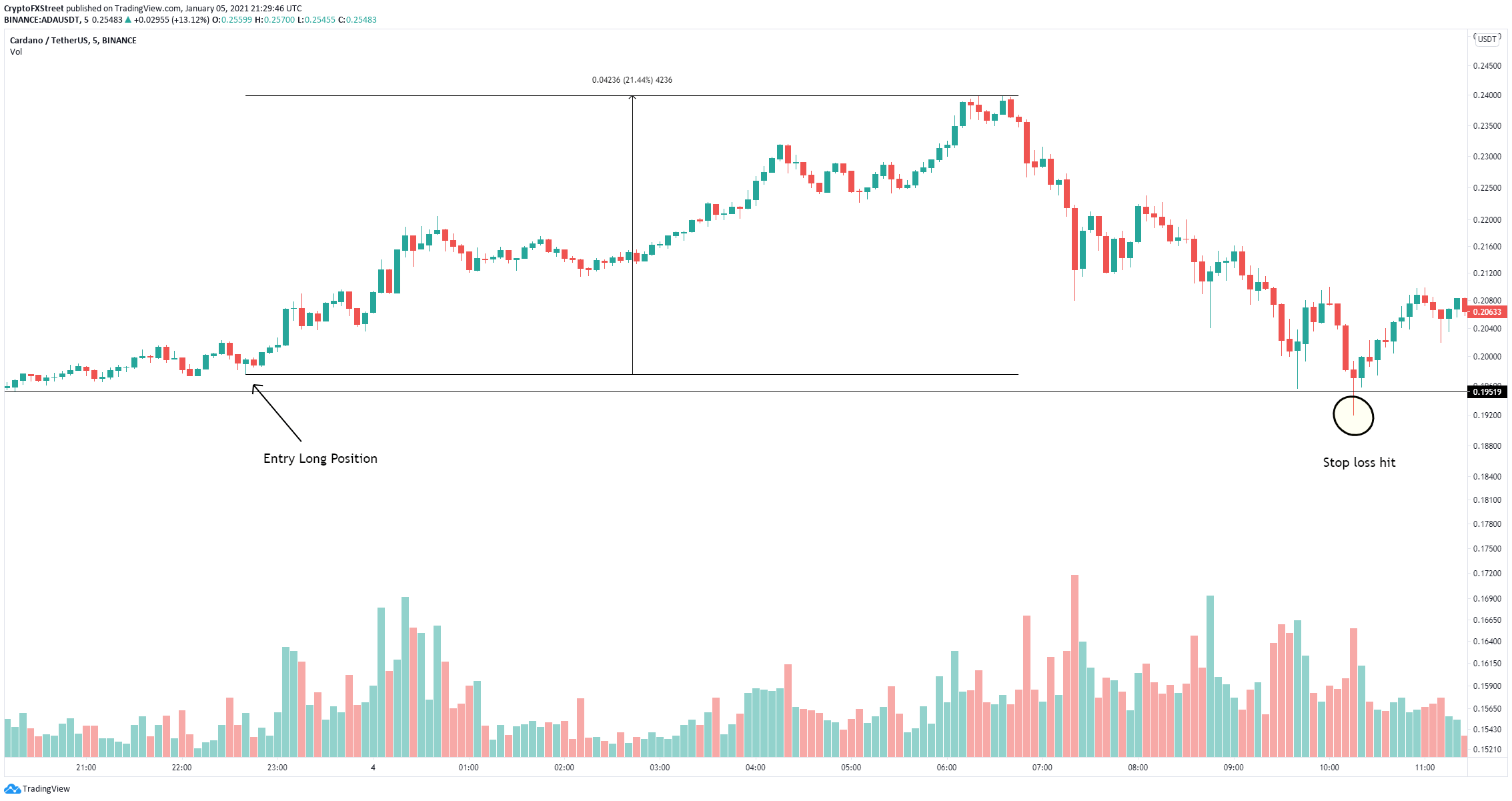

ADA/USD 5-minute chart

In the example above, a trader made an amazing entry at $0.197 on Cardano which then had a 21.4% move to the upside. The trader placed his stop loss at $0.195 because it was a previous support level. Unfortunately, he didn’t take any profits on the way up, expecting Cardano to continue rising and eventually hit the stop-loss. What’s worse here is that besides that short dip, Cardano price continued climbing higher and it’s currently trading at $0.255.

This can easily happen to the downside as well. New traders will feel the temptation to let losing trades run. Even with a stop-loss in place, some traders might have the urge of canceling it and let it ride longer in the hopes of a recovery. You need to understand that even professional traders will lose many trades as the most important factor for a profitable trader is the risk/reward ratio. For instance, a professional trader might lose 60% of the times but every positive trade is three times as profitable as any loss which puts him at a gain overall.

Risking too much using leverage

Although leverage is a great tool for experienced traders, it is extremely risky for new traders, especially in the cryptocurrency market. Most exchanges will offer up to 125x leverage on some assets.

The main idea behind leverage is simply, it’s a tool that allows you to enter more sizable positions without investing more money. Basically, at a 50x leverage, you can buy $50,000 worth of an asset using only $1,000.

But leveraging is a double-edged sword as it also implies greater losses. Exchanges use a mechanism called liquidation which will be automatically triggered if your position doesn’t go in your favor, wiping out your entire account. Without leveraging your position, you will only lose everything if somehow the asset drops to $0. However, using leverage can quickly liquidate your account.

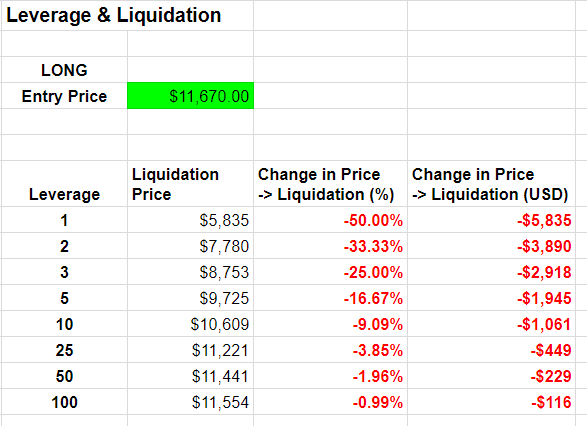

Liquidation chart

The image above shows the percentage move required for your position to get liquidated depending on the amount of leverage. As you can see, using 100x leverage is extremely risk and a 0.99% change in price is enough to fully liquidate your position. Keep in mind that a 1% move can happen within minutes or even seconds in the cryptocurrency market.

Conclusion

You should always have a plan when you start trading and you must absolutely stick to it even if it’s hard at first. Everyone makes mistakes and it’s ok to lose as long as you have good stop-losses in place. Although emotions can quickly cloud your decision-making skills, you must try your best to ignore them.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.