- ThorChain surpassed $1 billion in transaction volume in the last five days, a surge attributed to illicit activity.

- RUNE price has seen an impressive increase over the past week before a 5% dip on the daily chart.

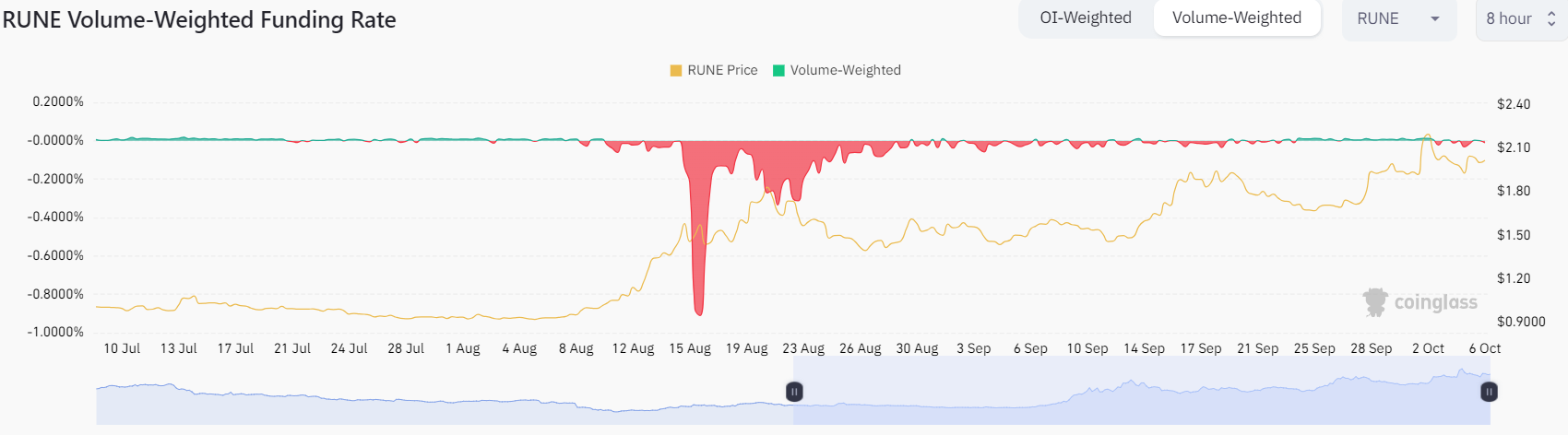

- Long and Short liquidations appear to be balancing out.

THORChain (RUNE) is exhibiting bullish price movement, but investors need to be cautious as the recent surge in trading activity could be linked to illicit transfers. THORSwap exchange said Friday that it has paused its swapping feature amid concerns it has been used to move illicit funds. In the past week, RUNE experienced a price rally due to an uptick in trading volume, but the token price has dipped 5% in the daily frame.

THORSwap pauses swaps

THORSwap DEX confirmed in a tweet on Friday that it is currently being updated and cryptocurrency swaps are unavailable amid the news of illicit transfers. However, other activities on the platform like providing liquidity, earning interest, borrowing, and staking remain operational, as per the official statement on X.

THORSwap is currently undergoing Maintenance. Swaps are paused.

— THORSwap ⚡ #BetterThanCEX (@THORSwap) October 6, 2023

LP actions, Earn (savers), Borrow (lending), Staking actions are all fully operational. Thank you for your patience and understanding. https://t.co/yoPlnE1AAu

THORSwap entered maintenance mode on Friday after confirming that illicit funds are flowing through THORChain. It noted, “A pressing and persistent concern has recently come to light: the potential movement of illicit funds through THORChain and, specifically, THORSwap. Such activities have no place on the THORSwap platform, and THORSwap stands firmly against any and all criminal actions.”

Previously, Chinese journalist Colin Wu confirmed in a tweet that the sharp increase in transaction volume to $355 million on Thursday could be on the back of hackers exploiting this cross-chain capability. Especially since ThorChain surpassed $1 billion in cumulative transaction volume in just five days. Therefore, investors needed to exercise caution while interpreting such a spike.

THORChain's RUNE token is trading under $2 at the time of writing. Based on CoinGecko calculations, the 24-hour trading volume stands at $592 million with a circulating supply of 300 million. The last seven days saw a price increase of 1%, while the gain is nearly 9% in the last two weeks.

While the price action seemed bullish, it was crucial to note that ThorChain is a decentralized liquidity network. It allows cross-chain token swaps, and facilitates non-custodial trading across blockchains. And bad actors can exploit this capability for transfers.

THORChain’s Long, Short liquidations balance out

THORChain's derivatives data indicate Long and Short positions are balancing out. Based on Coinglass data, there is a 36% increase in trade volume of total derivative contracts. Open interest or contracts that are currently outstanding have risen by 8.34% to $51.49 million. The LongShort ratio in the last 24 hours is at 0.97. This metric is considered a barometer of investor expectations, and generally a high ratio indicates positive investor expectations as long positions outweigh short ones.

1-day RUNE price and volume chart

The position of traders show that almost equal bets are placed on RUNE price going up or down.

Based on the fundamentals, ThorChain is currently at a block height of 12.8 million, with a total supply of 485 million RUNE tokens. The total historical volume on the blockchain amounts to $18 billion, with a total of 79,147 addresses involved.

THORChain maintains 94 active nodes at the time of writing. In terms of contribution to the Total Value Locked (TVL), the chain has $135.57 million locked as per Defillama figures.

Therefore, THORChain's recent price surge and trading volume that showcase bullish tendencies raise questions about the type of transfers. Investors need to practice caution while trading on figures with the expectation of a bullish trend. Meanwhile, amidst a surge in derivative trading activity, the Long-Short liquidations suggest that the market sentiment around price has balanced out.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Michael Saylor predicts Bitcoin to surge to $100K by year-end

MicroStrategy's executive chairman, Michael Saylor, predicts Bitcoin will hit $100,000 by the end of 2024, calling the United States (US) election outcome the most significant event for Bitcoin in the last four years.

Ripple surges to new 2024 high on XRP Robinhood listing, Gensler departure talk

Ripple price rallies almost 6% on Friday, extending the 12% increase seen on Thursday, following Robinhood’s listing of XRP on its exchange. XRP reacts positively to recent speculation about Chair Gary Gensler leaving the US Securities and Exchange Commission.

Bitcoin Weekly Forecast: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin (BTC) surged up to 16% in the first half of the week, reaching a new all-time high of $93,265, followed by a slight decline in the latter half. Reports suggest the continuation of the ongoing rally as they highlight that the current trading level is still not overvalued and that project targets are above $100K in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.