Three altcoins poised for bullish break: Fantom, MATIC and DENT

- Fantom is in a crucial demand zone, with no major resistance in its path towards $0.79.

- MATIC price could rally to $0.91 as there is no major resistance once Polygon’s native token tackles the $0.86 level.

- DENT supply on exchanges hits its lowest level in the past year, down to 51.21% on Friday.

Bitcoin’s price rally above $44,000 has supported altcoin price gains as several assets enjoy a relatively high correlation with BTC. Throughout December, large wallet holders of different altcoins engaged in accumulation, moving their tokens off exchanges and reducing the selling pressure on these assets, making way for higher gains as the year draws to a close.

Among others, three altcoins that are likely to note a bullish breakout are Fantom (FTM), Polygon (MATIC), and Dent (DENT).

Also read: Bitcoin price could climb towards $48,000 target with upcoming US SEC approval on BTC Spot ETF

Fantom price in crucial demand zone

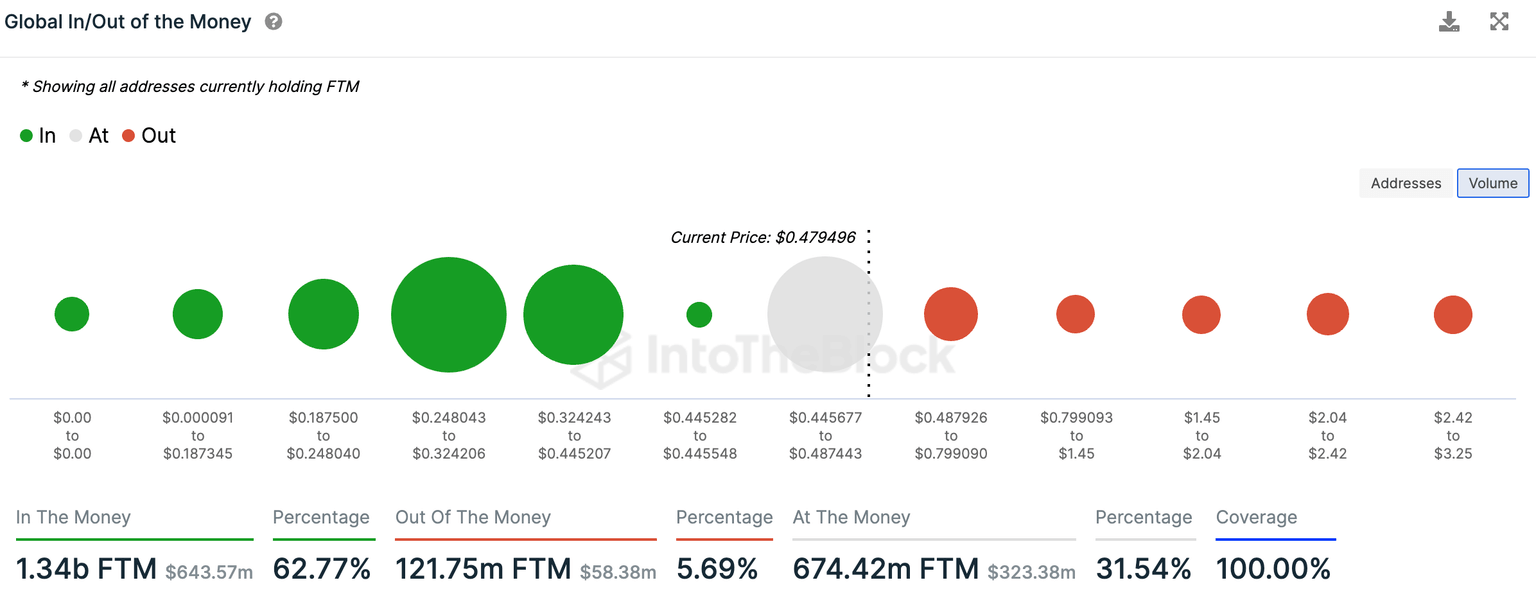

According to IntoTheBlock data, Fantom price is currently in a crucial demand zone between $0.4456 and $0.4874, where 3,666 addresses accumulated 674.42 million FTM tokens. Once the token breaks out of this zone, FTM price is likely to rally higher, with no major resistance in its path.

If Bitcoin price sustains above $44,000 and the outlook on the asset remains bullish, FTM price could rally to $0.7990, the upper boundary of the resistance zone where 7,710 wallet addresses acquired 61.6 million FTM tokens.

Global In/Out of the Money for FTM. Source: IntoTheBlock

Polygon native token eyes $0.91

MATIC price rally to its $0.91 target is likely as the altcoin recovers from its recent decline from the local peal of $0.9831 it reached on November 14. Following this rally in MATIC price, the altcoin suffered a correction, followed by a recovery. The pattern repeated itself, with MATIC price now set to tackle resistance at $0.8669.

Once MATIC price flips this resistance level to support, there is no major roadblock in its rally to $0.91, the 38.2% Fibonacci retracement level of the decline from its February 18 peak of $1.5675 to June 10 low of $0.5121.

MATIC/USDT 1-day chart

However, a daily candlestick close below the 50-day Exponential Moving Average (EMA) at $0.7890 could invalidate the bullish thesis for MATIC price.

DENT supply on exchanges hits lowest level in 2023

According to Santiment data, DENT supply on exchanges has hit its lowest point in the past 12 months. The metric is down to 51.21% of the token’s total supply, while price continues to rise.

DENT price is up 53% in the past month and the cryptocurrency’s gains are likely sustainable, according to on-chain metrics.

DENT supply on exchanges as % of total supply. Source: Santiment

Network Growth, a key on-chain metric that helps determine whether an asset’s gains are sustainable, is increasing alongside DENT price increase, supporting the rally.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B15.37.03%2C%252022%2520Dec%2C%25202023%5D-638388420562636729.png&w=1536&q=95)