This is when to buy Shiba Inu before it breaks out

- Shiba Inu price undergoes a bearish wave as FED official paints a dire picture of the rate path.

- SHIB price is further on the backfoot as quarterly earnings put investors on edge.

- Expect to see money flow out of SHIB, with a correction back to $0.00002200.

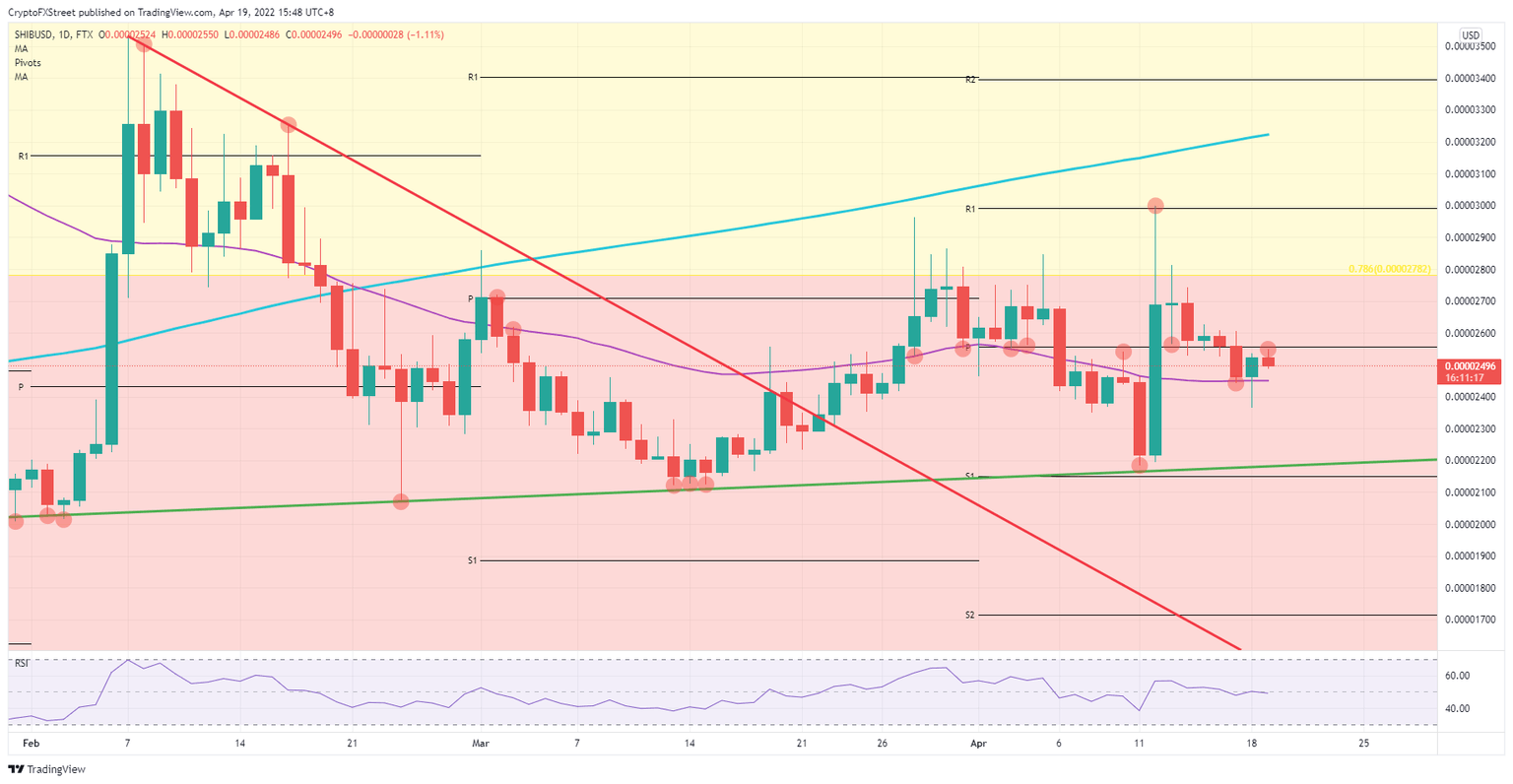

Shiba Inu (SHIB) price slips back below $0.00002600 as price action undergoes a rejection by the monthly pivot at $0.00002550 after forming a bull trap. Additionally, the Relative Strength Index (RSI) is slipping below 50, showing that investors’ interest is fading as traders are on edge due to the fact the new earnings quarter is set to kick in today, and FED comments this morning painted a possibly even more hawkish rate path for the near future. That last one is important for setting the scene of risk appetite in the coming weeks and months and is pushing SHIB price towards $0.00002200 for now, resulting in a 12% loss.

SHIB price sees investors doubting, sidelined for the proper pullback to jump in

Shiba Inu price is slipping further to the downside after bulls tried to return above the monthly pivot at $0.00002550 on Monday. Instead, bulls got hammered at the open on Tuesday as volume picked up after the bank holiday. Investors already got a rude awakening by a few comments from a FED official pointing to a 0.75% rate hike on the docket at the next FED meeting. ASIA PAC investors quickly returned their SHIB tokens for hard cash and looked to stay sidelined for a while.

SHIB price thus will bleed further into the session today and possibly for the next few days to come. Tomorrow NETFLIX will be reporting its earnings after the bell, which will be taken as a leading indicator for FAANG stocks and the Nasdaq, an event that will be closely watched. Expect investors to keep pulling their cash out of SHIB price, resulting in a 12% correction towards $0.00002200 with the longer-term green ascending trend line, the monthly pivot S1 just below and the double bottom from April 11 as trifecta for catching price action.

SHIB/USD daily chart

If earnings before the US opening bell point to a wave of positive news, expect to see a quick reversal in the price action. The RSI would pop back above 50, attracting more buyers and investors, and set the scene for SHIB price to jump and close above $0.00002550. With a daily close above that, the road will be paved towards $0.00002800 in the coming days, holding an 11% gain.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.