Three altcoins look bullish even though the crypto market can fall another 50%, says former BitMEX CEO

- Former BitMEX CEO Arthur Hayes believes Bitcoin and Ethereum prices could crumble under massive selling pressure from liquidations in short-term.

- Hayes revealed undervalued altcoins that could plummet lower, but have a strong utility and bullish potential.

- Hayes highlights the fact that critical DeFi verticals are on sale right now, based on his fundamental analysis, these tokens could explode even in a bear market.

Former BitMEX CEO Arthur Hayes addressed the liquidity crunch that has hit the crypto market. Hayes believes Bitcoin and Ethereum prices could bleed further and identified altcoins that have bullish potential in the bear market.

Hayes identified these three altcoins with bullish potential

In light of the Celsius and Three Arrows Capital liquidity crisis, Hayes addressed the bear market conditions and argued that financial services have lent themselves to natural monopolies. In major DeFi verticals, there are three to five protocols that are regularly used by investors and they generate real revenue.

While the protocol value of their competitors could quickly trend to zero, the tokens of these DeFi projects could continue to grow, even in the ongoing bear market. Hayes analyzed projects built on the Ethereum network, under the assumption that over time, the number of Ethereum wallets will expand exponentially.

The total addressable market, or size of these DeFi protocols could continue to grow. Bear markets are characterized by short periods where activity and revenues of DeFi protocols fall or stagnate, however the total fees generated by these tokens will continue to expand.

ENS: Open expandable naming system built on Ethereum

The Ethereum Name Service (ENS), that offers simple domains that are not just usable websites, but tradable assets are trading on platforms like OpenSea and LooksRare. Users can purchase a “.eth” top level domain from ENS, pay fees in Ethereum and trade it in the open market.

Hayes evaluated ENS in the secondary market and noted that the project is the 15th most traded one over the past week and 27th most traded one in all time. The number of ENS domains created to date has grown exponentially.

Hayes believes ENS could mirror its Web2 counterpart Verisign’s success and trade at astronomical P/E ratios.

GMX: Hayes argues for future bull case for DEXes

Hayes argues that in the current crypto ecosystem, derivatives trading volume should be orders of magnitude higher than spot volumes. Hayes stresses on a future bull case for decentralized exchanges and considers GMX, the best one among competitors.

While the decentralized spot and perpetual exchange currently supports low swap fees and zero price impact trades GMX is not advanced enough to truly capture the fee wallet of DeFi leveraged traders en masse.

Hayes believes GMX has the potential to facilitate trading volumes much higher than spot decentralized exchanges such as Uniswap and Sushiswap.

LOOKS: Hayes considers this the first market cycle for NFTs

The former BitMEX CEO revealed that he believes this is the first real market cycle for tradable NFTs, therefore it is rational for digital asset and metaverse businesses to witness a 98% drawdown from their all-time highs.

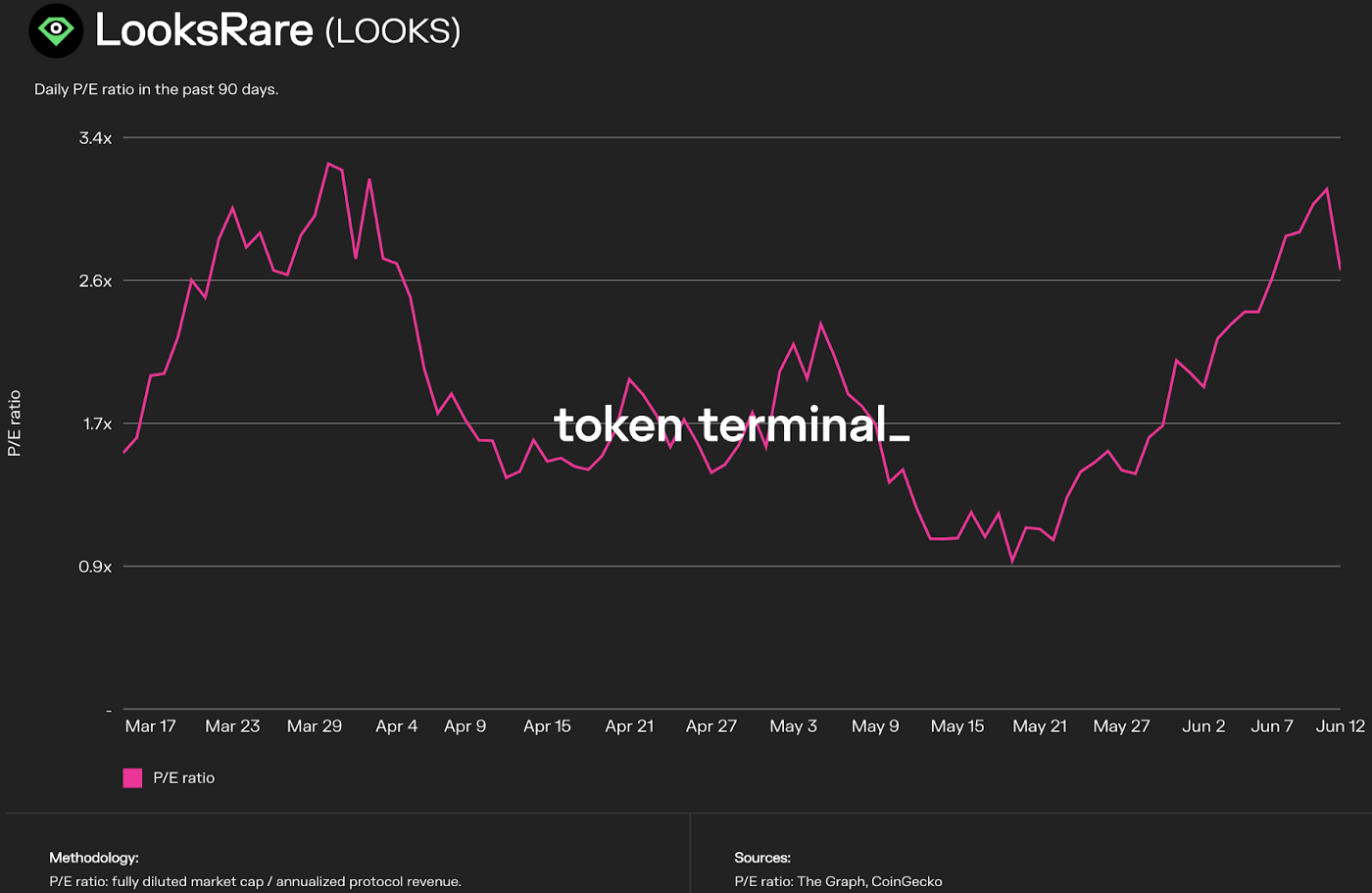

Hayes believes LooksRare, a community-first NFT marketplace that offers users rewards for participating and exploring the market could offer 2x to 3x earnings to its investors. While the volatility is higher in case of NFTs and digital assets, Hayes believes tokens like LOOKS are call options on an uncertain future, but they hold high intrinsic value.

The P/E ratio or price-to-earnings ratio is a quick way to see if a stock is undervalued or overvalued. And the lower the P/E ratio is, the better it is for potential investors. Hayes shared the P/E ratio for LOOKS which is considered relatively low in its current range, between 0.9x and circa 3.3x, and therefore presenting good value. The long-term average P/E ration for the S&P 500 for example is roughly 16x.

P/E ratio of LOOKS

While Hayes has predicted a drawdown in Bitcoin and Ethereum prices, the former BitMEX CEO remains bullish on DeFi tokens.

Analyst believes Bitcoin hasn't hit bottom yet

FXStreet sat down with technical analyst Eric Thies to evaluate where Bitcoin price could be heading next.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.