- Shiba Inu price slipped to retest September 2021 lows.

- SHIB is reeling from the largest spike in investor activity since October 2021 due to the June 11 crash.

- A large portion of selling was attributed to whale activity as cohorts holding 1 million to 10 million SHIB have reduced significantly.

Shiba Inu price has reached new lows over the last few days as the crypto market continues to refrain from marking a recovery. While there were some expectations for the market to decline further in June, it was also expected for investors to ride through the bearishness. However, a major cohort of SHIB holders has decided to choose the other option of exiting the market.

Shiba Inu price fall spooks whales

Shiba Inu price is sitting at new lows after the cryptocurrency fell victim to the crash of June 11, like the rest of the crypto market. Falling by more than 15% in the span of 24 hours, the meme coin hit a 21-month low mark. Trading at $0.00000669, the altcoin is retesting the September 2021 lows but might find some difficulty in recovering immediately.

SHIB/USD 1-day chart

Investors, whose activity plays a critical role in the digital asset’s rise and fall, had been skeptical, but the crash of June 11 spooked them to the point where many decided to back off completely.

Most of these addresses belonged to the whale cohort, which also controls about 67% of the entire circulating supply. The addresses holding between 1 million to 10 million SHIB declined by over 28k, signifying bearishness amongst the investors.

Shiba Inu supply distribution

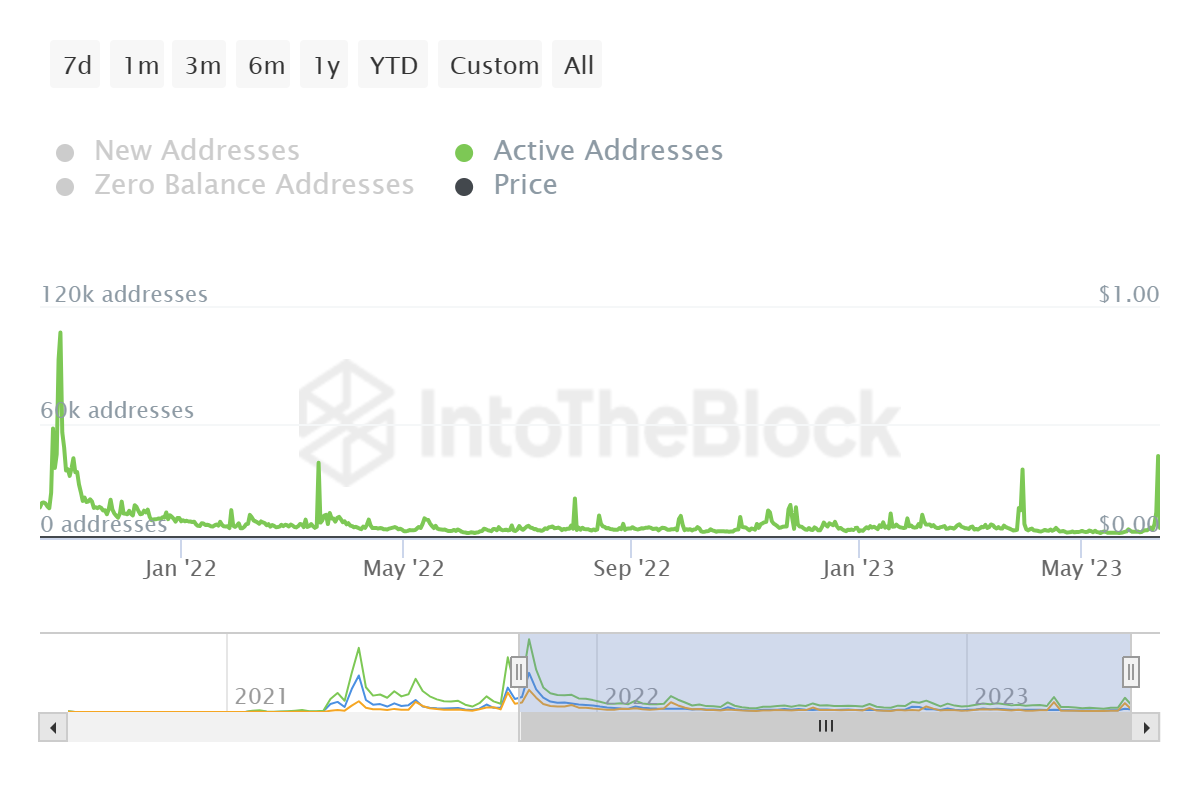

These addresses could have been among the many investors who actively participated on-chain on June 11. On the day of the crash, the network registered about 12K active addresses, noting a 122% increase from the daily average of 5.4K, the highest since October 2021.

Shiba Inu active addresses

However, despite the selling, investors are still holding out hope for a recovery and looking at the Market Value to Relative Value (MVRV) ratio, Shiba Inu price might be set for recovery. The indicator dropped below the -10% mark, slipping into a zone known as the “opportunity zone”.

Shiba Inu MVRV ratio

The price, historically, has bounced back the majority of the time the MVRV ratio has dipped into this zone. As low prices generally attract more investors, holders tend to accumulate tokens in order to gain profits once the price recovers. Thus, investors holding out hope for recovery might have an opportunity soon.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin Price Forecast: Further rally likely, fueled by Elon Musk's endorsement

Dogecoin price rises for a third consecutive day after bouncing from $0.128, Friday's low. Elon Musk's promotion of the meme coin has reignited interest in Dogecoin. A daily candlestick close below $0.126 would invalidate the bullish thesis.

Solana Price Forecast: Extra 10% gains possible as Solana network beats Ethereum in weekly DEX volume

Solana recovered from Friday’s intraday decline to near $160 over the weekend and trades at $178.04 at the time of writing on Monday. The native token of the Solana blockchain eyes further gains as on-chain metrics and technical charts support a bullish thesis.

Bitcoin Price Forecast: BTC recovers as BlackRock ETF sees over $1 billion in inflows for two weeks running

Bitcoin continues to recover and trades above $68,000 on Monday after declining and finding support around $66,000 on Friday. Despite BTC dipping to $65,260 last week, US spot Bitcoin ETFs recorded net inflows of $997.2 million, with BlackRock IBIT funds contributing by $1.15 billion.

Metaplanet stock jumps after announcing $10.5 million Bitcoin purchase

Metaplanet announces the purchase of an additional 156 Bitcoin on Monday, with the total holdings of the firm surpassing 1,000 BTC. The Japanese investment firm earned a 155.8% Bitcoin yield in October, up from the 41.7% recorded between July and September. Metaplanet stock gained 7% on the day.

Bitcoin: New all-time high at $78,900 looks feasible

Bitcoin price declines over 2% this week, but the bounce from a key technical level on the weekly chart signals chances of hitting a new all-time high in the short term. US spot Bitcoin ETFs posted $596 million in inflows until Thursday despite the increased profit-taking activity.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[20.40.11,%2013%20Jun,%202023]-638222714684400653.png)

%20[20.40.32,%2013%20Jun,%202023]-638222715165953457.png)