This next Ethereum price move could push 3 million addresses into the red

- Ethereum price is breaking below a significant trend line, hinting at a crash.

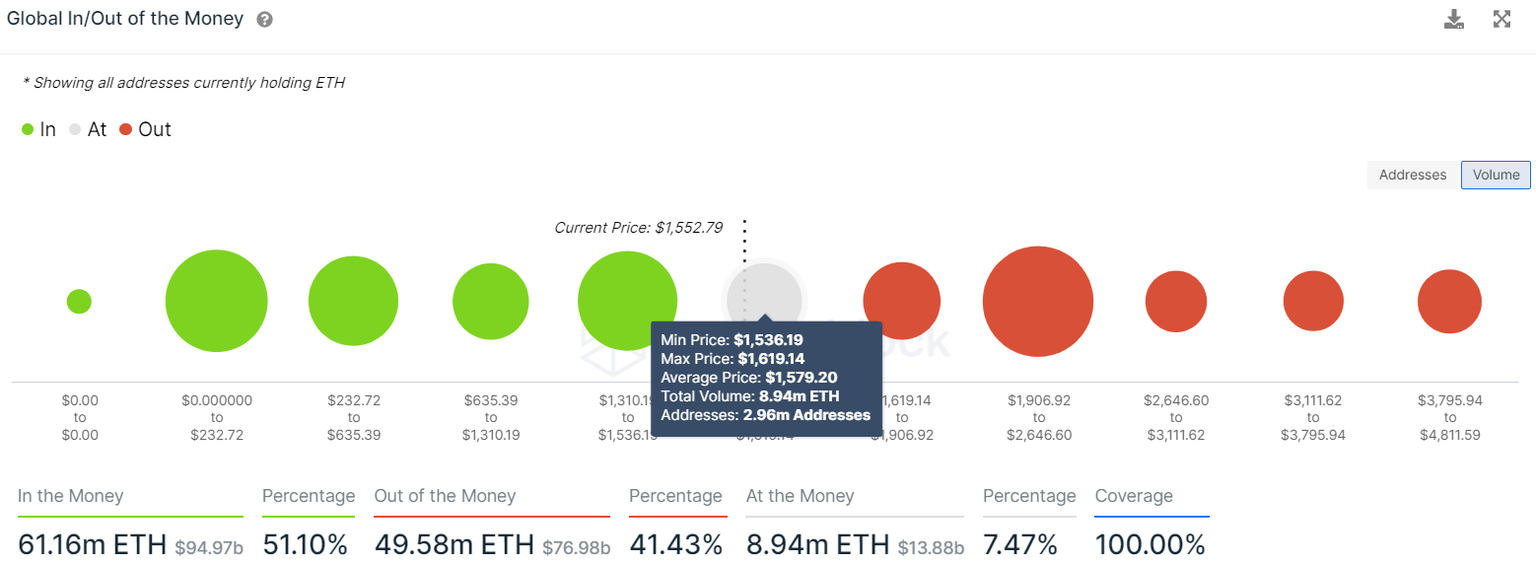

- Transaction data shows that roughly 9 million ETH held by 3 million addresses will slip into “Out of the Money” territory.

- A four-hour candlestick close above $1,646 will invalidate the bearish thesisfor ETH.

Ethereum price shows a lack of buying pressure that has resulted in a slip below a significant support structure. If bulls fail to make a comeback at this juncture, things could escalate quickly, sending ETH tumbling.

Ethereum price faces the fallout

Ethereum price created a set of higher highs since October 26 as it rallied 24% and set up a swing high at $1,680. This massive move was created on a weak foundation as the asset erected higher highs the Relative Strength Index (RSI) momentum indicator created lower highs.

This non-conformity indicates that the Ethereum price rallied during a waning momentum, which suggests that the altcoin could come tumbling down. As seen in the chart, a breakdown of the trend line connecting the higher lows will confirm the bearish outlook for ETH.

The significant support levels that are capable of absorbing this selling pressure and slowing down the descent include $1,389 and $1,370.

ETHUSDT 4-hour chart

Further describing the pain of the investors should Ethereum price slide lower is IntoTheBlock’s Global In/Out of the Money. This indicator shows that roughly 2.96 million addresses that purchased nearly 9 million ETH at an average price of $1,579 are at risk.

A breakdown of the inclined trend line connecting lower lows could trigger a sell-off for ETH price, pushing these holders underwater.

ETH GIOM chart

While things are looking gloomy for Ethereum price, a four-hour candlestick close above $1,646 will invalidate the bearish thesis by creating a higher high. This development could trigger a buying spree from sidelined buyers, propelling ETH to $1,708 and $1,768 hurdles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.