Three altcoins that have kickstarted Q4 rally: LINK, RDNT, FLOKI

- Chainlink price has been on a tear for the last two weeks and has the potential for more upside.

- Radiant Capital price has breached a falling wedge and shows promise of further ascent.

- Floki Inu price also witnessed a huge spike in buying pressure and could continue its northbound move.

Crypto market volatility seems to be making a comeback with the start of 2023’s fourth quarter , and some altcoins are already making headway. Chainlink (LINK), Radiant Capital (RDNT) and Floki Inu (FLOKI) are some cryptos that are showing aggressive upside moves.

Also read: Week ahead: Fed speech and NFP likely to dictate crypto market moves this week

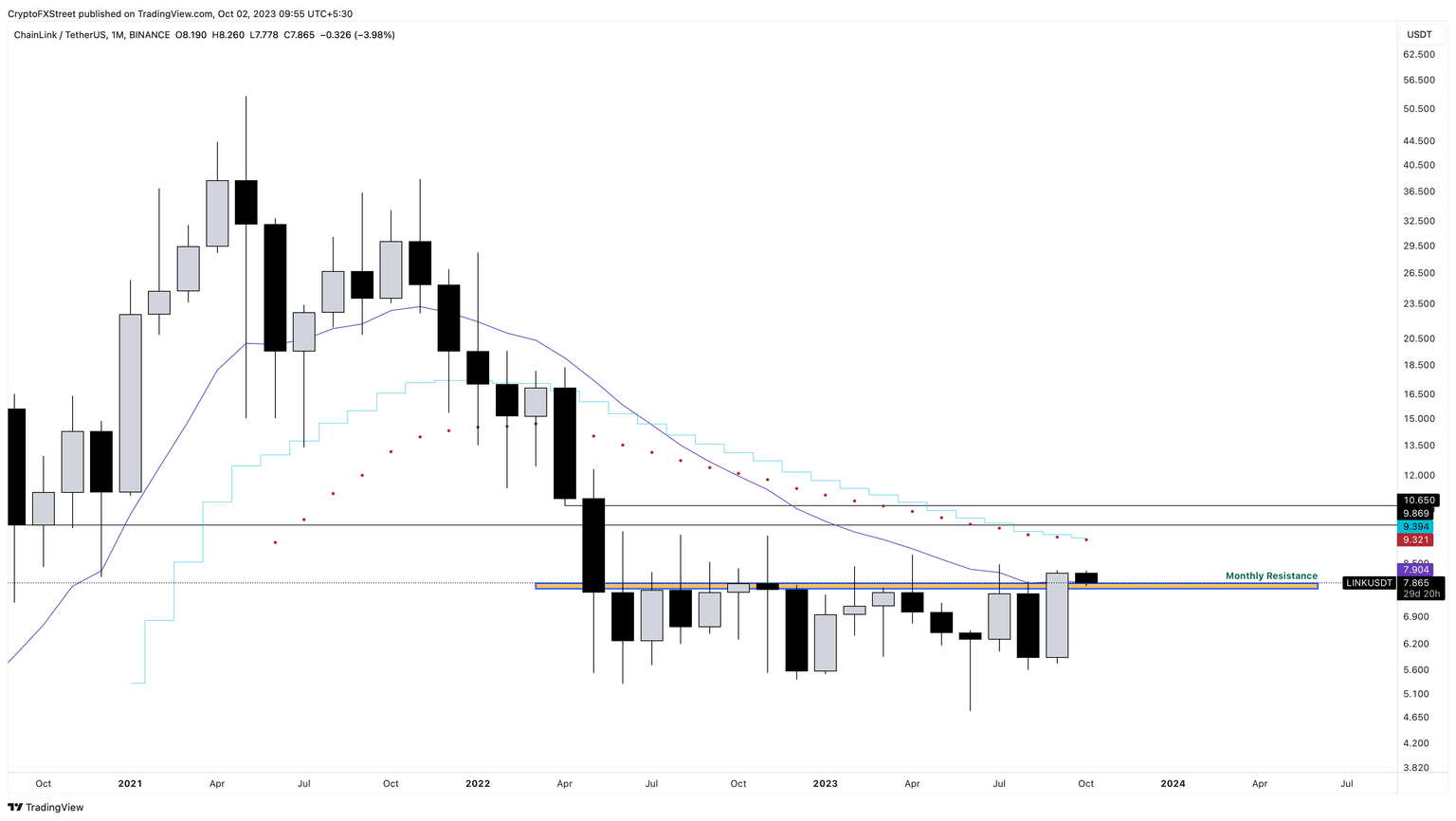

Chainlink price shows immense strength

Chainlink (LINK) price has shot up by 39% in September, pushing past the 15-month resistance level around the $7.80 area. This massive uptick now faces a decision – an extension of this move or a pullback. Considering recent whale activity, the chances of a northbound move are high.

The $7.80 support level is a good place for a bounce that leads to a retest of the $10 psychological level.

Further reading: Chainlink whales continue their accumulation spree after LINK’s 40% rally, why?

LINK/USDT 1-day chart

A decisive monthly candlestick close below $7.50 will invalidate the bullish thesis as it would breach the support level. In such a case, LINK could revisit $7.

Radiant Capital price triggers breakout

Radiant Capital (RDNT) price has breached a multi-month falling wedge setup, signaling the start of an uptrend. Additionally, RDNT bulls have also overcome the $0.250 hurdle. If the recently-breached level holds, investors can expect the altcoin to come face-to-face with the $0.297 and $0.334 hurdles, which would represent a roughly 15% and 28% increase from the current price of $0.261.

Further reading: Radiant Capital (RDNT) price nears the end of its five-month downtrend and could rally 40% soon

RDNT/USDT 1-day chart

A breakdown of the $0.250 support floor could open the chances of reentering the falling wedge setup. In such a case, RDNT could revisit the September 30 swing low at $0.231.

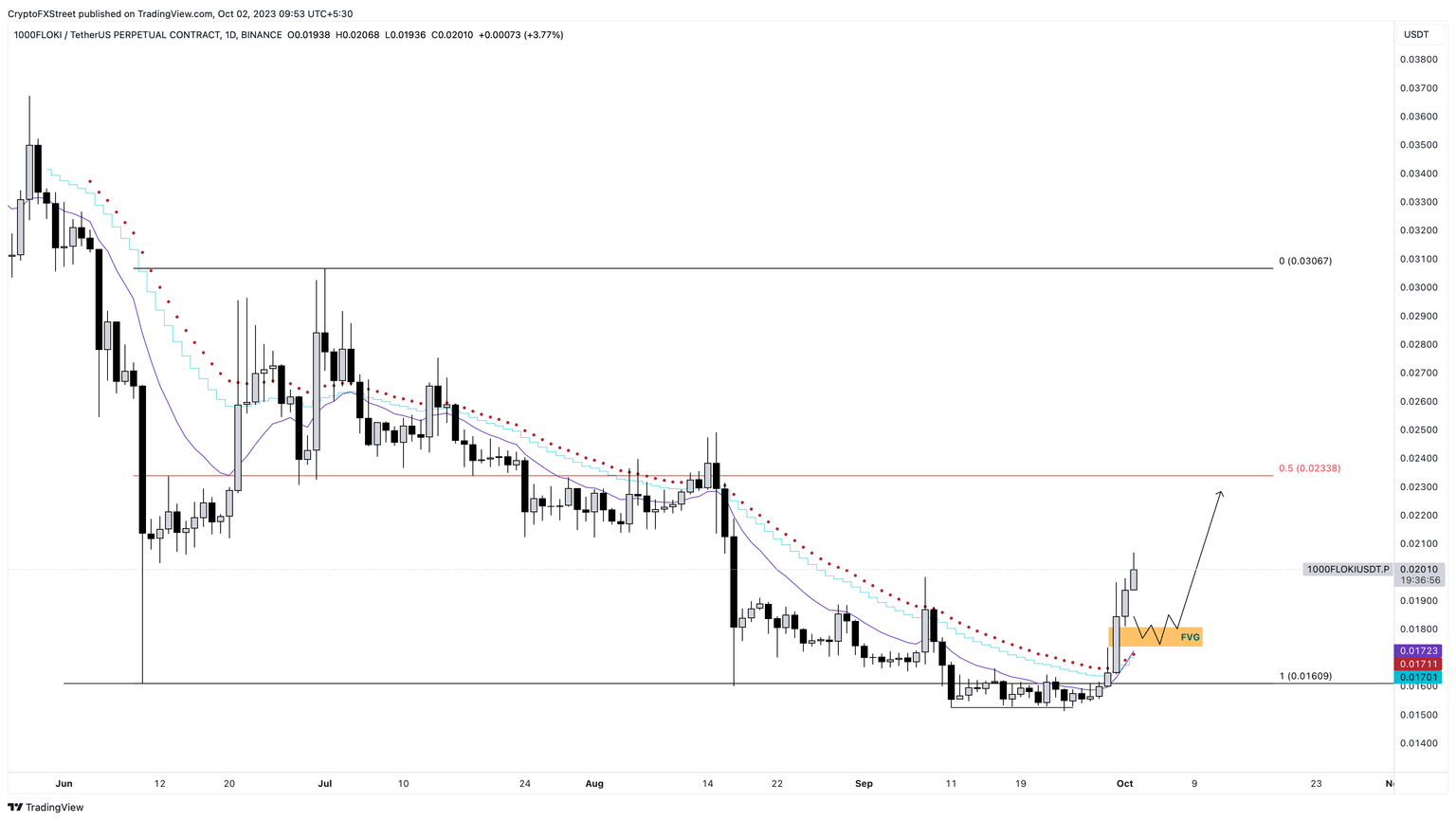

Floki Inu price shuts bears down

Floki Inu (FLOKI) price rallied nearly 20% on September 30 but pared some gains afterwards, closing the daily candlestick with a 12% return. Since then, FLOKI has rallied nearly 10% and currently trades at $0.0000202. If this momentum persists, the meme coin could revisit the $0.0000233 resistance level.

Further reading: Floki Inu Price Forecast: FLOKI sets stage for 30% rally

FLOKI/USDT 1-day chart

Regardless of the upbeat outlook, if Floki Inu price breaches $0.0000160, it would invalidate the bullish thesis. This move could see FLOKI revisit the swing lows formed around $0.0000152 for sell-side liquidity.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.