This token could trigger the next meltdown in Ethereum and crypto

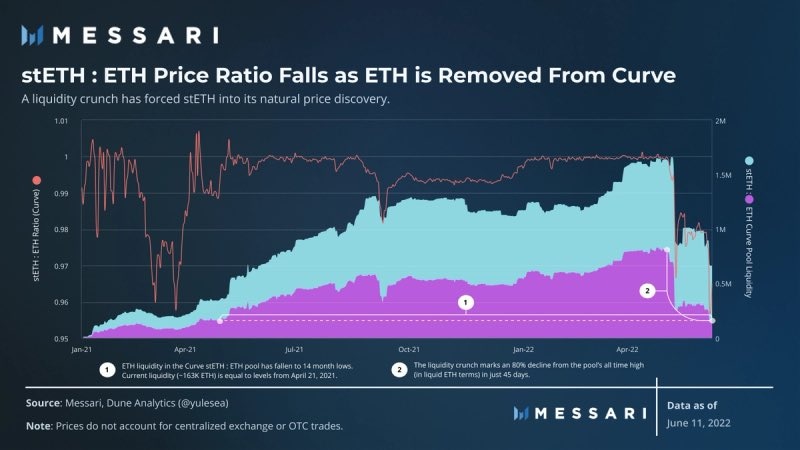

- Terra’s LUNA collapse triggered investors to prefer liquid assets over illiquid, resulting in a drawdown of 80% in liquid Ethereum in a pool on Curve Finance.

- stETH, the tokenized form of staked Ethereum witnessed an explosive rise in selling pressure and suffered a de-peg.

- Institutions like Celsius and Three Arrows Capital were caught in the crossfire, as Ethereum price continued to plummet.

Ethereum price continued its decline in the bloodbath this week. Experts argue Lido Finance’s stETH’s depeg from Ethereum has triggered a crisis and institutions like Celsius and 3AC witnessed massive liquidations.

Also read: Three Arrows Capital reportedly facing insolvency, crypto bubble is bursting

What is stETH?

Lido Finance, a DeFi platform that is one of the largest staking services provider for Ethereum, offers a tokenized form of staked Ether, known as stETH. The decentralized staking service provider promises stETH is backed by Ethereum 1:1.

Once Ethereum completes its transition from Proof-of-Work to Proof-of-Stake consensus mechanism, one stETH will be redeemable for one Ether on the Beacon chain. The merge was slated to occur as early as August 2022, according to Vitalik Buterin and Tim Beiko, however, it is likely that a delay could postpone the event to Q4 2022.

Therefore, stETH withdrawals are only possible after the Capella hard fork, an event slated to occur six months post the merge, meaning Q2 2023 or later.

Why Celsius and Three Arrows Capital swapped stETH for ETH?

It is possible to exchange stETH for Ethereum in the open market, as the pair historically traded close to 1:1, the peg. However, with volatility in demand, stETH price has plummeted below Ethereum this week and a few times in the past.

Terra’s LUNA crash played a crucial role in the depeg of stETH and the increase in selling pressure on the token. When LUNA/UST imploded, investors rushed towards liquid assets, dropping illiquid ones in the process. There was an 80% drawdown in liquid Ethereum in Curve Finance’s stETH:ETH pool. Institutions faced mass liquidation of their positions across exchange platforms and there was a large-scale sale of stETH for covering margin requirements.

stETH:ETH price ratio plummets

Celsius Network and Three Arrows Capital were among projects that intensified their sale of stETH and triggered a steep decline in the token’s price. This is referred to as a “depeg” since stETH started trading at a discount to Ethereum in the open market.

How the stETH depeg could push borrowers towards insolvency?

stETH is an illiquid asset that holds value as long as there are buyers for it. Once all the Ethereum is drained, and buyers disappear, there is no one to sell stETH to, making it a technically worthless token at the time.

What’s more, your collateral shrinks with a decline in Ethereum price. stETH is primarily used as a leverage tool, therefore an investor can obtain a loan where they stake their ETH and hold stETH. However, once Ethereum price declines, the value of their collateral reduces, they panic and sell stETH in the open market, triggering further depeg.

Borrowers struggle to pay back lenders when they hold illiquid assets like stETH, if selling persists and buyers for the token disappear.

@hodlKRYPTONITE, a pseudonymous analyst has shed light on how lenders like Celsius collapse as a result of counterparty risk.

12/x ultimately, panic selling in stETH will lead to selling in ETH and drag down the broader crypto complex. We already have macro headwinds, these structural selling flows will exacerbate the crisis. In my opinion we will see a repeat of march 2020.

— degentrading (@hodlKRYPTONITE) June 11, 2022

Liquidity crunch is a slippery slope

@hodlKRYPTONITE explains that lenders like Celsius, when faced with a collapse, they trigger a contagion in the ecosystem. The complicated web of transactions, where Ethereum is staked for stETH and stETH is used as a leveraging tool, credit shrinks.

A decline in the price of the liquid asset could result in considerable shrinkage of capital deployed, loans are to be paid back and assets are sold for USD or stablecoins.

13/x - When lenders like Celsius collapse - they trigger contagion in the ecosystem as they have a complicated web of transactions with other players. Counter party risk becomes real. Credit shrinks - loans have to be repaid and assets have to be sold for dollars.

— degentrading (@hodlKRYPTONITE) June 11, 2022

Analysts predict trend reversal in Etheruem price

Analysts at FXStreet have evaluated the Ethereum price trend and argue that buyers are scooping up the asset at discounted prices. If buying continues, Ethereum price could cross hurdle at $1,270 and bounce back to $1,730.

ETH-USD price chart

Bitcoin could bottom out at this level

FXStreet analysts have identified the level at which Bitcoin price could bottom out. As the asset recovers from the recent slump, investors resume buying. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.